If you’re looking for information about We Fix Money and its services, you’ve come to the right place! We Fix Money is a personal finance platform that offers financial assistance to people struggling with debt and credit issues.

In this blog post, we’ll look at We Fix Money reviews to help you decide if it’s a good fit for you. We’ll discuss the pros and cons of We Fix Money and what other customers have said about their experience using the service.

Table of Contents

What is We Fix Money?

WeFixMoney is a family-owned company founded in 2008 specializing in short-term financial solutions. The company claims to provide clients with the highest security and customer care standards.

WeFixMoney offers different types of financial assistance. This includes payday loans, installment loans, lines of credit, and other loan options. They also offer prepaid debit cards, budgeting tools, and free financial counseling.

The process of obtaining a loan from WeFixMoney is simple. All you need to do is fill out an online form and await your loan approval. The entire process can take as little as 24 hours, and if approved, the funds will be deposited directly into your bank account.

WeFixMoney also offers a variety of ways for you to repay your loan. You can choose to pay back your loan through direct deposit, or you can make payments using your debit card or credit card. The company also offers flexible repayment plans that allow you to adjust the payment due date or amount due.

How Do We Fix Money Work?

We Fix Money is an online installment loan broker that helps borrowers connect with lenders for personal loans. To get started, you only need to submit a short online application with some basic information about yourself and your loan needs. From there, We Fix Money will search its network of lenders to match you with the most suitable offer.

Your loan amount will depend on your credit score, the lender’s requirements, and loan terms. Most lenders will allow you to borrow up to $2,500 depending on your credit score, but this will vary from lender to lender. Your APR rate will also be determined by your credit score. Still, We Fix Money reviews suggest that their customers have received APRs ranging from 5.99% – 35.99%.

We Fix Money is a member of the Online Lenders Alliance (OLA) and the Community Financial Services Association of America (CFSA). They are committed to providing responsible and safe lending practices. They also have a user-friendly website that provides essential information about their services, such as eligibility requirements and loan terms. However, they don’t provide exact loan amounts or APR rates.

If you have any questions or need help completing your application, you can write or call them using a live chat feature on the website. They also offer a free loan calculator to determine how much you’ll need to borrow and how much you’ll need to repay over time.

What Do They Offer?

We Fix Money allows customers to apply for personal loans of up to $2,500. However, depending on the lender and borrower’s credit history, it is possible to obtain a larger loan. The application process is made easier with same-day funding if approved. When applying for a loan, customers must provide their personal information. They will receive a call from We Fix Money to verify.

Suppose customers need more time to repay their loans. In that case, they may be able to roll over the loan and extend their loan terms. However, this is likely associated with additional fees. Late fees may also be charged for missed payments.

How to Qualify for a Loan?

To be eligible for a loan with We Fix Money, you must meet the following criteria:

- You must be a US citizen or legal resident;

- You must be at least 18 years old;

- You must have a regular source of income of at least $800 per month;

- You must have an active checking account.

Once you meet these requirements, you can then apply for a loan through We Fix Money. You must provide information about your employment, bank account, and other financial details to apply. After submitting your application, We Fix Money will review it and determine your eligibility for a loan. If approved, you will receive the Money in your bank account within one business day.

We Fix Money Pros

- When you require cash fast, We Fix Money offers a reliable solution with its quick loan approval process.

- Their loans are offered up to $2500, so you’ll be able to get the cash you need without having to worry about borrowing too much.

- Moreover, they offer same-day deposits to help you get the funds you need faster and without waiting. This is perfect when you have an emergency expense that can’t wait and need cash quickly.

- On top of that, their interest rates are competitive, and you don’t have to worry about hidden fees or charges that add up over time.

We Fix Money Cons

- Many customers complain about the fees they charge, which can be pretty hefty. The company also has high-interest rates, and there is no guarantee that you’ll be approved for a loan.

- Additionally, getting a loan approved promptly can be challenging, as several requirements must be met to qualify.

- Customer service can also leave something to be desired, as some customers report getting conflicting information from different agents.

- Furthermore, the loan terms can be confusing and difficult to understand, so reading through them carefully before signing anything is essential.

- Finally, We Fix Money may not be ideal for those with bad credit, as their eligibility criteria can be strict.

We Fix Money Reviews by Customers

We Fix Money has been in business since 2008, and over the years, they’ve earned plenty of positive customer reviews. Most customers cite their fast loan approval process and helpful customer service team as the main reasons for choosing. We Fix Money.

One customer wrote: “I had an excellent experience with We Fix Money. The application process was easy, and I got approved within minutes. The customer service team was also extremely friendly and helpful. I would definitely recommend We Fix Money to anyone looking for a loan.”

Another customer said: “We Fix Money is a great option for those with low credit scores. They provided me with a loan even though I had poor credit, and the whole process was very fast. I would highly recommend them if you need cash quickly.”

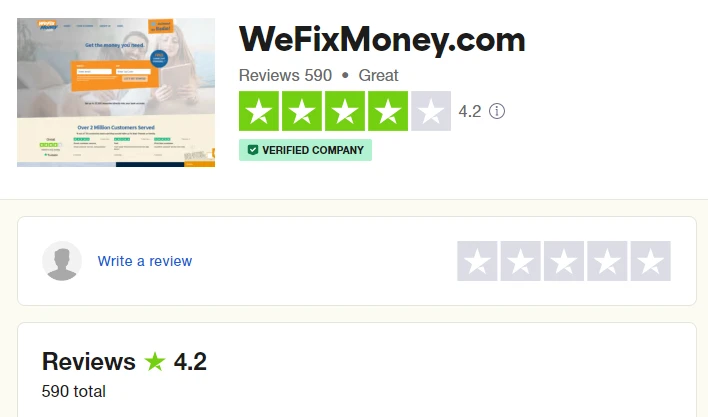

In addition to customer reviews, We Fix Money has an impressive rating of 4.2 out of 5 stars on Trustpilot. Out of 590 reviews, the majority of them are positive. Customers praise the company for their quick loan approval process, helpful customer service team, and competitive interest rates.

Overall, We Fix Money is a legitimate and reliable loan provider. This could be a good option if you require cash quickly and have a low credit score. Just read the terms and conditions carefully and ensure you can afford the payments before taking out a loan.

Is We Fix Money Legit?

We Fix Money is a legitimate financial service provider. They are a part of the Credit Interlink Group, a private lender and servicer that has operated since 2008.

The service is designed to help borrowers get out of short-term cash flow problems quickly and easily. We Fix Money offers convenient repayment options tailored to the individual’s needs. The application process is fast and easy, and borrowers can expect to receive their loan funds within one business day.

When considering a loan from We Fix Money, it’s essential to understand the terms and conditions of the loan and any applicable fees. Borrowers should also be aware that failure to make timely payments on a loan can negatively impact credit scores.

In conclusion, We Fix Money is a legitimate company that provides short-term loans to those needing financial relief. However, borrowers need to understand all of the terms and conditions of their loan before applying. By doing so, they can ensure they get the best deal possible and avoid any potential pitfalls.

How can you reach their customer care services?

If you need help from We Fix Money, there are several ways to contact their customer care services. You can contact their live agents via chat between 9 AM and 5 PM EST. You can also email them at info@wefixmoney.com or call them at 1-855-632-1673.

Additionally, they have an extensive FAQ page and a blog section with helpful articles. No matter your chosen method, the knowledgeable customer care team is ready to assist you.

We Fix Money Alternatives

Dave: Dave is a personal finance app that provides cash advances up to $100 with no interest or late fees. The app also offers budgeting tools to help users get their finances on track. Dave can be an alternative to We Fix Money because it provides quick cash advances without interest or late fees.

Quick Cash Advances with Empower: Empower is a personal finance app that helps users manage their money better by providing insights and suggestions. It also allows users to access up to $250 cash advances without interest or late fees. This makes it an ideal alternative to We Fix Money for those who need quick cash advances without worrying about interest and late fees.

Earnin: Earnin is another personal finance app that helps users access their earned income before their payday. With Earnin, users can get up to $500 in cash advances without interest or late fees. This makes it an excellent alternative to We Fix Money, especially for those who need earning-based borrowing.

PayActiv: PayActiv is an app that helps users access their earned wages before their paychecks arrive. It provides cash advances up to $500 with no interest or late fees, making it a great alternative to We Fix Money for those who need short-term loans.

Brigit is a personal finance app that helps users manage their finances better. It also provides access to same-day loans up to $250 with no interest or late fees, making it a great alternative to We Fix Money for those who need cash quickly.

MoneyLion: MoneyLion is a personal finance app that helps users stay on top of their finances. It also offers multiple options for borrowing, including 0% APR cash advances up to $250. This makes MoneyLion an excellent alternative to We Fix Money for those who need access to multiple borrowing options.

Our Verdict on We Fix Money

We Fix Money is a legitimate loan provider that offers quick and convenient access to cash for those with less-than-perfect credit scores. It is an ideal option for individuals needing to cover an unexpected expense or needing extra funds before their next paycheck arrives.

The company is committed to offering its customers competitive rates and flexible payment terms, making it an excellent option for anyone looking for a short-term loan. We Fix Money has a strong customer service team who can help you through the loan process.

Although there are many advantages of taking out a loan with We Fix Money, it is vital to ensure you understand all the terms and conditions before signing up. Make sure you are comfortable with your loan’s interest rate, repayment terms, and fees to make the most informed decision possible.

Also, take the time to read reviews from other customers who have used We Fix Money to better understand their experiences. Ultimately, you should feel confident that We Fix Money suits you. In that case, it may be worth considering as a reliable loan provider.

Also Read

Beachsissi reviews – is it legit & worth your money?

Tourmaline Socks Review: The Secret to Slimming Health Socks?

Zekear Boots Reviews: Are Zekear Shoes Legit?

Also Read

Hey Dude Shoes Review – Must Read Before Buying

Miniolie Reviews – Is Miniolie a Legit Site?

Happy Mammoth Review – Is It Worth It? Will It Provide the Required Nutrition?

Also Read

Harklinikken Reviews – Is It Worth Considering For Your Hair?

Lilicloth Reviews – Is Lilicloth Clothing Worth Your Money?

Kyzue Reviews: Is This The Best Clothing Store For Women?

Also Read

Lukalula Reviews – Is Lukalula Clothing Legit or a Scam?reviews

Herbaluxy Teeth Whitening Reviews – Is It Really The Best Teeth Whitening Product?

Pawrade Reviews – Is Pawrade a Legit Company or Scam?

Also Read

Knix Underwear Reviews: Is It Worth Trying?

Ogee Makeup Reviews – Everything You Need to Know!

Stick It Rollers Review – Is This Cleaner Worth It?

Also Read

Bellelily Reviews – Is Belle Lily Clothing Legit & Worth Your Money?

Coffee Break Loans Reviews – Is Coffee Break Loans Legit?

Fykee Cordless Vacuum Review: Is It The Best Vacuum For Your Home?

Also Read

Ninja Woodfire Grill Review: A Multi-Use Portable Grill That Packs a Punch!

Sgin Laptop Review: Are Sgin Laptops Good & Worth It?

Orwyy Clothing Reviews – Is Orwyy a Legit Company?

Also Read

Pineapple Street Book Review: Is It Worth Reading?

Sonos Era 300 Review – Everything You Need to Know

NOW Broadband Reviews – Is It Worth Your Money?

Also Read

Love Holidays Reviews – Is It a Reliable Travel Booking Site?

Cazoo Reviews – Is This Leading Seller of Used Cars Worth It?

Onbuy.com Reviews – Is It a Legit Site to Buy and Sell?

Also Read

Cinch Cars Reviews – Are Cinch Cars Any Good?

Pretty Litter Reviews – Is It Best for Your Kitty?

Chicken al Pastor Chipotle Review – Is It Worth Trying?

Also Read

Wocklean Review – Is Wocklean Legit & Helpful For Relaxation?

Ketology Keto Gummies Review – The Truth About This Popular Keto Supplement

AKG Y600NC Wireless Headphones Review – Is It Worth Your Money?

Also Read

Staysure Travel Insurance Reviews – Is Staysure Travel Insurance Any Good?