Tranzact Card Scam: TranzactCard, a financial services provider, has recently faced scrutiny and allegations surrounding its operations, particularly its affiliation with Ponzi schemes. Concerns have been raised about the feasibility and legitimacy of their business model, as well as their claims of being FDIC-insured.

The lack of information on reputable business platforms and discrepancies in physical addresses have added to suspicions about TranzactCard’s legitimacy.

In this article, we will thoroughly examine the reviews and allegations surrounding the Tranzact Card scam, providing an objective analysis for our discerning readers.

Table of Contents

The Background of Tranzact Card Scam

The background of the Tranzact Card scam has raised concerns about the legitimacy and feasibility of the company’s affiliate and customer referral schemes. TranzactCard’s fraudulent activities have come into question, and there is a need to uncover their deceptive practices.

The company offers various schemes, such as the Digital Bank Office (DBO) franchise and customer referral programs, which promise bonuses and rewards. However, there have been reports of difficulties in receiving refunds and closing franchises, raising doubts about the feasibility of these schemes. Additionally, TranzactCard claims to be FDIC-insured, despite lacking proper verification.

The presence of MLM-based schemes and recent changes in the company have further fueled suspicions about its legitimacy. It is crucial to delve deeper into the truth behind TranzactCard’s activities to protect individuals from falling victim to their fraudulent practices.

Tranzact Card Ponzi Affiliate Schemes

Exploring the deceptive nature of Tranzact Card’s Ponzi affiliate schemes reveals the potential risks and financial harm they pose to unsuspecting participants. The Tranzact Card affiliate program and franchise issues have raised concerns among investors and individuals looking to join the program. Here are five key points to consider:

- Tranzact Card offered a Digital Bank Office (DBO) franchise for $495, which has raised doubts about its feasibility given the reputation of Solid Bank.

- DBO franchisees have reported difficulties in closing their franchise and obtaining a refund from Tranzact Card.

- To receive a portion from the community revenue pool, DBOs are required to acquire three more DBOs under them.

- Tranzact Card’s affiliate and customer referral schemes are MLM-based, which can be a red flag for potential participants.

- Recent changes, the presence of Richard Smith, and unrealistic MLM and Ponzi schemes raise suspicions about the legitimacy of Tranzact Card.

It is crucial for individuals considering involvement with Tranzact Card to thoroughly research and assess the potential risks before making any financial commitments.

Tranzact Card Ponzi Customer Schemes

Highlighting the potential risks and financial implications, Tranzact Card’s Ponzi customer schemes entice individuals with a $25 lifetime fee and promises of bonuses for referrals, raising concerns about the legitimacy and credibility of the program.

To better understand the effectiveness of Tranzact Card’s rewards program, it is essential to conduct a thorough analysis of the ZBuck rewards program.

Customer experiences with TranzactCard’s referral system also play a crucial role in evaluating the program’s legitimacy. It is important to gather feedback from customers who have participated in the referral system to assess the benefits they have received and whether the program delivers on its promises.

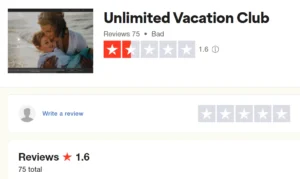

Concerns About Tranzact Card’s Legitimacy

Amidst the ongoing discussions, several stakeholders have expressed growing apprehension about Tranzact Card’s legitimacy, particularly in light of recent changes and the presence of Richard Smith.

Concerns have been raised regarding the company’s claims of being FDIC-insured and the involvement of Richard Smith in Tranzact Card’s operations. These concerns have sparked a deeper analysis of Tranzact Card’s credibility and have led to a thorough examination of its business practices.

To better understand the concerns surrounding Tranzact Card, here are five key points that have been highlighted:

- Tranzact Card’s affiliation with Evolve, Trust, and CBW Bank as opposed to being directly FDIC insured.

- The presence of Richard Smith, whose involvement raises questions about the company’s intentions and credibility.

- The MLM-based affiliate and customer referral schemes that Tranzact Card employs, which some stakeholders view as unrealistic and potentially fraudulent.

- Recent changes within Tranzact Card, such as the loss of its banking service provider and the transition to a new Bank Identification Number, have raised doubts about the company’s stability and ability to provide reliable services.

- The lack of presence on reputable platforms such as BBB and D&B, as well as discrepancies in the company’s physical address, further contribute to the growing suspicions about Tranzact Card’s legitimacy.

It is crucial for stakeholders to thoroughly examine these concerns before making any decisions or investments related to Tranzact Card.

Conclusion – Tranzact Card Scam

In conclusion, the allegations surrounding TranzactCard and its affiliation with Ponzi schemes raise significant concerns about the legitimacy and feasibility of its business model.

The company’s questionable bonuses, rewards, and franchise opportunities, along with suspicions about its FDIC-insured status and lack of presence on reputable business platforms, have further fueled doubts within the financial community.

These issues warrant a closer examination of TranzactCard’s operations and the involvement of certain individuals.

Also Read

Is Bytobit Scam or Legit? Don’t Be the Next Victim!

Is Ronald 90 Day Fiance Scam Exposed – Discover the Shocking Truth

Is Micron Investment a Legitimate Investment Opportunity or a Scam?

Also Read

Is Vio.com Legit or a Scam? Your Trusted Travel Companion?

Is Nezertex Scam or Legit? Don’t Fall for Their Deceitful Promises!

Dunelm Warehouse Clearance Legit Or Scam?

Also Read

Is Ferristale Scam or Legit? Uncovering The Truth Behind

Is Brrttyess Legit or a Scam? Brrttyess.Com Reviews

Joules Clearance Scam – Don’t Fall Victim to This Cunning Scheme!

Also Read

Is Regatta Outlets Com Scam or Legit? Discover the Shocking Truth!

Colorscape Us Scam- Reschedule Delivery Scam Message!

Lymenex Scam or Legit? Discover the Shocking Truth Behind Lymenex

Also Read

Vegatradex Scam or Legit? – Vegatradex.Com Exposed

Slash Watts Scam Exposed: Don’t Be The Next Victim!

Is Ericdress Legit or a Scam? Ericdress Online Shop Review

Also Read