Peggy Williams Scammer – In the case of Peggy Ann Fulford, a financial advisor, her deceptive actions led to significant financial losses for athletes like Dennis Rodman and others.

Fulford, who falsely claimed to be Harvard-educated, manipulated her clients by controlling their money and using it for her own gain.

With a network of numerous bank accounts and shell corporations, she engaged in money laundering.

Rodman, among other athletes, suffered substantial financial setbacks as a result.

Fulford’s fraudulent activities were eventually exposed, leading to her arrest and a 10-year prison sentence, along with a substantial restitution order.

Table of Contents

Peggy Williams Scammer – Peggy Ann Fulford’s Deception

Peggy Ann Fulford engaged in deceptive actions, such as falsely claiming to be a Harvard-educated financial advisor and using clients to build her own wealth, resulting in significant financial losses for athletes like Dennis Rodman.

Fulford’s fraudulent schemes involved making false promises to clients, including not charging fees and providing financial advice based on her alleged Harvard education. However, instead of acting in her client’s best interests, she used their income to accumulate wealth for herself.

By depositing clients’ funds into her own bank accounts and exerting control over their finances through power of attorney, Fulford manipulated and exploited her clients.

This deceitful behavior had a profound impact on the financial stability of athletes like Dennis Rodman, who suffered a loss of $1.24 million due to Fulford’s actions.

The Extent of Her Illegal Activities

The extent of Peggy Ann Fulford’s illegal activities involved managing a significant number of bank accounts and shell corporations, all part of a sophisticated money laundering scheme. Investigation findings revealed that Fulford had control over 85 bank accounts and more than 20 shell corporations, which she used to hide and move money illicitly.

This allowed her to engage in fraudulent activities and deceive her clients, including Dennis Rodman and other athletes. By depositing clients’ income into her own bank accounts and using her power of attorney to control their money, Fulford built her own fortune at the expense of her clients.

Her deceptive actions and false claims, including falsely claiming to be a Harvard-educated financial advisor, enabled her to carry out these illegal activities for a significant period of time before authorities uncovered the truth.

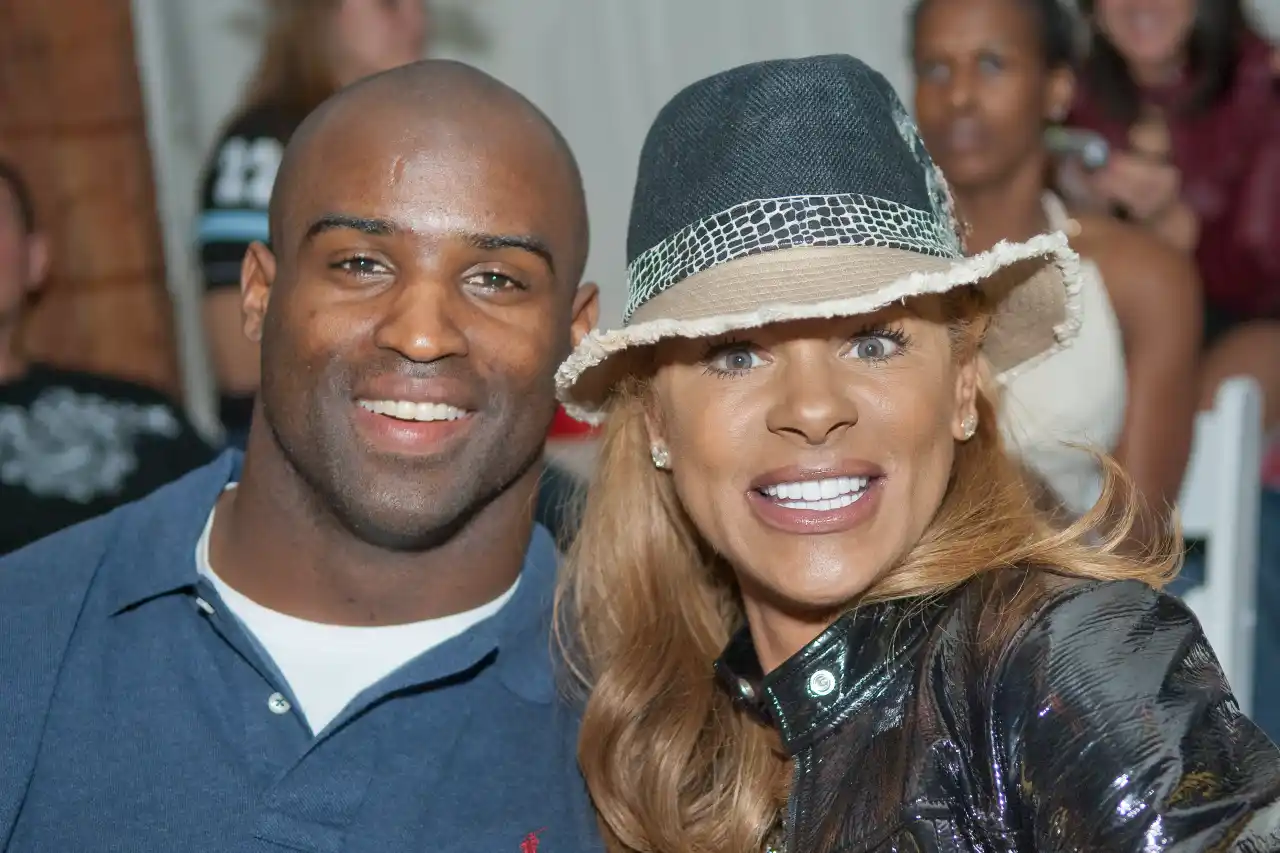

Dennis Rodman’s Experience

During his dealings with Peggy Ann Fulford, Hall of Famer Dennis Rodman encountered significant financial difficulties. Fulford, who falsely claimed to be a Harvard-educated financial advisor, blamed Rodman’s spending habits for his financial downfall. She accused him of being untrustworthy with his own accounts, deflecting responsibility for her deceptive actions.

Despite Rodman’s attempts to discuss his financial issues with Fulford, she refused to take accountability. This experience had a profound impact on Rodman and other athletes, as it shattered their trust in financial advisors.

Fulford’s actions not only resulted in monetary losses for Rodman but also undermined the confidence athletes had in professionals entrusted with their financial well-being.

The betrayal by Fulford serves as a cautionary tale for athletes, highlighting the importance of due diligence and skepticism when it comes to managing their finances.

Arrest and Sentence

After being arrested in December 2016, Peggy Ann Fulford was sentenced to 10 years in prison and ordered to pay $5.7 million in restitution. Her illegal activities had a significant impact on the careers of athletes like Dennis Rodman.

The deceptive actions of Fulford resulted in substantial financial losses for these athletes, which had long-lasting consequences. These athletes trusted Fulford to manage their finances and make wise investments, but instead, she used their money to build her own fortune.

The case highlights the importance of financial education for athletes. Many athletes, like Rodman, have limited knowledge and experience in managing large sums of money. They often rely on financial advisors without fully understanding the consequences.

By providing athletes with proper financial education, they can make informed decisions and protect themselves from individuals like Peggy Ann Fulford.

Provable Losses Suffered

Several athletes, including Ricky Williams, Dennis Rodman, Travis Best, Lex Hilliard, and Rashad McCants, suffered significant financial losses as a result of Peggy Ann Fulford’s illegal activities. These athletes, who placed their trust in Fulford as their financial advisor, were victims of her deceptive actions and false promises.

Fulford managed numerous bank accounts and shell corporations as part of her fraudulent scheme, using them to launder money and build her own fortune.

The impact of these financial scams on athletes is a harsh lesson on the importance of carefully selecting trustworthy advisors and closely monitoring their financial affairs.

The losses suffered by these athletes highlight the need for financial literacy and education to protect individuals from falling victim to scams and fraud. It serves as a reminder for everyone to be vigilant and cautious when entrusting their finances to others.

Frequently Asked Questions

How did Peggy Ann Fulford manage to deceive her clients and build her own fortune?

Peggy Ann Fulford deceived her clients and built her own fortune through manipulative tactics. She falsely claimed to be a Harvard-educated financial advisor, promised no fees, controlled clients’ money through power of attorney, and used their income to build her own wealth. The impact of her actions on her clients’ lives was significant, resulting in financial losses and the discovery of her fraudulent activities.

What were the specific fraudulent activities that Peggy Ann Fulford engaged in with her clients’ money?

Peggy Ann Fulford engaged in fraudulent activities with clients’ money, including falsely claiming to be a Harvard-educated financial advisor, using clients to build her own fortune, depositing their income into her bank accounts, and using power of attorney to control their funds.

How did Dennis Rodman initially become involved with Peggy Ann Fulford and what were his experiences working with her?

Dennis Rodman initially became involved with Peggy Ann Fulford as his financial advisor. However, he had negative experiences working with her as she blamed his spending habits and accused him of being untrustworthy. Fulford’s fraudulent activities and subsequent arrest had a significant impact on Rodman’s finances and he ultimately cut ties with her. Other athletes, such as Ricky Williams and Travis Best, also suffered financial losses due to Fulford’s deceptive actions.

What were the circumstances surrounding Peggy Ann Fulford’s arrest and what was the outcome of her trial?

Peggy Ann Fulford was arrested in December 2016 for her deceptive actions, including falsely claiming to be a Harvard-educated financial advisor. She was sentenced to 10 years in prison and ordered to pay $5.7 million in restitution.

Aside from Dennis Rodman, which other athletes and celebrities suffered provable financial losses due to Peggy Ann Fulford’s actions?

Other athletes and celebrities affected by Peggy Ann Fulford’s actions include Ricky Williams, Travis Best, Lex Hilliard, and Rashad McCants. The long-term financial consequences for Dennis Rodman and these victims resulted in provable losses ranging from $132,123 to $3.01 million.

Also Read

Is Ferristale Scam or Legit? Uncovering The Truth Behind

Is Brrttyess Legit or a Scam? Brrttyess.Com Reviews

Joules Clearance Scam – Don’t Fall Victim to This Cunning Scheme!

Also Read

Is Regatta Outlets Com Scam or Legit? Discover the Shocking Truth!

Colorscape Us Scam- Reschedule Delivery Scam Message!

Lymenex Scam or Legit? Discover the Shocking Truth Behind Lymenex

Also Read

Is Mybedlife Scam or Legit? Don’t be Fooled by This Scam!

Bella Heather Missing – Discover The Gripping Tale of Her Disappearance.

Is Prizechecker.Com Scam or Legit? Uncovering The Truth

Also Read

Is Coupon65 Scam or Legit? Coupon65 Canada Reviews

TD Digital Certificate Scam – Learn How to Thwart Phishing Attacks!

Wellstocancel Scam Exposed – Shocking Wells Fargo Scam Text!

Also Read

Is Postertok Scam or Legit? Unveiling the Postertok.Com Scam

Jake Paul Scam – Allegations Against Jake Paul In Illegal Crypto Promotion

Clarks Seasonal Sales Online Scam – Discover the Shocking Truth!

Also Read

Is Handbagoutlet-sale.com Legit or a Scam? Don’t be a Victim!

Is Shoe Carnival Legit or a Scam? Shoe Carnival Reviews

Is PPV.com Legit or a Scam? Pay-Per-View Reviews

Also Read

Truist Alert Scam Exposed – Be One Step Ahead of Scammers!

X260 Ebike Scam Exposed – Scam Stores Selling Fake Segway Ebikes

Is Seataoo Scam or Legit? Don’t Fall Victim to Their Deceitful Tactics

Also Read

Brooksdale Tax Refund Scam – Uncover the Shocking Truth!

Is Online Profit DNA Scam or Legit? Discover the Truth About