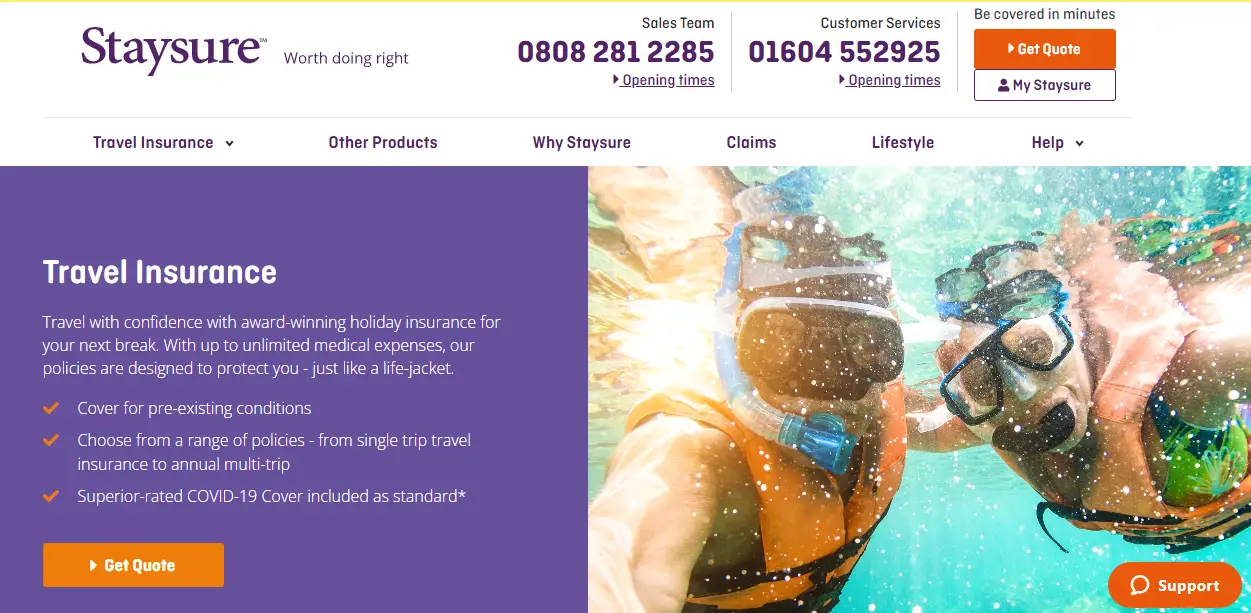

Are you looking for Staysure travel insurance reviews to help you decide if Staysure travel insurance is right? If so, you’ve come to the right place! In this blog post, we’ll look at Staysure travel insurance reviews to see what customers say about their experiences and whether or not Staysure travel insurance is worth investing in.

Read on to learn more about Staysure travel insurance reviews and make an informed decision about your travel insurance coverage.

Table of Contents

What is Staysure Travel Insurance?

Staysure travel insurance offers an extensive range of cover options, with up to £10 million worth of medical and repatriation coverage and a variety of add-ons such as winter sports and cruise cover. Its policies include benefits such as personal liability and personal belongings cover, cancellations and curtailment cover, legal expenses, and emergency medical assistance.

Staysure travel insurance also protects against unexpected events such as flight delays and missed connections, with trip interruption and cancellation also included in its standard packages.

The company is also known for its customer service, with a 24/7 emergency helpline available should customers need help abroad. In addition, Staysure offers a range of discounts for certain types of travelers, including families, couples, and those over 50.

What Does Staysure Travel Insurance Offer?

Staysure offers a range of tailor-made travel insurance solutions designed to meet the needs of all kinds of travelers. Whether you’re taking a one-off trip or a globetrotter looking for hassle-free cover, Staysure has got you covered.

For those taking an annual multi-trip, Staysure’s insurance policy allows customers to take unlimited trips with no upper limit on days away. This policy also covers pre-existing medical conditions and allows customers to add additional covers such as winter sports and cruise covers.

Staysure’s winter sports cover is ideal for anyone hitting the slopes this winter, providing insurance for everything from skiing and snowboarding to tobogganing and ice skating. Cruise cover is also available, offering protection both onboard and in port.

For those looking to explore further afield with peace of mind, Staysure also offers medical travel insurance. This policy provides extensive coverage for all kinds of pre-existing medical conditions, making it ideal for those with health concerns who still want to see the world.

The over-70s travel insurance policy protects those aged 70 and over who want to explore more of the world. With no upper age limit and a range of additional benefits included in the policy, age is no barrier when traveling with Staysure.

Finally, Staysure’s travel insurance policies also come with COVID coverage. Customers are covered before their trip, during their trip, and for any medical costs incurred due to coronavirus while traveling. So you can plan your next trip with confidence.

Why choose Staysure?

Staysure is one of the leading travel insurance providers, offering comprehensive coverage and peace of mind to millions of travelers worldwide. As a specialist provider, Staysure offers a range of policies designed to meet the needs of all kinds of travelers, including those with pre-existing medical conditions.

With Staysure, you can get up to total medical emergency expenses, generous cancellation cover up to £5,000, and a policy that covers most pre-existing medical conditions. In addition, Staysure’s data shows that since 2005, they have given over 10 million people the peace of mind and security needed for safe and enjoyable trips.

No matter if you are traveling for business or leisure, Staysure can provide you with the perfect coverage for your travels. With Staysure’s easy online application process and quick response times, you can be sure to have your policy in place in no time.

Staysure Travel Insurance Plans

| Covers | Basic | Comprehensive |

|---|---|---|

| Medical emergencies and repatriation | Up to £5 million | Unlimited |

| Cancellation | Up to £500 | Up to £5,000 |

| Cutting your holiday short | Up to £500 | Up to £5,000 |

| Baggage | Up to £300 | Up to £2,500 |

| Cash lost or stolen | Up to £250 | Up to £500 |

| Personal Liability | – | Up to £2 million |

| Legal protection cover | – | Up to £25,000 |

| End Supplier Failure | – | Up to £3,000 |

| Excess | £85 – £100 | £65 |

What does Staysure Basic Travel Insurance Cover?

- Staysure Basic Travel Insurance offers a variety of coverages for a wide range of needs. This includes medical emergencies and repatriation, with up to £5 million coverage, and cancellation of your trip up to £500 (or up to £5,000 for an extended policy).

- Additionally, should you need to cut your holiday short due to unforeseen circumstances, Staysure will offer you up to £500 in compensation.

- You’ll also be able to get reimbursement for baggage losses or thefts up to £300 and lost or stolen cash of up to £250.

- Unfortunately, personal liability, legal protection cover, and end supplier failure are not included in Staysure Basic Travel Insurance.

- Furthermore, the excess on all policies is between £85-£100.

Staysure Basic Travel Insurance provides excellent coverage for various situations and needs, so you can rest assured that your trip is covered.

What does Staysure Comprehensive Travel Insurance Cover?

Staysure Comprehensive Travel Insurance covers a range of different areas, providing you with comprehensive protection while traveling.

- In the event of medical emergencies and repatriation, Staysure provides unlimited coverage, meaning that you can be sure that you will be covered no matter what happens.

- Additionally, Staysure offers cancellation coverage up to £5,000 so that you can receive compensation for your losses if you have to cancel your holiday due to an unexpected event.

- Staysure also covers lost or stolen baggage, up to £2,500, and cash, up to £500.

- Furthermore, it provides personal liability coverage of up to £2 million, and legal protection covers up to £25,000.

- It also includes End Supplier Failure coverage of up to £3,000 and an excess of £65.

With this extensive coverage, you can be sure you are adequately protected from various scenarios.

What’s not Covered in Staysure Travel Insurance?

When it comes to what is not covered in Staysure Travel Insurance, there are a few critical exclusions to consider.

These include incidents related to alcohol or controlled substances, choosing not to travel, any pre-existing medical condition you have not declared at the time of booking, strike action that was common knowledge when you booked, and travel for medical procedures.

It is essential to read through the policy thoroughly.

Hence, you understand what is and is not covered before taking out a policy. This way, you can ensure you are covered for any eventualities that may arise on your travels.

What optional policy extras to your travel insurance?

Staysure offers several additional policy extras to supplement your travel insurance coverage. These include Cruise Plus Cover, Gadget Cover, Winter Sports, Excess Waiver, Golf Insurance Covers, Travel Disruption Cover, and European FCDO Travel Advice Extension.

- Cruise Plus Cover is an extension of your travel insurance policy that covers medical expenses, cancellations, missed departures, personal liability, and repatriation due to injury or illness while on a cruise.

- It also covers additional costs for a more extended stay in port and for missing onward connections due to a delayed or canceled cruise ship.

- Gadget Cover is designed to cover the cost of replacing any lost, stolen, or damaged gadgets such as mobile phones, tablets, cameras, and laptops up to a certain amount.

- Winter Sports cover is available for those looking to participate in skiing or snowboarding activities and includes cover for medical emergencies, ski equipment hire, and lift pass replacement.

- Excess Waiver allows you to reduce the excess on your travel insurance policy to zero in exchange for an additional premium.

- Golf Insurance Covers can be added to your policy if you plan on playing golf abroad and will provide protection against loss of or damage to golf equipment, golf tuition fees, and green fees up to a specified amount.

- Travel Disruption Cover compensates you if your travel plans are disrupted due to flight delays, technical issues, or inclement weather.

- Finally, the European FCDO Travel Advice Extension is an optional policy that provides cover if your trip is canceled due to FCDO advice against travel.

How much is travel insurance?

When it comes to travel insurance, you get what you pay for. The cost of your travel insurance will depend on several factors, including age, pre-existing medical conditions, how long you’re traveling for, where you’re traveling to, and the policy limits you choose. Generally, younger travelers will pay less for their policies, while seniors may pay more.

In addition to age, pre-existing medical conditions can significantly impact the cost of your travel insurance. If you have any pre-existing conditions, disclose them when applying for a policy to get an accurate quote.

The length of your trip and the destination you’re traveling to will also affect the cost of your policy. Suppose you’re traveling to a high-risk country with a history of political unrest or terrorism. In that case, you can expect to pay more for your policy than traveling to a safe, low-risk destination.

Finally, the policy limits you choose will play a significant role in determining the cost of your policy. Higher limits mean higher premiums. That’s why it’s essential to consider how much coverage you actually need before purchasing a policy.

Do I need travel insurance?

The simple answer is yes! Travel insurance is a must for any trip, no matter how short or long. Whether you are traveling for business or pleasure, travel insurance can provide financial protection in an emergency.

From medical emergencies to lost luggage and flight cancellations, a good travel insurance policy can help you recover from unexpected losses and hassles during your travels.

It’s also important to note that many countries and regions require proof of travel insurance before allowing you to enter or travel in their country, so it’s essential to have a valid policy.

With travel insurance, you can rest assured that you’ll be covered in case something goes wrong on your trip.

What is single-trip travel insurance?

Single-trip travel insurance is an insurance policy that covers you for a single round trip to one or more destinations.

It is designed to protect you from any unexpected costs while you are away, such as medical bills or lost/stolen items.

Depending on the policy, single-trip insurance can cover you for up to 104 days or even 18 months for long-stay policies.

Anticipate making multiple trips in the next 12 months. An annual multi-trip policy could be a better option.

Who can be Covered by Single Trip Travel Insurance?

Single Trip Travel Insurance from Staysure is designed to cover individuals, couples, and families of all ages. Our policy offers flexibility and peace of mind so you can take the stress out of planning your trip.

You can add up to 7 people, of any age, onto your policy. Family members must all live at the same address as the primary policyholder. When you add multiple people to your policy, you will automatically receive a discount on the total price of your cover.

If you’re going on a family holiday or traveling with friends, our Single Trip Travel Insurance covers all of you. With various cover levels to choose from, you can pick the right level for everyone in your party.

Whether you’re looking for essential protection or more comprehensive coverage, our policies provide flexibility and peace of mind regarding travel insurance.

What is the Difference between Single Trip & Annual Multi Trip Insurance?

Single-trip holiday insurance covers one single trip, and the length of cover is usually determined by the duration of your trip. It could be a great choice if you only travel once a year. It offers protection for the entire duration of your holiday, including your time spent abroad and during transit.

On the other hand, Annual Multi-Trip Insurance covers multiple trips taken over the course of a 12-month period. You can travel as many times as you want throughout that period, provided the total number of days abroad doesn’t exceed 183 days in any given year. The exact length of coverage may depend on your age, but typically you can expect to be covered for 31 days in one go.

It’s important to note that each policy differs, and you should always read the policy wording carefully before purchasing. Staysure has several policies available to suit every type of traveler, so it’s worth exploring all the options and finding the right cover for your needs.

Staysure Travel Insurance Reviews by Customers –

What Do Customers Say About Staysure Travel Insurance?

Staysure Travel Insurance offers comprehensive travel insurance plans to fit all types of travelers. Whether you’re a single traveler, a family, or a business traveler, Staysure has the plan to meet your needs. But just how good is the coverage they offer? To find out, let’s look at what customers say about their experience with Staysure Travel Insurance.

On Trustpilot, Staysure has an impressive 4.7 out of 5 ratings, with 259,585 reviews. Most customers express satisfaction with their coverage, praising the company for its excellent customer service and the wide range of options available. Many customers also mention that the policies are affordable and provide excellent value for money.

CompareByReview.com gives Staysure Travel Insurance an impressive 9.9 out of 10 ratings based on 183204 reviews. Most customers praise the company for its reliable coverage and wide range of options, with many noting that the policy was easy to understand and buy.

Customers also report that claims were processed quickly and efficiently without hassle or delays.

Customers have had positive experiences with Staysure Travel Insurance.

Many praises the company’s customer service and the extensive coverage options available. With such a high customer satisfaction rate, it’s clear that Staysure Travel Insurance is an excellent choice for anyone looking for reliable and affordable travel insurance coverage.

The Bottom Line

Regarding travel insurance, finding a policy that offers you the coverage you need at a price that fits your budget is crucial. Staysure Travel Insurance offers various plans and coverage levels to meet all travelers’ needs. With a wide range of benefits and optional extras, Staysure can provide the coverage you need for your next trip.

Customers have generally had good experiences with Staysure, noting their helpful customer service and competitive prices. With various coverage levels to choose from and many optional extras, Staysure can provide the coverage you need for your next trip. Whether looking for basic travel insurance or more comprehensive coverage, Staysure can provide the protection you need when traveling abroad.

Also Read

Is MBenzgram Legit? MBenzgram Car Accessories Reviews

Is Kickscrew Legit? An Exploration of This Online Footwear & Apparel Store

Airtalk Wireless Reviews – Is Airtalk Wireless Legit?

Also Read

Is Lucy in the Sky Legit? A Review of Lucy in the Sky Dresses

Abbyson Furniture Reviews – Is it Worth Your Money?

Zeelool Glasses Review – Everything You Need to Know

Also Read

Rihoas Reviews: Is This Budget-Friendly Clothing Brand Legit?

Public Rec Pants Review – Are They Worth It?

Flycatcher Toys Review – Is Flycatcher Toys Legit?

Also Read

Lulububbles Reviews – Is Lulububbles a Legit Online Store for Baby Clothes?

Sora Bra Reviews – Is Sora Bra a Legit Company?

Is Nourishvita Legit? A Comprehensive Review

Also Read

Beachsissi reviews – is it legit & worth your money?

Tourmaline Socks Review: The Secret to Slimming Health Socks?

Zekear Boots Reviews: Are Zekear Shoes Legit?

Also Read

Hey Dude Shoes Review – Must Read Before Buying

Miniolie Reviews – Is Miniolie a Legit Site?

Happy Mammoth Review – Is It Worth It? Will It Provide the Required Nutrition?

Also Read

Harklinikken Reviews – Is It Worth Considering For Your Hair?

Lilicloth Reviews – Is Lilicloth Clothing Worth Your Money?

Kyzue Reviews: Is This The Best Clothing Store For Women?

Also Read

Lukalula Reviews – Is Lukalula Clothing Legit or a Scam?reviews

Herbaluxy Teeth Whitening Reviews – Is It Really The Best Teeth Whitening Product?

Pawrade Reviews – Is Pawrade a Legit Company or Scam?

Also Read

Knix Underwear Reviews: Is It Worth Trying?

Ogee Makeup Reviews – Everything You Need to Know!

Stick It Rollers Review – Is This Cleaner Worth It?

Also Read

Bellelily Reviews – Is Belle Lily Clothing Legit & Worth Your Money?

Coffee Break Loans Reviews – Is Coffee Break Loans Legit?

Fykee Cordless Vacuum Review: Is It The Best Vacuum For Your Home?

Also Read

Ninja Woodfire Grill Review: A Multi-Use Portable Grill That Packs a Punch!

Sgin Laptop Review: Are Sgin Laptops Good & Worth It?

Orwyy Clothing Reviews – Is Orwyy a Legit Company?

Also Read

Pineapple Street Book Review: Is It Worth Reading?

Sonos Era 300 Review – Everything You Need to Know

NOW Broadband Reviews – Is It Worth Your Money?

Also Read

Love Holidays Reviews – Is It a Reliable Travel Booking Site?

Cazoo Reviews – Is This Leading Seller of Used Cars Worth It?

Onbuy.com Reviews – Is It a Legit Site to Buy and Sell?

Also Read

Cinch Cars Reviews – Are Cinch Cars Any Good?

Pretty Litter Reviews – Is It Best for Your Kitty?

Chicken al Pastor Chipotle Review – Is It Worth Trying?

Also Read

Wocklean Review – Is Wocklean Legit & Helpful For Relaxation?

Ketology Keto Gummies Review – The Truth About This Popular Keto Supplement

AKG Y600NC Wireless Headphones Review – Is It Worth Your Money?