MC Prepaid Management on Bank Statement Scam Explained: Are you worried about falling victim to a bank statement scam? Look out for the growing threat of MC Prepaid Management on your bank statement.

Scammers are targeting this popular financial service, using common tactics to deceive unsuspecting individuals.

It’s crucial to take steps to protect yourself. In this article, we will discuss the signs of a bank statement scam, how to safeguard your information, and what to do if you become a victim.

Table of Contents

The Growing Threat of Bank Statement Scams

You need to be aware of the growing threat of bank statement scams. Scammers are getting smarter and more sophisticated in their techniques, making it easier for them to trick unsuspecting individuals.

One common scam involves fake bank statements that appear to be from legitimate financial institutions. These statements often contain false information, such as unauthorized transactions or fraudulent charges.

The purpose is to deceive you into thinking that your account has been compromised, leading you to provide personal information or make unnecessary payments.

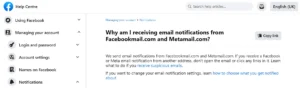

Another type of bank statement scam is phishing, where scammers send fraudulent emails or text messages claiming to be from your bank. They may ask you to click on a link or provide sensitive information, which they can then use to access your accounts or steal your identity.

It’s crucial to stay vigilant and cautious when reviewing your bank statements and to report any suspicious activity immediately.

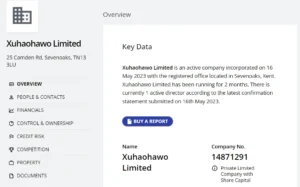

How MC Prepaid Management Is Being Targeted

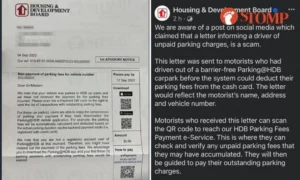

Currently, there is a concerning trend of individuals targeting customers of MC Prepaid Management through fraudulent bank statements. You need to be aware of this scam and take necessary precautions to protect yourself.

Fraudsters are sending fake bank statements to MC Prepaid Management customers, tricking them into thinking that there have been unauthorized transactions on their accounts. They then provide a phone number for customers to call and resolve the issue.

However, when customers call the number, they are connected with scammers who pretend to be customer service representatives. These scammers then try to extract personal information, such as account numbers and social security numbers, from unsuspecting customers.

It is important to remember that MC Prepaid Management will never ask for such information over the phone.

If you receive a suspicious bank statement or are contacted by someone claiming to be from MC Prepaid Management, it is recommended to contact the company directly using the official contact information available on their website.

Stay vigilant and protect yourself from falling victim to this fraudulent scheme.

Common Tactics Used by Scammers

Beware of scammers who employ various tactics to deceive unsuspecting individuals and gain access to their personal information.

One common tactic used by these scammers is posing as legitimate companies or organizations, such as MC Prepaid Management, in order to gain your trust. They may send you emails or text messages claiming that there is an issue with your account and that you need to provide your personal information to resolve it.

Another tactic is using scare tactics, such as threatening legal action or suspension of your account, to pressure you into giving up your personal information.

These scammers may also create fake websites that look nearly identical to the real ones, tricking you into entering your login credentials or financial details.

Always be cautious and never share your personal information unless you are absolutely certain of the source.

Steps to Protect Yourself From Bank Statement Scams

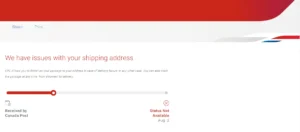

One effective way to safeguard your personal information is by regularly monitoring your financial transactions.

By keeping a close eye on your bank statements, credit card statements, and other financial records, you can quickly detect any unauthorized activity or suspicious transactions.

Make it a habit to review your statements as soon as they become available, and report any discrepancies or fraudulent charges to your financial institution immediately.

Additionally, consider signing up for text or email alerts from your bank or credit card company, which can notify you of any unusual activity in real time.

Remember to also check your online banking and credit card accounts regularly for any signs of unauthorized access or suspicious activity.

Reporting and Recovering From a Bank Statement Scam

If you’ve been a victim of a bank statement scam, the first step in recovering your funds is to contact your financial institution immediately. They will be able to guide you through the necessary steps to report the scam and protect your account.

Provide them with all the relevant details, such as the fraudulent transactions and any suspicious activities you may have noticed. They may ask you to fill out a dispute form and may also initiate an investigation into the matter.

It is important to act quickly, as delaying the reporting process could make it more difficult to recover your funds. Remember to stay vigilant and regularly monitor your bank statements to catch any future fraudulent activities.

Frequently Asked Questions

What Are the Different Types of Scams Other Than Bank Statement Scams?

There are various types of scams to watch out for, apart from bank statement scams.

These include phishing scams, identity theft, lottery scams, and fake tech support calls.

Stay vigilant and protect yourself from falling victim to these fraudulent activities.

How Can I Identify if I Have Fallen Victim to a Bank Statement Scam?

To identify if you’ve fallen victim to a bank statement scam, review your statements for unfamiliar charges. Contact your bank immediately. They can investigate and help you resolve any fraudulent activity.

Are There Any Legal Actions Being Taken Against MC Prepaid Management for Their Involvement in These Scams?

Yes, legal actions are being taken against MC Prepaid Management for their involvement in these scams.

You should stay updated on the progress of the case and be cautious with your bank statements.

What Are the Long-Term Consequences of Falling Victim to a Bank Statement Scam?

If you fall victim to a bank statement scam, the long-term consequences can be severe. You may lose money. You may suffer damage to your credit score. You may face difficulties in getting loans or financial services in the future.

How Can I Prevent Scammers From Obtaining My Personal Information in the First Place?

To prevent scammers from obtaining your personal information, there are several steps you can take:

- Be cautious of suspicious emails or phone calls asking for sensitive data.

- Use strong and unique passwords for all your accounts.

- Enable two-factor authentication whenever possible.

- Regularly monitor your bank statements for any unauthorized activity.

Conclusion – MC Prepaid Management on Bank Statement Scam Explained

In conclusion, protecting yourself from bank statement scams is crucial in today’s digital world. By staying vigilant and following simple steps, you can safeguard your finances.

Regularly monitoring your bank statements is an important practice. This allows you to quickly identify any suspicious charges and take immediate action.

Verifying any suspicious charges is another crucial step. If you notice any transactions that you did not authorize or recognize, contact your bank immediately to report the issue.

Reporting scams to your bank is essential. They have dedicated teams that can investigate the issue and take necessary actions to protect your account.

Remember, scammers are constantly evolving their tactics. It’s important to stay informed about the latest scams and fraud techniques. This knowledge will help you take proactive measures to protect your hard-earned money.

Stay alert, be cautious, and don’t let the scammers get the upper hand. Taking these steps will greatly reduce the risk of falling victim to bank statement scams.

Also Read

Is Hotsshoing a Scam or Legit? Hotsshoing.Com Exposed

Bedstock Clearance Scam or Legit? Bedstockclearance.Com Exposed

Enxyi Clothing Reviews – Is Enxyi Clothing Legit or a Scam?

Also Read

ShinnyJennifer Clothing Reviews: Is It Legit or a Scam?

Heritage Federal Credit Union Scam Exposed: Don’t Be Fooled!

Wilko Warehouse Clearance Sale Scam Exposed: Don’t Get Duped

Also Read

Wilko Closing Down Sale Online Scam: Don’t Fall Victim to Fake Stores

Wilko Administration Sale Online Scam: Don’t Fall for Fake Websites

ICCU Scam Text Exposed: Discover the Shocking Tactics!

Also Read

LGE Community Credit Union Text Scam Exposed: Stay Alert!

Yetcostca.Com Reviews – Is Yetcostca.Com Legit or a Scam?

Hurshels.us Reviews – Is Hurshels.us Legit or a Scam?

Also Read

Beambead.com Reviews – Is Beambead Legit or a Scam?

Motovinreports Scam or Legit? Motovinreports.Com Exposed

Is Chorus Ranch Scam or Legit? Chorusranch.Com Review

Also Read

Facebook Marketplace Scam Asking for Phone Number Exposed!

Old Mutual Scam Exposed – Stay One Step Ahead Now!

Nike Voice of the Athlete Legit or Scam? Voiceoftheathlete.Nike.Com Reviews

Also Read

GLS Postman Scam Exposed – Facebook Marketplace Scam

Harvey Alexander Scam Exposed – Don’t Fall for Their Traps

Tesfa Logistics Ltd Scam Exposed – Don’t Fall for Fake Delivery Emails

Also Read

DPD Postman Scam Exposed: Don’t Fall Victim to Facebook Marketplace Scams

Digiprint Ink Ltd Scam: Digiprintinklimited.Com Unmasked!

Cokoou.Shop Scam or Legit? Unveiling the Shocking Truth

Also Read

Bank of America Customer Service Scam: Discover the Shocking Tactics

Altonexus Technologies Inc Scam Exposed – Don’t Fall Victim

Digiprint Ink Ltd Careers Scam or Legit? Shocking Truth!

Also Read

Is Professional Tax Consultants Inc Scam or Legit?

Signal Private Messenger Scams: Don’t Fall Victim to Hackers