Are you considering purchasing a policy from Otto Insurance but need to know if they are a legitimate company? If so, you’ve come to the right place. In this comprehensive review, we will take an in-depth look at Otto Insurance to answer the question: is otto insurance legit?

We will cover its history, policies, customer service, and more to give you a complete picture of the company and what they have to offer. By the end of this article, you should have a better idea of whether or not Otto Insurance is the right choice for you.

Table of Contents

What is Otto Insurance?

Otto Insurance is a lead-generation website connecting customers seeking auto, pet, home, life, or commercial Insurance with its partners. The company works with an extensive network of nationwide carriers, regional carriers, and individual agents to get you the best car insurance premiums.

Founded by Joshua Keller, Otto is a wholly owned subsidiary of Global Agora, a venture capital firm. The company website only provides a little information about its history, team, or offerings. Still, it claims it can help you get free car insurance rates in seconds.

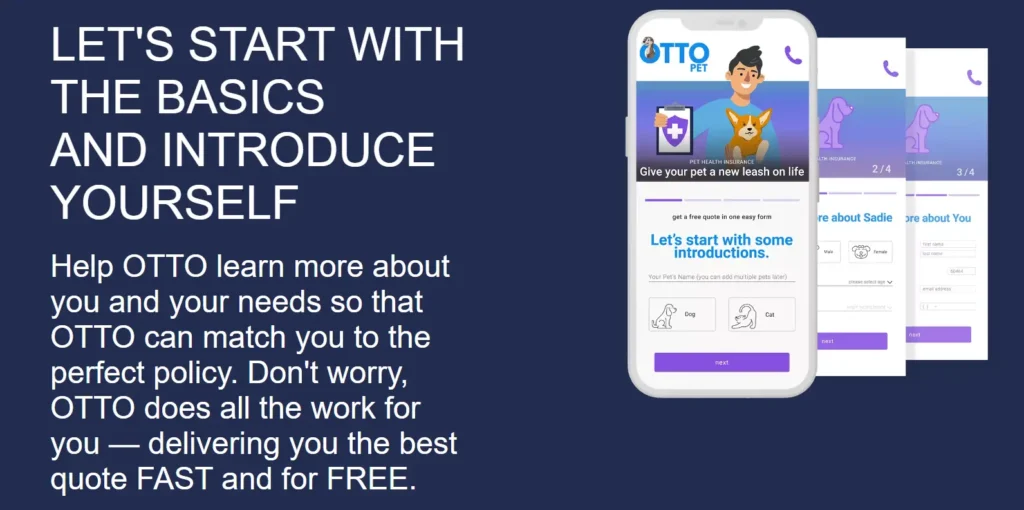

How Does Otto Insurance Work?

Otto Insurance is an online marketplace that helps customers compare insurance plans and find the best fit for their needs. Unlike most traditional insurance brokers, Otto does not provide quotes directly. Instead, it acts as a lead generator, connecting customers to its network of over 1,000 partners.

When you enter your personal information into Otto’s website, it will be sent to its partner companies, who will review it and try to match you with an appropriate plan. These partners include insurance, mortgage, solar panel, and energy providers.

Once your information has been shared with Otto’s partners, it’s up to them to review it and get back to you with quotes. If a partner finds a successful match, Otto may receive compensation from the partner company.

Ultimately, Otto’s goal is to simplify the insurance shopping experience and make it more convenient for customers. By providing customers with multiple options, Otto makes it easier for them to find the best plan for their needs without having to do all of the legwork themselves.

Is Otto Insurance legit?

Otto Insurance is a legitimate business. It connects consumers with insurance agencies and carriers as a lead generation website. While the company does not provide Insurance directly, it may help you find the right provider and policy for your needs. However, it is essential to note that Otto Insurance does not have a financial strength rating from AM Best or appear on J.D.

Power’s rankings of auto insurance companies. Additionally, the company does not have a current Better Business Bureau profile. Therefore, we recommend researching any insurance companies or policies you may find through the website to ensure they are reputable and offer the coverage you need.

The Pros and Cons of Otto Insurance

Pros

- Otto Insurance is a free, easy-to-use service that connects you to thousands of affiliates for car, pet, home, and life insurance.

- However, it’s important to note that Otto Insurance is not an insurance company; instead, it’s a service that connects you with potential insurance providers.

- One of the biggest pros of using Otto Insurance is its ease of use. You can get quotes from multiple insurance companies with just a few clicks, saving you time and hassle.

- Furthermore, Otto Insurance doesn’t charge any fees for its services, which makes it an attractive option for those looking to compare prices.

Cons

- On the downside, a limited amount of information is available about the company itself, and it doesn’t quote prices.

- Furthermore, it shares your personal information with insurance agents, which means you may be inundated with calls and emails.

- Additionally, with Otto Insurance, you can’t choose which companies you want to get rates from, which can limit your options.

What Insurance does Otto Insurance offer?

Otto Insurance offers a variety of different insurance policies and coverage options.

- Liability coverage helps protect you in case you cause an accident that results in injury or property damage to another person.

- Collision coverage helps cover repairing or replace your vehicle if it is damaged in an accident.

- Comprehensive coverage helps cover the cost of repair or replacement for damage to your vehicle caused by something other than a collision, such as theft, vandalism, fire, hail, or flooding.

- Personal Injury Protection (PIP) covers medical costs for you and the passengers in your car if you are injured in an accident.

- Uninsured/Underinsured Motorist coverage helps cover medical expenses if you are injured in an accident involving a driver without Insurance or who doesn’t have enough Insurance.

- Medical expense coverage helps pay for medical bills due to an accident.

- Guaranteed Auto Protection (GAP) insurance helps pay the difference between what you owe on your car and its actual cash value if it is stolen or totaled in an accident.

- Rental reimbursement coverage helps pay for rental car expenses while your car is being repaired after an accident.

- Roadside assistance and towing coverage help pay for emergency services like towing or tire changes.

- Non-owner Insurance provides liability coverage for drivers who don’t own a car but need Insurance when they rent or borrow a vehicle.

- Additionally, Otto Insurance provides quotes on pet insurance, home insurance, and life insurance.

How Cheap Is Otto Insurance?

When it comes to the question of how cheap Otto Insurance is, it is hard to make a definitive statement. The Otto website advertises car insurance for as little as $19 per month, but this claim is difficult to validate.

While the quote process starts on the Otto website, you are quickly redirected to a recommended insurance company’s website, which requires you to provide additional information to receive an actual quoted price.

Otto’s recommended insurers’ prices vary depending on the vehicle type, your driving history, and where you live. It is possible to find some competitive rates, but it can take a bit of research and shopping around to find the best deal. Ultimately, comparing different providers and quotes is best to find the most affordable car insurance.

How to get an insurance quote from Otto Insurance?

Once you have completed the initial questionnaire, you will be connected to multiple providers. Each provider will provide a unique quote tailored to your needs and situation. You can compare the quotes to determine the best coverage for your budget and situation.

You can also apply discounts or request additional coverage options. Once you have found the right policy, you can purchase it directly from Otto’s partner companies.

If you have any questions during the process, contact Otto’s customer support team for assistance. They are available 24/7 to help you find the best policy for your needs.

How to find discounts?

- 1. Automatic payments: Setting up automatic payments from your checking account or credit card can give you a discount on your car insurance premiums.

- 2. Defensive driving: A certified defensive driving course may qualify you for a discount.

- 3. Distant student: If you have a full-time student who isn’t using your car while away at college, you may qualify for a discount.

- 4. Good student: Full-time students who maintain a B or higher grade average may be eligible for a discount.

- 5. Homeowners: You may qualify for a discount just for owning a home, regardless of whether your homeowner’s Insurance is with the same insurer.

- 6. Multi-car: Insuring several vehicles on the same policy could save you money.

- 7. Multi-policy: Bundling your car insurance with other policies, such as homeowner’s or renter’s Insurance, may get you a discount.

- 8. Pay in full: Your premiums may cost less if you pay upfront for six months to a year instead of monthly.

- 9. Safe driver: If you haven’t had any traffic tickets or accidents in the past three years, you may be eligible for a safe driver discount.

How to maximize savings?

Improving your credit score is one of the best ways to maximize savings with Otto Insurance. A good credit score can significantly lower your premiums and make you a more attractive insurer customer.

Additionally, if you switch up your car model, you can get better deals from Otto Insurance. Many insurers offer better rates on specific makes and models. If you can, avoid purchasing expensive vehicles as well.

Maintaining a clean driving record is also crucial for getting the best rates with Otto Insurance. This means obeying traffic laws and avoiding risky driving behaviors like speeding or reckless driving. Ensure to keep up with regular vehicle maintenance and repairs to avoid costly tickets and other problems.

Finally, shopping around and comparing rates is essential when looking for the best deals on Otto Insurance. Research different companies and read reviews to find out what kind of service they offer and how much they charge. You can find great discounts by bundling services, taking a defensive driving course, or signing up for auto-pay.

Is Otto Insurance a scam?

No, Otto Insurance is not a scam. It has been a legitimate company in the insurance industry for over 30 years. They offer a wide range of products, from life insurance to auto insurance, and work with trusted partners to provide their customers with the best possible coverage.

That said, some of their partners may not be insurance providers, meaning you could receive calls or emails from them if you share your information with Otto. To ensure you are dealing with a legitimate provider, research their partners and read the terms and conditions of any policy before signing up.

Otto Insurance Reviews by Customers

Customer reviews for Otto Insurance are overwhelmingly negative. Many customers complained that they were bombarded with calls, texts, and emails after providing their information to Otto. Additionally, customers found the platform misleading, as it often gives inaccurate quotes.

Others have expressed frustration with customer service, noting long wait times and difficulty answering questions. Some customers have even reported being charged more than the quote they received initially.

Customers feel that Otto Insurance could be more accurate and have had mostly negative experiences.

What is the minimum coverage for Otto Insurance?

The minimum coverage required for Otto Insurance depends on your state. Generally, it is recommended that all drivers carry at least liability coverage. This will cover any damage done to another person or property in an accident for which you are found to be at fault.

It is essential to check the specific requirements for your state before getting an insurance quote from Otto Insurance. Some states may also require additional types of coverage, such as uninsured motorist coverage, medical payments coverage, and collision coverage.

What is the difference between Otto Insurance and Hartford Insurance?

Otto Insurance is an online platform that connects customers to different insurance providers. Customers can shop around and compare different plans and prices. They can also purchase plans directly from the website.

Hartford Insurance is a traditional company offering car, home, business, and life insurance products. They also offer additional services such as retirement planning and financial advice. Hartford Insurance offers more comprehensive coverage and has a physical presence in many states.

In comparison, Otto Insurance does not offer any physical services or physical presence in any state. They are purely an online platform and rely on their partner insurance companies for services.

Customers must go through the partner companies to purchase plans or receive services. Additionally, Otto Insurance offers fewer coverage options than Hartford Insurance, and its plans are generally less comprehensive.

Is Otto Insurance Worth It?

When choosing an insurance provider, you need to consider many factors. One of these is whether the provider is worth it. When it comes to Otto Insurance, the answer depends on your needs.

Otto Insurance offers a range of coverage options that make them attractive to many customers. The company offers auto, home, renters, health insurance, and life and disability insurance policies. They also offer a range of discounts, such as discounts for multiple policies and loyalty discounts.

One of the benefits of choosing Otto Insurance is its customer service. Customers can contact the company 24/7 to get help with their policies and even file a claim. Their friendly and knowledgeable customer service team makes them a good choice for those needing insurance assistance.

The cost of Otto Insurance will depend on several factors, including where you live and the coverage you need. However, the company offers competitive rates compared to other providers. Additionally, they offer discounts that can help lower your premiums.

Overall, Otto Insurance is a reliable and trustworthy provider. They offer various coverage options that can meet the needs of many customers. Otto Insurance may be worth considering if you seek an affordable and reliable provider.

Our Verdict

Overall, Otto Insurance is a legitimate lead-generation site that offers users the chance to receive quotes from two insurance companies. It has a network of over 1,000 insurance agents and affiliates.

Although there have been some negative reviews regarding unsolicited calls, there are still plenty of positive reviews. Therefore, it is worth trying Otto Insurance if you are not too concerned about getting too many calls.

Also Read

Hey Dude Shoes Review – Must Read Before Buying

Miniolie Reviews – Is Miniolie a Legit Site?

Happy Mammoth Review – Is It Worth It? Will It Provide the Required Nutrition?

Also Read

Harklinikken Reviews – Is It Worth Considering For Your Hair?

Lilicloth Reviews – Is Lilicloth Clothing Worth Your Money?

Kyzue Reviews: Is This The Best Clothing Store For Women?

Also Read

Lukalula Reviews – Is Lukalula Clothing Legit or a Scam?reviews

Herbaluxy Teeth Whitening Reviews – Is It Really The Best Teeth Whitening Product?

Pawrade Reviews – Is Pawrade a Legit Company or Scam?

Also Read

Knix Underwear Reviews: Is It Worth Trying?

Ogee Makeup Reviews – Everything You Need to Know!

Stick It Rollers Review – Is This Cleaner Worth It?

Also Read

Bellelily Reviews – Is Belle Lily Clothing Legit & Worth Your Money?

Coffee Break Loans Reviews – Is Coffee Break Loans Legit?

Fykee Cordless Vacuum Review: Is It The Best Vacuum For Your Home?

Also Read

Ninja Woodfire Grill Review: A Multi-Use Portable Grill That Packs a Punch!

Sgin Laptop Review: Are Sgin Laptops Good & Worth It?

Orwyy Clothing Reviews – Is Orwyy a Legit Company?

Also Read

Pineapple Street Book Review: Is It Worth Reading?

Sonos Era 300 Review – Everything You Need to Know

NOW Broadband Reviews – Is It Worth Your Money?

Also Read

Love Holidays Reviews – Is It a Reliable Travel Booking Site?

Cazoo Reviews – Is This Leading Seller of Used Cars Worth It?

Onbuy.com Reviews – Is It a Legit Site to Buy and Sell?

Also Read

Cinch Cars Reviews – Are Cinch Cars Any Good?

Pretty Litter Reviews – Is It Best for Your Kitty?

Chicken al Pastor Chipotle Review – Is It Worth Trying?

Also Read

Wocklean Review – Is Wocklean Legit & Helpful For Relaxation?

Ketology Keto Gummies Review – The Truth About This Popular Keto Supplement

AKG Y600NC Wireless Headphones Review – Is It Worth Your Money?

Also Read

Staysure Travel Insurance Reviews – Is Staysure Travel Insurance Any Good?

Is We Fix Money Legit? We Fix Money Reviews

Tngnt Ski Bike Review: Everything You Need to Know

Also Read

Glamnetic Nails Reviews – Is This The Next Big Thing In Nail Art?

Petallush Reviews – Is This Clothing Store Legit & Worth It?

Emmiol Reviews – Is Emmiol Clothing Legit?

Also Read

Is Feetfinder Legit? We Reviewed This Popular Foot Fetish Site

Is Cettire Legit? A Comprehensive Review of the Popular Luxury Fashion Store

Is Grailed Legit? A Comprehensive Review of This Fashion Store