Are you considering taking out a loan from Tripoint Lending? If so, you may be wondering if they are legitimate and trustworthy. In this blog post, we will look at Tripoint Lending reviews to help you decide whether or not to take out a loan from them.

We’ll also discuss the company’s services and customer feedback so that you can determine if their loan products are right for you.

Table of Contents

What is TriPoint Lending?

TriPoint Lending is a marketing lead generator that offers financial relief to its clients. The company is run by Alleviate Financial, LLC, and is a duly licensed California finance lender. With four years of experience in the industry, TriPoint Lending aims to provide solutions to clients who need financial assistance.

Their main office is in Irvine, CA; clients can contact them at (800) 307-1789. The company claims to offer personal loans to clients with low credit scores. It provides them with various financial products to suit their needs.

TriPoint Lending is a lending company that partners with different lending institutions and matches clients to the best financial product for their financial situation. Through this approach, the company can offer competitive interest rates to clients.

Suppose you’re considering applying for a loan with TriPoint Lending. In that case, it’s essential to research the company and evaluate whether they’re the right choice for you. This blog post will explore what people say about TriPoint Lending, how it works, and whether it’s a good option for you.

How does TriPointLending.com work?

TriPoint Lending is an online platform that connects borrowers with lenders to offer personal loans with fixed interest rates. Their process is quick and easy, starting with selecting the loan that fits your financial needs.

Once you have chosen your loan, you will complete a simple application that requires basic information, such as your income, employment status, and credit score.

After submitting your application, TriPoint Lending will match you with a lender who meets your needs. You will receive your funds if your application is approved in a few minutes. TriPoint Lending’s loans come with fixed interest rates, meaning your monthly payments will stay the same throughout the loan term.

It’s important to note that TriPoint Lending does not guarantee eligibility, and your ability to secure a loan will depend on your creditworthiness and other factors. The platform also charges origination fees that are subtracted from the loan amount.

How much does TriPoint Lending cost?

When considering taking out a loan, one of the first questions you might have is, “How much is this going to cost me?” With TriPoint Lending, the answer is going to depend on a variety of factors.

TriPoint Lending offers annual percentage rates (APRs) for first-time borrowers ranging from 5.49% to 30.00%. These rates are competitive compared to other online lenders. Still, it’s important to remember that the rate you are offered will depend on your credit score and other factors.

If you come to TriPoint Lending through paid advertisements on Google or Bing, they offer even lower rates of 35.99% APR or lower. This can be an excellent option for those looking to save money on interest rates and want a quick and easy loan.

Another factor that will impact the cost of your loan is the repayment term you choose. TriPoint Lending offers repayment terms ranging from 61 days to 180 months. Longer repayment terms can mean lower monthly payments. Still, they can also lead to paying more in interest over the life of the loan.

It’s essential to remember that your loan’s cost will depend on your financial situation and creditworthiness. TriPoint Lending offers a personalized approach to lending and will work with you to find a loan option that fits your needs and budget.

TriPoint Lending Reviews

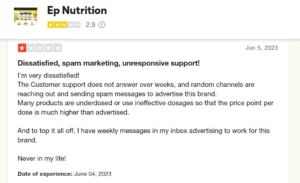

Before deciding on any loan service, looking at previous customer reviews is essential to better understand their experience with the company. In this section, we will be taking a closer look at TriPoint Lending reviews to determine whether or not this service is worth your time and money.

A critical source of information when looking at the legitimacy of a company is the Better Business Bureau (BBB) website. TriPoint Lending currently has an A+ rating on the BBB, with a 4.03 out of 5. While this is a decent score, it’s worth noting that they have received eight complaints in the last three years and two in the previous year alone.

However, when we looked through TriPoint Lending reviews from previous customers, we found that many wanted more satisfaction with their experience.

Many reviews mentioned communication and customer service issues, with some stating that TriPoint Lending representatives were unprofessional and pushy. Some customers also reported problems with loan payments and billing, which caused unnecessary stress and financial strain.

Despite these negative reviews, some positive experiences were shared by customers who found TriPoint Lending to be a good option for their needs. Some customers were pleased with the fast and easy application process and found the loan rates fair and reasonable.

Overall, it seems that TriPoint Lending may be a hit-or-miss option for borrowers, depending on their experience. While their BBB rating is high, it’s important to weigh this against the negative reviews left by previous customers. If you decide to work with TriPoint Lending, carefully research and read through their loan terms and conditions before signing any contracts.

How do I qualify for a TriPoint Lending personal loan?

If you’re considering taking out a personal loan from TriPoint Lending, you might wonder what qualifications must be approved. While every application is reviewed on a case-by-case basis, there are some general requirements you should be aware of.

Firstly, it’s crucial to have a debt-to-income ratio under 50%. Your total debt, including the amount you want to borrow from TriPoint Lending, should be less than half of your total income. If you have a high debt-to-income ratio, you might want to consider paying down some of your debt before applying for a personal loan.

Secondly, TriPoint Lending will want to see that you have verifiable employment, preferably with a W-2, for at least one year. This shows that you have a stable source of income and are less likely to default on your loan.

Lastly, you’ll need to demonstrate that you can make the monthly payments on your loan with your current income. TriPoint Lending will consider your monthly expenses, such as rent, car payments, and utilities, to determine if you have enough disposable income to repay your loan.

TriPoint Lending credit score requirements

One of the first things people wonder about TriPoint Lending is their credit score requirement. The good news is that TriPoint Lending does not have a minimum credit score requirement, meaning they are open to working with individuals with various credit backgrounds. However, it’s important to note that your credit score will still play a significant role in the loan offers you receive.

If your credit score is below 640, you will likely see high-interest rates, making the loan a less favorable option. This is because lower credit scores are associated with a higher risk of default, and lenders need to protect themselves from potential losses.

On the other hand, if your credit score is above 700, you are more likely to receive an outstanding loan offer with TriPoint Lending. This is because a higher credit score signifies a lower risk of default, making lenders more willing to extend more attractive loan terms.

It’s also important to note that TriPoint Lending considers more than just your credit score when determining your loan offer. They will also review your income, employment history, and other factors to determine your eligibility for a loan.

Is TriPoint Lending legit?

Many wonders if TriPoint Lending is a legitimate personal loan provider or another scam. The answer is that TriPoint Lending is indeed an honest lending company registered with the US Securities and Exchange Commission. However, their marketing tactics have been a cause for concern among some consumers.

Some customers have reported receiving misleading mailers promising low-interest rates and large loan amounts, only to find out they did not qualify for those rates or payments. Some lending companies use This standard marketing technique, known as “bait and switch.” While this approach may be legal, it can frustrate and mislead customers.

Despite these concerns, TriPoint Lending is still a legitimate option for personal loans. It’s essential to read the terms and conditions carefully and ask questions about anything unclear.

Do your research, read reviews from other customers, and consider multiple options before deciding.

Ultimately, TriPoint Lending is not a scam. Still, it’s always wise to be cautious and informed when considering financial decisions.

Is Tripoint Lending a good option for me?

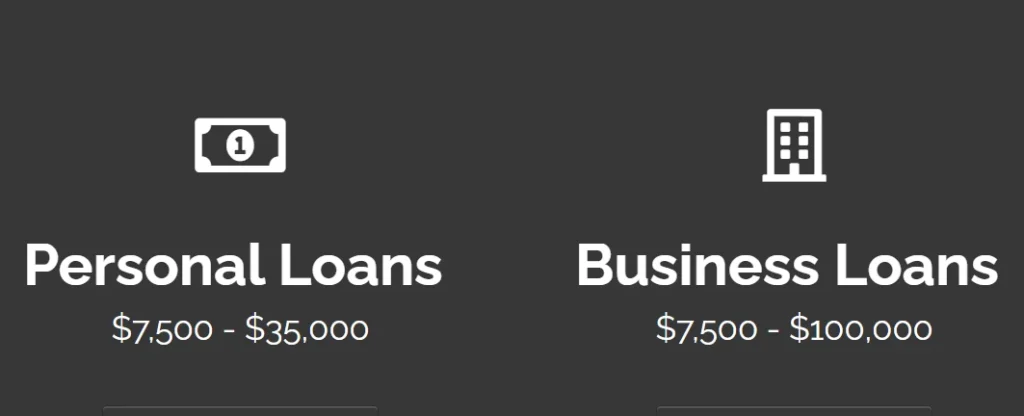

The answer to this question depends on your specific financial needs. Tripoint Lending offers personal loans with a maximum loan amount of $25,000 and a repayment term of up to five years.

If you need a larger loan or a longer repayment term, there may be better options than Tripoint Lending. However, if you need a smaller loan and can repay it within five years, then Tripoint Lending may be a good option.

Additionally, Tripoint Lending may be a good option for those with fair credit scores. While the company does have credit score requirements, they may be more lenient than other lenders. Suppose you have an appropriate credit score and need help to be approved for a personal loan.

In that case, Tripoint Lending may be worth considering.

Whether or not Tripoint Lending is a good option depends on your specific financial needs and credit score. Be sure to compare rates and terms from multiple lenders before deciding.

Will Tripoint Lending Hurt My Credit?

If you consider taking out a personal loan with Tripoint Lending, you may wonder if it will hurt your credit. The answer is that it depends on your situation.

First, let’s talk about how Tripoint Lending works. They are a lending platform that connects borrowers with lenders willing to offer personal loans. When you apply for a loan through Tripoint Lending, they will perform a soft credit check, which does not affect your credit score. This allows them to give you an idea of what interest rates and loan terms you may qualify for.

If you decide to move forward with a loan, the lender will perform a hard credit check, which may impact your credit score. This is because a hard inquiry signals credit bureaus that you are actively seeking new credit, which could signify financial stress.

However, making your loan payments on time and on the whole can positively impact your credit score. This is because your payment history makes up a significant portion of your credit score, and lenders want to see that you are responsible for your debt.

On the other hand, if you miss payments or default on a loan, this could have a negative impact on your credit score. Late payments can stay on your credit report for up to seven years, and defaulting on a loan can lead to collections and even legal action.

So, to answer the question, will Tripoint Lending hurt your credit? The answer is that it depends on how you manage your loan. If you make your payments on time and the whole, it can help your credit score.

However, if you miss payments or default on your loan, it can negatively impact you. It’s essential to carefully consider your ability to repay the loan before taking it out and ensure you only borrow what you can afford to pay back.

Is Tripoint Lending A Scam?

One of the first questions people ask when considering using TriPoint Lending is whether or not it’s a scam. While it’s always wise to be cautious when considering a new lending institution, TriPoint Lending seems to be a legitimate company offering personal loans.

TriPoint Lending is essentially a lead generator for personal loan companies. When you apply for a loan through TriPoint Lending, you’ll be connected with a third-party lender that can offer you a loan. However, this means that TriPoint Lending doesn’t issue the loans themselves.

During some reports of TriPoint Lending being challenging to get in touch with or experiencing issues with receiving loans, most reviews suggest that the company is not a scam. However, it’s important to carefully read the terms and conditions before agreeing to take out a loan with any lender.

Suppose you have doubts about the legitimacy of TriPoint Lending or any other lending institution. In that case, it’s always a good idea to check with the Better Business Bureau or do additional research online to ensure you’re making an informed decision. While TriPoint Lending may not be the right choice for everyone, it does not appear to be a scam and can be helpful for those seeking personal loans.

Conclusion

After evaluating TriPoint Lending, it’s safe to say that the company is a legitimate option for individuals needing personal loans. However, as with any financial decision, it’s crucial to do your due diligence and fully understand the terms and fees associated with the loan before committing to it.

It’s also important to note that while TriPoint Lending may not require a high credit score, having a solid financial history is essential to increase your chances of getting approved and securing a favorable interest rate. TriPoint Lending can be a viable solution for those seeking a personal loan, but consider all your options and compare rates before deciding.

Also Read

Herpesyl Reviews – Is Herpesyl Legit? (Must Read Before Trying)

WAICID Laptop Reviews – Is This the Right Laptop for You?

Lucid Tattoos Reviews – Is This a Revolutionary Approach to Body Art?

Also Read

ZipSmart AI Reviews: The Best Real Estate Decision-Making AI Tool?

Bonesoundz Reviews – Are These Waterproof Headphones Worth the Hype?

Orantmart Reviews: Is This Shop Trustworthy or a Scam?

Also Read

Papifunko Reviews – Is Papifunko Scam or a Legit Website?

Milemax Reviews – The Reality of the Fuel-Saving MileMax Scam

Setskot Shop Review: Legit or Scam? Are They Worth It?

Also Read

Stanleyde.com Reviews – Is Stanleyde.com a Scam or a Legit?

Ultimate Posture Reviews: Does It Work or Is It Another Scam?

Tlopa Collagen Boost Review: Is It Affordable and Actually Works?

Also Read

IKNOW Skincare Reviews: Views on Powerful Skin Care Products?

Buzz Blast Pro Reviews – Buzz Blast Pro Legit or a Scam?

Wanderumal.com Reviews – Is Wanderumal.com a Scam or Legit Site?

Also Read

Continuity Clothing Reviews – Is It Legit & Worth Your Money?

Full of Expect Jumpsuit Review: Is It Comfortable and Lightweight?

Perfectx Joint & Bone Reviews – Is It Legit & Worth Trying?

Also Read

Everythingbreaks.com Reviews: Is everything breaks legit or a scam?

Foreverpans.com Reviews – Is It Worth Your Money?

Google Pixel 7a Review – Is It Worth Your Money?

Also Read