If you’re looking to make easy money, beware of the Iff Investment Scam. This investment ponzi scheme promises high returns with little effort on your part. However, it’s important to know how this scam works and what red flags to watch out for.

In this article, we will explore the origins of the Iff Investment Scam, provide real-life examples of victims, and offer steps to take if you suspect you’ve been targeted.

Stay informed and protect yourself from falling into this trap.

Table of Contents

The Origins of the Iff Investment Scam

You must understand the complex backstory behind the Iff Investment Scam.

It all began with a charismatic man named John Ifferson, who portrayed himself as a successful and experienced investor. He promised high returns on investments and convinced many unsuspecting individuals to hand over their hard-earned money.

Ifferson used intricate marketing strategies, including lavish parties and extravagant testimonials, to create an illusion of credibility. People were drawn to the idea of quick and effortless wealth.

However, behind the scenes, Ifferson was using new investors’ funds to pay off earlier investors, in a classic Ponzi scheme. The scheme eventually collapsed when it became impossible to sustain the ever-growing number of investors.

Many innocent people lost their life savings, and the Iff Investment Scam became a cautionary tale for all investors.

How the Iff Investment Scam Works

Understanding the mechanics of the Iff Investment Scam involves recognizing the deceptive tactics employed by John Ifferson and the systematic way in which he defrauded unsuspecting investors.

The scam operated by promising high returns on investments and enticing individuals to invest large sums of money. Initially, investors would receive regular payouts, reinforcing their belief in the legitimacy of the scheme. However, these payouts weren’t generated from actual profits but were instead funded by the investments of new participants.

This classic Ponzi scheme allowed Ifferson to create an illusion of success while constantly needing new investors to sustain the payouts. Eventually, when the number of new investors dwindled, the scheme collapsed, leaving many individuals with significant losses.

Red Flags to Watch Out for in the Iff Investment Scam

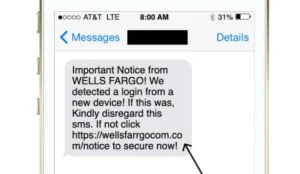

To protect yourself from falling victim to the Iff Investment Scam, be on the lookout for red flags and pay attention to any suspicious signs.

One of the first red flags to watch out for is an unusually high rate of return on your investment. If an opportunity promises guaranteed and abnormally high returns, it’s likely too good to be true.

Another warning sign is the lack of transparency and limited information provided about the investment. Legitimate investment opportunities should be transparent and provide investors with detailed information about the company, its operations, and its financials.

Additionally, be cautious if you’re pressured to make quick decisions or if the investment opportunity is only available to a select group of individuals. These are all potential red flags that shouldn’t be ignored.

Real-Life Examples of Victims of the Iff Investment Scam

Many individuals have fallen victim to the Iff Investment Scam, and their stories serve as cautionary tales.

One such victim is Sarah, a hardworking single mother who was lured by the promise of high returns. Sarah invested her life savings, hoping to secure a better future for her children. However, when the promised returns failed to materialize, she realized she’d been scammed.

Another victim, John, a retired teacher, was enticed by the charismatic salesperson who claimed to have insider knowledge of lucrative investment opportunities. John trusted the person and invested a significant amount of money, only to discover that it was all a sham.

These real-life examples highlight the devastating impact of the Iff Investment Scam, reminding us to be vigilant and skeptical of too-good-to-be-true investment opportunities.

Steps to Take if You Suspect You’ve Been Targeted by the Iff Investment Scam

If you suspect you’ve been targeted by the Iff Investment Scam, you should immediately report it to the authorities. Contact your local law enforcement agency or financial regulatory authority to inform them about the scam and provide any evidence or information you have.

Time is of the essence in such cases, as it can help prevent further victims from falling into the trap. Additionally, you should gather all relevant documents, emails, and other forms of communication related to the scam. This evidence will be crucial in assisting the authorities with their investigation.

It’s important to remember that reporting the scam isn’t only beneficial for yourself but also for others who might become potential victims.

Frequently Asked Questions

Can You Provide Specific Details About the Mastermind Behind the Iff Investment Scam?

The mastermind behind the Iff Investment Scam remains unidentified.

However, authorities are actively investigating to gather specific details about the person responsible for orchestrating this fraudulent Ponzi scheme.

Are There Any Legal Actions Being Taken Against the Individuals Involved in the Iff Investment Scam?

Yes, legal actions are being taken against the individuals involved in the Iff Investment Scam.

They’re being pursued by the authorities and will face the consequences of their fraudulent actions.

What Are the Long-Term Consequences for Victims Who Have Lost Their Investments in the Iff Investment Scam?

If you have lost your investments in the Iff Investment Scam, the long-term consequences can be devastating.

Financial ruin, emotional distress, and difficulties in rebuilding your financial stability are all potential outcomes of such a scam.

Could the Iff Investment Scam Be Connected to Other Similar Ponzi Schemes That Have Occurred in the Past?

Could the iff investment scam be connected to other similar ponzi schemes that have occurred in the past?

Yes, it’s possible. Many ponzi schemes share common characteristics and methods, so it wouldn’t be surprising if there were connections.

Are There Any Government Agencies or Organizations Actively Working to Prevent Scams Like the Iff Investment Scam From Happening in the Future?

Yes, there are government agencies and organizations actively working to prevent scams like the IFF investment scam from happening in the future.

They’ve implemented measures and regulations to ensure investor protection and financial stability.

Conclusion

If you come across the Iff Investment scam, be sure to steer clear. This Ponzi scheme preys on unsuspecting investors, promising high returns that are too good to be true. By understanding the red flags and real-life examples of victims, you can protect yourself from falling into this trap.

If you suspect you’ve been targeted, take immediate action to report it and seek help from authorities. Stay vigilant and remember, if it sounds too good to be true, it probably is.

Also Read

Ghjoeij Store Reviews – Is Ghjoeij Store A Legit Source For Luxury Watches?

Pure Leaf Grant Scam – Is Pure Leaf Grant Legit? Find Out!

Prysmian Group Scam or Legit? Discover the Shocking Truth

Also Read

Vital Flex Core Scam – Don’t be fooled by this supplement Store

The Legends of Oz Scam – Unveil the shocking truth now!

Tinuiti Advertising Scam – Discover the Shocking Truth

Also Read

Neo Media World Scam – Warning Signs to Avoid Being a Victim