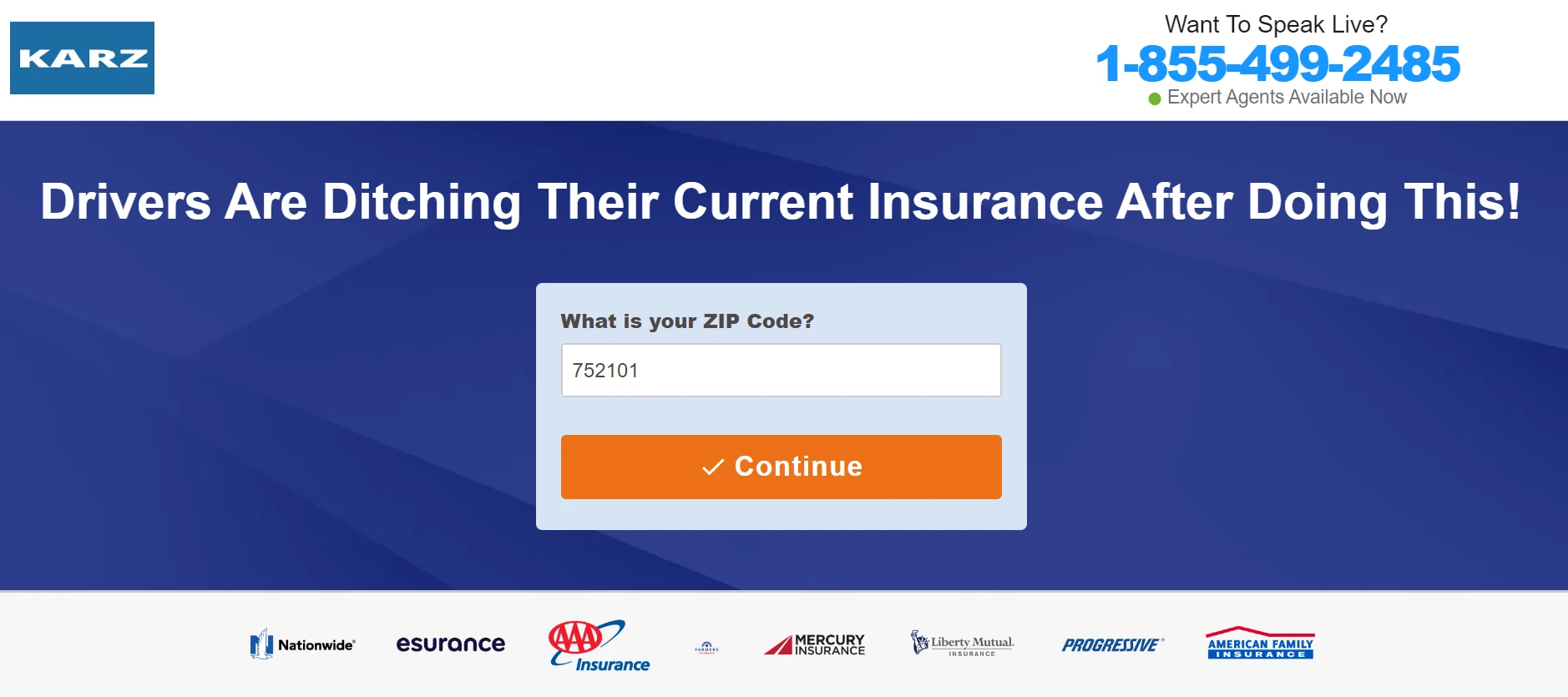

Karz Insurance Reviews have been circulating in the insurance world for some time now, and the big question is – is Karz Insurance legit? In this blog post, we’ll look in-depth at Karz Insurance to determine whether it is reliable and trustworthy.

We’ll review the company’s product offerings, customer service, pricing, and more to understand its service. So, let’s dive in and look closely at Karz Insurance reviews.

Table of Contents

What is karz insurance?

Karz Insurance is an online platform that connects individuals with reliable and reputable insurance companies throughout the United States.

While Karz Insurance does not directly provide insurance services, it partners with established and reputable insurance companies to offer customers auto insurance policies and claims services.

The primary aim of Karz Insurance is to simplify the process of shopping for auto insurance by providing individuals with access to quotes and policies from some of the most trusted and respected insurance companies in the United States.

With Karz Insurance, individuals can compare different insurance policies and prices and choose the one that best suits their needs and budget.

How Does this Insurance Work?

Karz Insurance is an online insurance provider offering personal and commercial vehicle coverage options. The insurance company’s coverage plans are designed to provide financial assistance and coverage in the event of an accident, damage, or theft.

The process of obtaining Karz insurance is easy. All you need to do is visit the Karz insurance website, provide the necessary information, and select the insurance plan that suits your needs. Once you have completed the process and paid, you will receive an insurance policy outlining your coverage details, including your deductible, policy limits, and benefits.

In the event of an accident, you would pay your deductible, and Karz’s insurance would cover the rest of the costs up to your policy limits. The claims process with karz insurance is simple, as you can file your claim online or by phone. The insurance company has a team of professionals who are available 24/7 to assist you with any questions or concerns you may have.

It is worth noting that Karz Insurance has a network of repair shops and service centers that offer high-quality repair services. The insurance company works closely with these repair shops to ensure you receive the best possible service and repair work at a reasonable price.

What Does Karz Insurance Cover?

Karz Insurance is an auto insurance provider that offers a variety of coverage options to its customers. Here’s what you can expect when you purchase a policy from Karz Insurance:

Karz Insurance offers liability coverage for repairs, property damage, medical expenses for injuries sustained by others in the car, and other costs associated with an at-fault accident, like legal fees.

If you hit another car or object, Karz Insurance offers collision coverage that will reimburse you for repairing your vehicle after you pay your deductible.

Karz Insurance also provides comprehensive coverage, which protects your vehicle against non-collision incidents such as theft, vandalism, or natural disasters.

Personal Injury Protection (PIP):

This type of coverage is available in some states. It provides coverage for medical expenses, lost wages, and other expenses that result from injuries sustained in an accident.

Uninsured/Underinsured Motorist Coverage:

Suppose you are involved in an accident with a driver who doesn’t have insurance or doesn’t have enough insurance to cover the damages. In that case, Karz Insurance offers uninsured/underinsured motorist coverage that will help pay for your medical bills, lost wages, and other expenses.

Rental Car Coverage:

Suppose your car is in the shop for repairs after an accident. In that case, Karz Insurance provides rental car coverage so you can still get around while your vehicle is fixed.

When should I buy Karz insurance?

Karz insurance could be an excellent option to consider if you are looking for insurance that offers affordable coverage for your vehicle. When it comes to purchasing karz insurance, timing is essential. Ideally, you should purchase Karz insurance before you buy your vehicle. This way, you can have coverage when you take possession of your car.

Driving without insurance is not only risky, but it is also illegal in many states. You could be financially liable for damages to other vehicles or people involved in an accident without insurance coverage. Therefore, an insurance policy is always a good idea before hitting the road.

If you buy a vehicle from a dealer, you may have the option to purchase insurance. However, this insurance may only sometimes be the best option for you regarding cost and coverage. By shopping around for different insurance options, such as Karz Insurance, you can compare policies and find the best fit for your needs and budget.

Karz insurance offers various benefits, such as coverage for damage caused by accidents, theft, and natural disasters. Additionally, karz insurance is known for its affordable rates and an easy-to-use online portal. By purchasing Karz insurance, you can have peace of mind knowing that your vehicle is protected and you are covered financially in the event of an accident.

In summary, you should buy Karz insurance before buying your vehicle to ensure coverage as soon as you possess your car. It is essential to have insurance coverage when driving to avoid financial liability for damages or accidents. With its affordable rates and excellent coverage options, karz insurance can be a perfect choice for those looking for car insurance.

Benefits of Karz Insurance

Karz Insurance is an auto insurance company that offers affordable rates, flexible payment options, excellent customer service, comprehensive coverage, and various discounts. Let’s take a closer look at these benefits.

Affordable rates: Karz auto insurance offers competitive rates that can help you save money on your car insurance costs. They understand that affordability is crucial to customers and strive to offer easy rates on the budget.

Flexible payment options: With the Karz car insurance policy, you can pay your premiums monthly, quarterly, or annually, depending on your financial situation. This gives customers more control over their payment schedule and helps them plan better.

Excellent customer service: One of the standout features of Karz Insurance is its excellent customer service. The company has a team of knowledgeable and friendly agents who are always ready to assist you with your insurance needs. Customers can reach out to them via phone, email, or chat.

Comprehensive coverage: Karz auto insurance provides comprehensive coverage that includes liability, collision, and comprehensive coverage. This means that customers will be protected against financial loss in case of an accident, theft, or damage to their car.

Discounts: Karz auto insurance offers various discounts to its customers, such as safe driver discounts, multi-car discounts, and good student discounts. These discounts can help customers save even more on their auto insurance premiums.

Karz Insurance offers affordable rates, flexible payment options, excellent customer service, comprehensive coverage, and various discounts. It’s worth considering if you’re in the market for auto insurance.

What are the benefits of karz insurance?

Karz Insurance offers a variety of benefits to its customers, making it a popular choice among car owners. Firstly, their affordable rates allow customers to save on car insurance premiums.

In addition, Karz Insurance provides flexible payment options, allowing customers to choose payment plans based on their budget. This makes it easier for customers to manage their finances without worrying about paying for their insurance in one lump sum.

Karz Insurance also provides comprehensive coverage, which includes liability, collision, and comprehensive coverage. This ensures that customers are protected against financial loss in the event of an accident, theft, or damage to their vehicle. This is especially important as car repairs can be costly, and having comprehensive coverage can help reduce the financial burden.

Another benefit of Karz Insurance is its discounts. They offer various values, such as safe driver discounts, multi-car discounts, and good student discounts. These discounts can help customers save money on their car insurance premiums, which can be especially beneficial for those on a tight budget.

Finally, Karz Insurance is known for its excellent customer service. Their knowledgeable and friendly representatives are always available to help customers with their insurance needs, ensuring a positive experience with the company.

What are the drawbacks of Karz insurance?

Despite its many benefits, Karz Insurance has a few drawbacks that potential policyholders should consider before purchasing their policy. Some of these drawbacks include:

Limited availability: One major downside of Karz automobile insurance is that it is only available in California. This means you cannot purchase a Karz insurance policy if you live in another state.

Limited coverage options: While Karz automobile insurance offers comprehensive coverage, it may offer fewer additional options than other insurance companies. For example, they may not provide roadside assistance or rental car coverage, which could be necessary if you drive long distances or travel often.

Limited online presence: Another drawback of Karz Insurance is that the company needs a significant online presence. This may make it difficult for consumers to access information about their policies or file claims online, which can be a hassle for busy individuals.

Limited policy customization: Karz auto insurance may offer less than other insurance companies, which means you may be unable to tailor your coverage to meet your specific needs. This can be a disadvantage if you have unique coverage requirements or need to add extra protection to your policy.

Limited discounts: While Karz auto insurance offers various deals, they may provide fewer than other insurance companies. This means that you may not be able to save as much money on your car insurance premiums as you would with another insurer.

Karz Insurance Reviews

Overall, Karz Insurance has received positive reviews from its customers. Many users appreciate the convenience of comparing insurance quotes from multiple providers in one place. The website is easy to navigate, and getting a quote is quick and straightforward.

Customers have also praised the customer service provided by Karz Insurance. Representatives are knowledgeable and helpful and willing to go above and beyond to answer any questions and address clients’ concerns.

Some customers have reported that they could save money on their car insurance premiums by using Karz Insurance. However, it’s important to note that the amount you can save will vary depending on various factors, including your driving record, age, and vehicle type.

While most reviews of Karz Insurance are positive, some users have reported experiencing issues with their policies or billing. However, it’s worth noting that these negative experiences appear to be isolated incidents, and overall, most customers are satisfied with their experience using Karz Insurance.

Is Katz insurance legit?

Whether Karz insurance is legit is a common concern for many prospective customers. The good news is that Karz has a solid evaluation from the Better Business Bureau (BBB) and has received positive feedback on forums such as Reddit.

One reassuring factor is that Karz has an actual physical location, office, and phone numbers. This suggests they are not just a virtual entity trying to scam people online. Regarding quality, Karz’s rating is 5 out of 5, indicating that the service is trustworthy and reliable.

However, it’s important to note that our team is still evaluating Karz Insurance. While there is no evidence of any fraudulent activities or other suspicious behavior, it’s always advisable to do your research before making a decision.

Overall, the signs indicate Karz is a legitimate and trustworthy insurance provider. Of course, every customer’s experience may differ, so it’s always important to read reviews and gather as much information as possible before making any decisions.

Is Karz insurance worth it?

Deciding whether or not Karz insurance is worth it for you will depend on a few factors. Suppose you own a car that is older or has higher mileage. In that case, Karz insurance might be an excellent investment to protect yourself from unexpected breakdowns or repairs.

Additionally, if you use your car frequently or rely on it for work, having the added peace of mind that Karz insurance provides may be beneficial.

However, suppose you have a newer car with a manufacturer’s warranty still in place or use your car sparingly. In that case, you may not need Karz insurance. It is essential to weigh the insurance cost against the likelihood of needing it and the potential cost of repairs or breakdowns.

Ultimately, the decision of whether or not Karz insurance is worth it will be unique to each individual and their specific circumstances. It is recommended to carefully evaluate your car’s age and condition, driving habits, and insurance costs to make an informed decision.

Conclusion

After conducting research on Karz Insurance and analyzing various reviews, it is safe to say that Karz Insurance is a legitimate insurance provider.

It offers a wide range of coverage options that are affordable and flexible, making it an attractive choice for drivers of all kinds. While there are some mixed reviews, the overall sentiment from customers is positive, citing excellent customer service and timely claims processing.

As with any insurance policy, Karz Insurance has benefits and drawbacks. Ultimately, whether or not it is worth it depends on individual circumstances and needs. Karz Insurance may be an excellent choice if you value reliable and affordable coverage with excellent customer service.

However, shopping around and comparing policies is always best if you require more extensive coverage or have unique driving circumstances.

Overall, Karz Insurance is a reputable and legitimate insurance provider that offers a solid option for drivers looking for reliable coverage at a fair price.

Also Read

Civil Car Coverage Insurance Reviews: Is It Trustworthy & Reliable?

Sendinfokit.com Reviews – Is This Insurance Worth the Investment?

Is Otto Insurance Legit? A Comprehensive Review

Staysure Travel Insurance Reviews – Is Staysure Travel Insurance Any Good?

Safe Travels USA Comprehensive Insurance Review – The Ultimate Guide

AAMI Home Insurance Review: A Comprehensive Guide

Knose Pet Insurance Review: Is It Worth the Investment?

Tick Travel Insurance Review – Explore Everything

John Hancock Travel Insurance Reviews – Is It Worth It?

Columbus Direct Travel Insurance Reviews – The Good & The Bad

Leisure Guard Travel Insurance Reviews – The Best and Worst

NHS Discount Travel Insurance – Everything You Need to Know