If you’re considering investing in pet insurance for your furry friends, you may have come across Knose Pet Insurance. But is it worth the cost?

In this Knose Pet Insurance Review, we’ll be taking a closer look at what makes this insurance policy unique and whether or not it’s the right choice for you and your pet. From coverage options to customer service, we’ll cover it so you can make an informed decision.

Table of Contents

About Knose Insurance

Knose Pet Insurance is an innovative pet insurance provider founded in 2017 to help pet owners manage the cost of caring for their furry friends. The company is dedicated to providing quality coverage, flexible plans, and competitive prices.

Knose Pet Insurance offers three levels of coverage – Basic, Plus, and Premier – that provide various benefits to fit multiple needs and budgets. Each plan covers the cost of accidents and illnesses, preventive care, and routine care services. The policies also include 24/7 access to Knose’s veterinary helpline and discounts on pet-related products and services.

Knose Pet Insurance also offers optional add-ons such as alternative therapies, overseas travel coverage, and coverage for chronic conditions. The company has an online portal for easy policy management, including claims processing and online payment. They also have an app that allows pet owners to access their accounts on the go.

Knose points to pride itself on providing exceptional customer service and helping pet owners take the best care of their furry friends. They strive to make pet insurance simple, transparent, and accessible.

What Does Knose Cover?

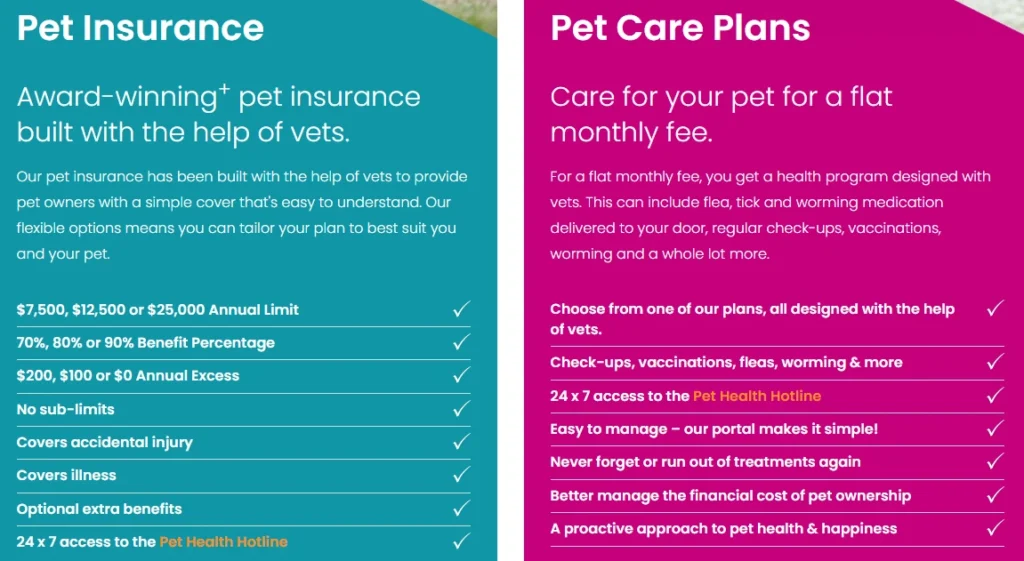

Knose pet insurance offers comprehensive coverage for both dogs and cats. Its plans are customizable and allow customers to choose the amount of annual benefit limit, the percentage of vet bills they wish to claim back, the excess they wish to pay, and the optional add-ons they want to be included.

Knose offers three levels of annual benefit limits: $7,500, $12,500, or $25,000. Customers can also choose between claiming 70%, 80%, or 90% back on eligible vet bills and choosing from a $0, $100, or $200 excess.

Knose does not have sub-limits, so customers are covered for eligible vet bills up to their chosen annual benefit limit. Customers do not have to worry about hitting any limits on specific treatments.

In addition, customers can also opt for optional add-ons such as third-party liability cover, holiday cancellation cover, and even dental treatment cover. They also receive 24/7 access to the Pet Health Hotline, which provides expert advice and guidance when needed.

Knose is available to pets aged six weeks to 8 years old, making it an excellent option for those looking for peace of mind regarding their pet’s health and well-being.

What To Consider

When considering pet insurance, it’s essential to weigh the pros and cons of each company you’re considering. Here are some things to consider when looking at Knose pet insurance:

Cost: Knose pet insurance is more expensive than some other pet insurance providers, with monthly premiums ranging from $50-$150 depending on the type of coverage and the breed of pet.

No Multi-Pet Discount: Unfortunately, Knose does not offer a discount if you have multiple pets insured.

No GapOnly: Knose does not offer “GapOnly” coverage, which means they will only cover medical costs up to a certain amount. You will be responsible for the difference if your pet needs more than that amount.

Exclusions: Like many pet insurance companies, Knose excludes certain conditions from their coverage. These exclusions include pre-existing conditions, hereditary and congenital conditions, and routine care such as vaccinations. Reviewing the list of exclusions before signing up for a policy is essential.

What Do Other Customers Think of Knose?

Customers appreciate the transparency of the Knose pet insurance policies. One customer said, “Knose is so easy to understand, and their coverage is great.” Another praised their customer service, saying, “I was pleased with the polite and knowledgeable customer service I received when setting up my policy.”

Knose customers have nothing but good things to say when it comes to claiming time. A customer said, “Claims are quick and easy, and all communication is timely and professional.” Another said, “Knose pet insurance makes the claims process simple and stress-free,” while a third customer called it “an efficient and painless claims process.”

Overall, Knose customers are delighted with the pet insurance they’ve chosen. They appreciate the straightforward policy options, the friendly customer service, and the stress-free claims process. With such positive feedback, it’s easy to see why many people choose Knose pet insurance.

Knose Pet Insurance Pros

- Knose Pet Insurance is an excellent choice for comprehensive coverage and a generous annual benefit limit. With no sub-limits and a 14-day waiting time for illnesses, you can rest assured that your pet will get the care it needs when it matters most.

- Plus, you can customize your policy by choosing your desired level of coverage – 70%, 80%, or 90%. This allows you to tailor the policy best to meet your and your pet’s needs while also ensuring that you are paying for a plan you can afford.

- Knose Pet Insurance is an excellent choice for those who want comprehensive coverage at a competitive price. Not only do they offer plenty of options to choose from when customizing their policies, but they also make sure their customers understand what they’re getting into with their plans.

- Their customer service staff is friendly and knowledgeable, so any questions about their policies will be answered quickly and accurately.

- Knose Pet Insurance offers peace of mind knowing that your pet will receive the best possible care without going over budget.

- Furthermore, if your pet requires surgery or other treatments, there’s no need to worry about how much it might cost as long as you keep up with your monthly payments. As long as you do so, you’ll be able to use Knose Pet Insurance’s full benefits confidently.

Knose Pet Insurance Cons

- Although Knose Pet Insurance offers comprehensive coverage, there are better choices than this if you only look for a basic range covering accidents.

- The plans provided by Knose are more expensive than other brands like Woolworths and may not be the most cost-effective option.

- Knose doesn’t offer any additional benefits like discounts on pet care products or veterinary services that some other pet insurance companies offer. This means you won’t get any extra perks when you purchase a policy from Knose.

- Finally, Knose’s claim process can be slow and difficult to navigate, requiring you to submit a lot of paperwork and documentation. This could make it time-consuming and frustrating if you’re trying to get your pet covered quickly.

Why choose Knose Pet Insurance?

Knose Pet Insurance offers a comprehensive range of benefits designed to provide your pet with the best possible protection. With Knose, you get peace of mind knowing that in the event of an accident or illness, you will have coverage for treatment.

Knose Pet Insurance includes cover for emergency boarding and paralysis tick benefit, which can help cover additional costs related to your pet’s health. Suppose you plan on taking your pet overseas. In that case, you can also purchase international travel cover to ensure their health is taken care of while away from home.

One of the great features of Knose Pet Insurance is the choice of benefit percentage. You can select either 80% or 90% of eligible vet costs depending on your budget and pet’s needs. This means you can tailor your policy to suit your pocket while still giving your pet the best care.

With all these great benefits, it’s easy to see why many pet owners choose Knose Pet Insurance. The peace of mind it provides, combined with excellent coverage options, makes it a great choice for any pet parent.

How much does Knose pet insurance cost?

The following dog breeds are a sample of some of Knose’s pet insurance quotes for annual premiums. If you want the best deal, compare policies and sections based on factors like the breed, age, and location of your dog.

| Dog Breed | 1yr old | 5yr old |

|---|---|---|

| Maltese Cross | $1,168.44 | $1,467.36 |

| Cavoodle | $1,142.28 | $1,628.28 |

| Labrador | $1,697.04 | $2,219.52 |

| Staffordshire Bull Terrier | $1,540.32 | $2,186.28 |

| Border Collie | $1,394.64 | $1,955.28 |

What pet insurance policies make Knose offer?

On Knose’s website, pet owners can choose between 2 plans for their animals, either for dogs or for cats.

| 🐱 Cover for cats | Covers accidents and illnessesChoice of 70%, 80% or 90% cover more info button$25,000 annual benefit limitAll eligible vet bills including cruciate ligament and tick paralysis treatment covered up to $25,000No additional excessesSame-day cover for accidents14-day waiting period for illnesses6 months waiting period for orthopaedics and hereditary conditions |

| 🐶 Cover for dogs | Covers accidents and illnessesChoice of 70%, 80% or 90% cover more info button$25,000 annual benefit limitAll eligible vet bills including cruciate ligament and tick paralysis treatment covered up to $25,000No additional excessesSame-day cover for accidents14-day waiting period for illnesses6 months waiting period for orthopaedics and hereditary conditions |

Knose pet insurance reviews

Additionally, we looked at Knose pet insurance customer reviews on productreview.com from August 2021, which goes back two years. This is how Knose fared:

A total of 90 out of 100 reviews received a 5-star rating.

It usually takes two weeks for a claim to be accepted.

While the reviews are overwhelmingly positive, there are only 100 of them – other pet insurers have more thoughts, like PIA and Bow Wow.

We also found reports online that claims can sometimes take longer than two weeks to process with Knouse, so that’s something to consider when deciding whether or not it’s worth it to invest in this particular provider.

Customers have also reported needing help understanding their policy before signing up. Hence, they suggest talking with an agent first before committing.

Ultimately, you’ll need to evaluate if it makes sense to choose Knose based on the individual coverage needs of your pet.

Consider researching policies offered by competitors if you feel that the cost-benefit ratio needs to be corrected with Knose pet insurance.

What isn’t covered by a Knose policy?

Unfortunately, Knose pet insurance does not cover pre-existing conditions, intentional harm or neglect, vet costs that are not an emergency, medications not registered or approved in Australia, boarding and transportation costs, and costs after your pet’s death, epidemics, pandemics, or new influenza.

Pre-existing conditions are conditions or illnesses that your pet has already been diagnosed with before taking out a policy.

Intentional harm or neglect can occur when an owner deliberately causes injury or illness to their pet.

Any additional vet costs, such as house calls when they are not an emergency, will not be covered by a Knose policy. Knose does not cover any medications that are not registered or approved in Australia.

Boarding and transportation costs are also excluded from Knose policies. Prices after the death of your pet are also not covered, such as cremation and burial fees.

Finally, epidemics, pandemics, and new influenza are also not covered by a Knose policy.

It is essential to consider what is and isn’t covered by a policy before deciding on a pet insurance provider. It is necessary to understand the exclusions of each procedure to choose the right one for your pet.

The Bottom Line

Knose Pet Insurance is a solid option for pet owners who want to protect their pets from the financial burden of illness or injury. With plans that cover a wide range of scenarios, Knose can help take the stress out of caring for your pet if the unexpected happens.

The company’s customer service and easy claim process make it a breeze to get reimbursed quickly, and their competitive prices and no-claims discounts are a bonus.

Ultimately, Knose Pet Insurance is worth the investment if you want to ensure that your pet will be protected no matter what.

Also Read – Tick Travel Insurance Review – Explore Everything

Sofomy.com Reviews: Is Sofomy Legit or a Scam?

Snipes USA Review: Is This Sneaker Store Legit?

Hawalili Reviews – Is Hawalili a Scam or a Legit Clothing Site?

SignalTech WiFi Booster Reviews – Find Out If This WiFi Booster Works!

Travelcation reviews – Is travelcation.us a legit travel booking site or a scam?

Vchics Clothing Review: Is This Store Worth Your Time & Money?

Upustyle Reviews: Is Upustyle Genuine or a Scam?

YoclubWear.com Review – Is YoclubWear Legit or a Scam?

Travellergram Reviews: Is this Travel Site Legit or a Scam?

Fashiontiy Reviews – Is Fashiontiy Legit?

Nishiki Bike Reviews: Is it Worth Buying?