Are you looking for 89cash.com reviews to determine if this website is legit or a scam? If so, you’ve come to the right place. In this blog post, we will provide you with all the information you need to make an informed decision about 89cash.com.

We will cover topics such as their services, customer feedback, and their overall legitimacy. So if you’re considering signing up with 89cash.com, keep reading to learn more!

Table of Contents

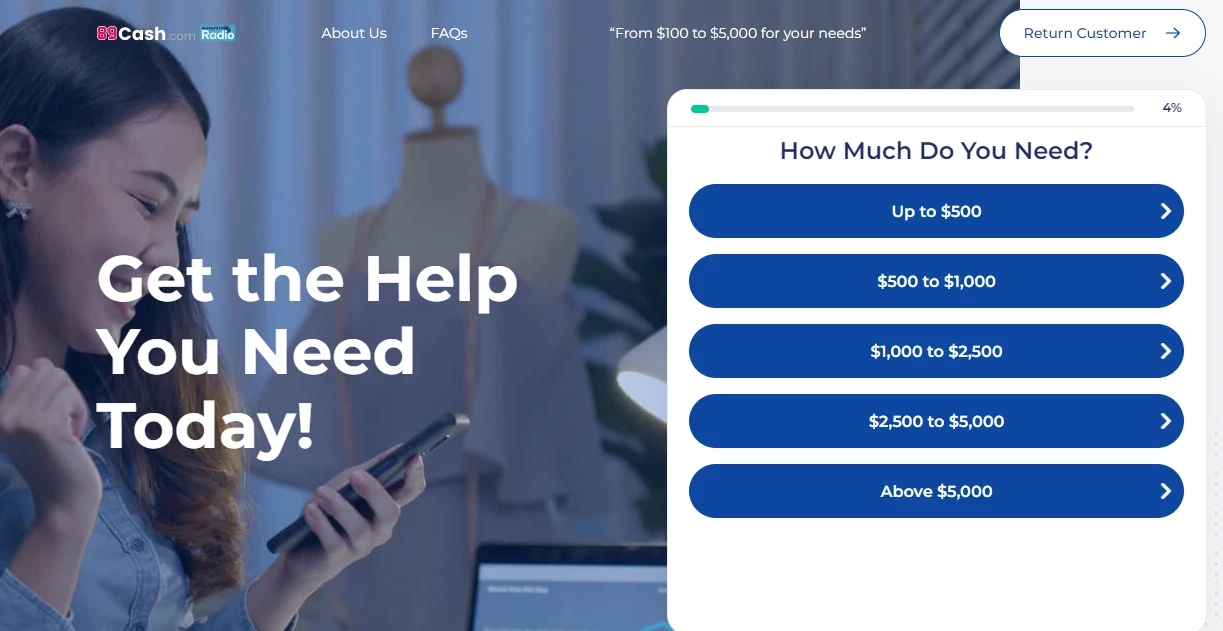

About 89cash.com

89Cash.com is a short-term loan marketplace that aims to provide you with cash fast and at a reasonable interest rate. All you need to do is fill out the loan request form, and they will send you an offer. It’s up to you whether you accept or reject it. They promise to process your loan request quickly and without hassle.

Furthermore, 89cash.com also provides several other financial services, such as money transfers, debt consolidation, and emergency cash.

In addition, they also offer a customer support service where you can ask questions and get quick answers.

How 89cash.com Works?

Step 1: Fill out a loan application

The first step to obtaining a loan from 89Cash.com is to fill out an application on their website. You must provide your name, address, email address, phone number, and the money you want to borrow. You will also need to answer questions about your employment and financial history.

Step 2: Get matched with a lender

Once your loan application has been submitted, 89Cash.com will search for a lending partner willing to provide you with a loan. You will be connected with the lender and receive an offer if there is a match.

Step 3: Sign the loan agreement

Once you have received the lender’s offer, you must sign the loan agreement. This agreement outlines the terms and conditions of the loan and includes information about the interest rate and repayment schedule.

Step 4: Receive your funds

Once both parties sign and accept the loan agreement, 89Cash.com will deposit the funds directly into your bank account. The money should arrive within 24-48 hours after you get the loan agreement.

89Cash.com provides an easy and convenient way to connect with lenders willing to lend money worldwide. The process is simple, and borrowers can get access to funds quickly if approved for a loan.

How much can I borrow from 89cash.com?

89cash.com offers loans starting from $500 and up to over $5000. The loan amount, interest rate, and fees will depend on the lender and the credit card limit you’re using to apply for the loan.

To get started, you must provide some basic information such as the loan amount, credit card limit, email address, etc. Once you’ve filled in all the required information, 89cash.com will provide you with a loan estimate that includes the loan amount, interest rate, and other fees associated with the loan.

Who can qualify for a personal loan from 89cash.com?

If you’re looking to get a personal loan from 89cash.com, there are some requirements that you must meet. First and foremost, you must be 18 years old or older and a US citizen or permanent resident. Additionally, you must have a reliable source of income, typically at least $1,000 after monthly taxes.

Aside from those requirements, 89cash.com also requires you to provide them with specific information before they approve your loan request. This includes a valid email address, work phone number, and home phone number. You may also be asked to provide other documents, such as proof of residence, bank statements, and pay stubs.

89cash.com typically reviews your credit score and repayment history to determine if you qualify for a loan. If you do qualify, they may require you to have been employed in your current position for at least 90 days or have another source of stable income before they can approve your loan.

The Pros of 89cash.com

One of the most significant advantages of 89cash.com is its simplicity and convenience. The application process to apply for a personal loan is straightforward, and you can easily connect with the lender to discuss your loan details.

Furthermore, the turnaround time to get your loan approved is speedy; if your application is endorsed, you can expect to receive the funding within 1-2 days.

Another great benefit of 89cash.com is that even people with low credit scores can qualify for a personal loan.

The company’s flexible terms and conditions mean it is willing to consider applications from borrowers who may need help accessing other loan products due to their credit history.

Finally, 89cash.com offers competitive rates on their loans. Compared with other lenders, they tend to be on the lower end of the scale. This ensures you can get a fair deal when applying for a loan through the company.

The Cons of 89cash.com

One of the main cons of 89cash.com is its high-interest rate on your loan. This can be costly if you are not careful with how much you borrow and how quickly you repay the loan.

Additionally, the advance payment loan has to be repaid within a short period, making it difficult to manage if your finances are tight.

Finally, there is no client review on other sites, so knowing whether 89cash.com is a legitimate service is challenging.

It is essential to do your own research into the company before taking out a loan with them.

89Cash Reviews: What Customers Are Saying?

Despite the lack of reviews on the 89Cash website, I found several comments about this service on other sites. Most of them were positive, with users praising the convenience and speed of the loan application process. Many reviews highlighted the competitive interest rates, fast disbursement, and hassle-free online experience.

Other reviews noted that the customer service team was friendly and attentive, providing timely support when needed.

On the other hand, some customers reported being charged hidden fees when making late payments or rolling over loans. Other customers complained about higher-than-expected APRs.

Is 89cash.com Legit or a Scam?

Regarding loan companies like 89cash.com, there are always questions about whether or not they are legitimate. The good news is that 89cash.com is a legitimate company. They specialize in providing payday loans and credit cards for people with poor credit ratings.

Their website is secure, and all transactions are handled using 256-bit encryption. All personal data is encrypted and never shared with third parties. You can feel confident that your financial data is safe when you use 89cash.com to get a loan.

They also have a customer service team available to answer any questions. They are very professional and are always willing to help. You can reach them by phone, email, or live chat during business hours.

How to Avoid Getting Scammed By Bad Loans?

1. Research the Loan Lender: Research the loan lender thoroughly before availing of a loan. Look for online reviews and customer feedback on the internet. Check out their website, read through their terms and conditions, contact the customer service team to clarify any doubts you have, and try to find out what kind of reputation they have.

2. Avoid lenders who charge high-interest rates: Ensure the loan lender is not charging an excessive interest rate. Check out the interest rate other lenders offer and compare the rates before availing of the loan.

3. Know the Repayment Terms: Know the repayment terms thoroughly before availing of a loan. This includes the monthly payments and other additional fees if any. Make sure that you can afford the repayments and that you understand the repayment schedule.

4. Be Aware of Prepayment Penalties: If you think you need to repay your loan earlier than expected, then you should check for any prepayment penalties associated with the loan. Some lenders may charge an early repayment penalty in such cases, which can add up significantly.

5. Check for Fraudulent Practices: Lastly, watch out for any fraudulent practices by the lender. Check for hidden fees or excessive charges that could indicate fraud. Be aware of any emails or phone calls from suspicious numbers that ask for personal details. Always make sure to double-check any information before providing it to the lender.

How to Choose the Right Loan for You?

1. Figure Out What You Need the Money For Before shopping for a loan, knowing precisely what the money is for is essential. This will help you narrow your loan options and ensure you get the best loan for your needs.

2. Research Your Options: Once you know why you need the money, you can research your different loan options and find the right one for your situation. Consider factors like the interest rate, repayment terms, fees, and requirements before deciding.

3. Compare Lenders: Different lenders offer different terms, so compare several lenders before choosing. Be sure to check out their customer reviews and BBB ratings to get an idea of their customer service and overall reputation.

4. Read the Fine Print: Before signing on the dotted line, read all the fine print in the loan documents. Pay attention to fees, repayment terms, prepayment penalties, and late fees.

5. Choose the Right Loan for You: At this point, you should have enough information to decide which loan is best for your situation. Remember to factor in fees, interest rates, and repayment terms when determining which loan is best for you.

Following these steps, you can easily find the best loan for your situation and avoid getting scammed by bad loans.

Can I still get a loan if I have bankruptcy or bad credit?

Yes, you may still be able to get a loan even if you have bankruptcy or bad credit. Many lenders and lending partners offer short-term loans specifically tailored for people with bad credit or those who have had a default.

When looking for a loan, it’s essential to understand the terms and conditions before signing any paperwork. Additionally, shop around and compare interest rates and fees between different lenders.

It’s also important to note that a loan taken out when you have bad credit or bankruptcy on your record can cause more harm than good if you don’t make payments on time and cannot repay the loan in full.

Therefore, it’s essential to consider all options before applying for a loan and ensure you can meet the monthly payment obligations before agreeing to take out a loan.

When and how do I repay my loan?

When you are approved for a loan from 89cash.com, your repayment schedule will be determined based on the amount of money you borrowed and the type of loan you choose.

Generally, repayment is set up to be taken out on your next payday. Your repayment schedule should be clearly stated in your loan agreement, and you should read it carefully before signing.

An automatic ACH payment plan is the most convenient way to repay your loan. This option will withdraw your loan payment directly from your bank account on its due date. This will help you avoid potential late fees or defaulting on your loan.

If you need an extension on your loan, don’t hesitate to contact your lender or lending partner before you miss a payment (additional fees may be involved). You can also make payments manually online or by phone using a credit card, debit card, check, or money order.

Conclusion

89Cash is an excellent option if you’re looking for a short-term loan to help bridge the gap between paychecks or to cover emergency expenses. The application process is simple and easy, and you can have your funds within 48 hours.

However, before taking out a loan, knowing the associated fees and risks is essential. Be sure to compare different lenders and consider the pros and cons of each before making a decision.

Research online reviews and customer feedback to understand how other customers have experienced the service. Ultimately, 89Cash can provide you with the fast cash you need when you need it, but you should always weigh the costs and benefits to ensure it’s right for you.

Also Read

O’malleys On Fourth Reviews: Is It Worth Your Time & Money?

True Classic Tees Review: Is It Worth Your Money?

DRMTLGY Reviews: Is DRMTLGY Legit & Worth Buying?

Also Read

Snaptravel Reviews: Is SnapTravel (Super Travel) Legit?

Traveluro Reviews – Is Traveluro Legit? Our In-Depth Review

Airmoto Reviews: Is This Air Pump Legit & Worth Your Money?

Also Read

Mirifica Bust Serum Review – Is It Truly The Best Breast Serum?

Sqairz Golf Shoes Reviews – Is This the Next Wave of Golf Footwear?

Mellanni Sheets Review – Are They Worth Buying?

Also Read

OnePlus 11 Review – Everything You Need to Know Before Buying

Rubmd Review- Is It A Reliable Local Massage Therapist Finder?

Alloned.com Review: Is This Dating App Legit or a Scam?

Also read

Ryabe Reviews – Is Ryabe Clothing Legit or a Scam?

Thermohandz Thermal Gloves Reviews – Is Thermohandz Legit?

Exipure Review: Does Exipure Really Work For Weightloss?

Also Read

Vibrosculpt Reviews: Does Vibrosculpt Massager Really Work?

BugMD Reviews – Does It Really Work? Explore Now

Inmod Landry Sofa Review – Is it Worth Your Money?

Also Read

Canon Autoboy Prisma Date Review – Is This Camera Worth It?

QuadAir Drone Review: The First High-End Drone at an Affordable Price?

Skyquad Drone Reviews: Is Skyquad Drone Legit or Scam?

Also Read

Exo Drones Review – Are Exo Drones Good & Worth Your Money?

Fader 2 Drone Review – Is It Worth Your Money?

Ascend Aeronautics ASC-2600 Drone Review – Is It Worth It?

Also Read

Clicgear 4.0 Review: The Best Golf Push Cart Yet?

Garmin Approach Z82 Golf GPS Laser Rangefinder Review: An In-Depth Look

The Ultimate Fly Orb Pro Flying Spinner Mini Drone Flying Review