People1st Advantage Scam or Legit? The People1st Advantage website offers a fraudulent scheme that has caught the attention of many individuals seeking financial opportunities online.

This article aims to shed light on the background of this scam, identify red flags and warning signs for potential victims, discuss ways to research and verify online platforms, provide guidance on protecting personal and financial information, explore options for reporting scams and seeking legal recourse, as well as emphasize the importance of spreading awareness and educating others about such scams.

In order to navigate the complex world of online finance securely, it is imperative to be aware of deceptive practices like the People1st Advantage website finance scam.

By understanding the tactics used by scammers and taking necessary precautions, individuals can protect themselves from falling victim to these fraudulent schemes. It is crucial to stay informed and share this knowledge with others in order to foster a safe and inclusive environment where everyone can make informed financial decisions.

Table of Contents

Background of the People1st Advantage Scam

The People1st Advantage website finance scam has gained considerable attention due to its deceptive nature and the significant financial losses incurred by unsuspecting individuals. This scam investigation revealed a well-organized scheme that preyed on vulnerable individuals seeking financial assistance.

The scammers behind the People1st Advantage website created an appearance of legitimacy by using professional-looking websites, fake testimonials, and promises of high returns on investments.

Once individuals provided their personal and financial information, the scammers would disappear with their money, leaving victims in severe financial distress. Legal consequences for those involved in this scam have been pursued vigorously, with law enforcement agencies working diligently to apprehend the perpetrators.

However, due to the sophisticated nature of the scam and its global reach, it remains challenging to bring all responsible parties to justice. Efforts are ongoing to raise awareness about such scams and educate individuals on how to protect themselves from falling victim to similar fraudulent schemes in the future.

Identifying Red Flags and Warning Signs

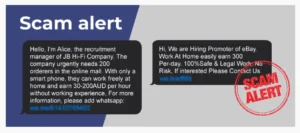

Identifying red flags and warning signs can be facilitated by observing peculiar indicators within the context of financial transactions. It is essential for individuals to have a level of financial education and awareness to protect themselves from scams like the People1st Advantage Website Finance Scam.

Online security also plays a crucial role in identifying potential risks. By being vigilant and paying attention to certain red flags, individuals can minimize their chances of falling victim to fraudulent schemes.

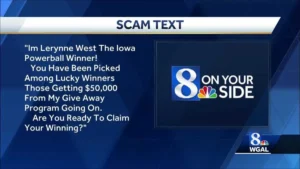

Some common warning signs include unsolicited emails or phone calls requesting personal information, promises of high returns with little risk, pressure tactics to make quick decisions, and requests for upfront payments or fees.

Additionally, individuals should always verify the legitimacy of websites and businesses before engaging in any financial transactions online. Taking these precautions can help safeguard against scams and ensure a secure online experience.

| Red Flags | Warning Signs |

| Unsolicited emails or phone calls requesting personal information | Promises of high returns with little risk |

| Pressure tactics to make quick decisions | Requests for upfront payments or fees |

| Warning Signs | |

| ——————- | ——————————– |

| Unsolicited emails or phone calls requesting personal information | Promises of high returns with little risk |

| Pressure tactics to make quick decisions | Requests for upfront payments or fees |

| Unprofessional or suspicious website or business practices | Requests for sensitive financial information without proper security measures |

| Lack of transparency or unwillingness to provide detailed information | Poor or negative reviews from other customers |

| Vague or unclear explanations about the investment or opportunity | Lack of proper licensing or registration |

| Inconsistent or misleading information provided | Use of high-pressure sales tactics |

| Refusal to provide written documentation or contracts | Unwillingness to answer questions or address concerns |

| Claims of insider knowledge or secret strategies | Lack of verifiable track record or credentials |

| Unusually high fees or commissions charged | Lack of clear exit strategy or plan for investors |

| Pushing for investments in unfamiliar or unregulated markets | Refusal to provide references or testimonials |

| Overly aggressive or persistent sales tactics | Lack of proper documentation or legal compliance |

| Lack of communication or delays in providing requested information | Sudden changes in investment terms or conditions |

| Lack of independent verification or third-party audits | Claims of guaranteed or “can’t miss” investment opportunities |

| Failure to disclose potential risks or downsides | Unprofessional or vague communication |

| Limited or no contact information provided | Use of emotional manipulation or fear tactics |

| Claims of being “exclusive” or available only to a select few | Lack of a physical address or verifiable contact information |

| Offers that seem too good to be true | Pressuring to invest without proper due diligence |

| Unusual or complex investment structures or strategies | Ignoring or downplaying concerns or red flags |

Researching and Verifying Online Platforms

Researching and verifying online platforms requires a thorough examination of their credibility and legitimacy through meticulous investigation and scrutiny. Online security measures play a crucial role in evaluating the credibility of these platforms.

It is essential to look for websites that utilize secure browsing protocols, such as HTTPS, to protect users’ personal information from potential threats. Additionally, checking for trust indicators like SSL certificates and privacy policies can further validate the platform’s commitment to data security.

It is also important to consider user reviews and ratings, as they provide valuable insights into the experiences of others with the platform.

Furthermore, cross-referencing information with reliable sources can help ascertain the authenticity of claims made by the website. By following these steps, individuals can safeguard themselves against falling victim to scams or fraudulent activities on online platforms.

Protecting Personal and Financial Information

Safeguarding personal and financial information is crucial in order to prevent unauthorized access and protect against potential threats. With the increasing reliance on online platforms for various transactions, it is essential to understand the importance of online privacy and take necessary cybersecurity measures.

Implementing strong passwords, regularly updating software, and being cautious while sharing sensitive information are some basic steps individuals can take to enhance their online security. Additionally, utilizing encryption technology and multi-factor authentication adds an extra layer of protection.

It is also advisable to be vigilant about phishing scams and avoid clicking on suspicious links or downloading attachments from unknown sources. By following these practices, individuals can minimize the risk of falling victim to identity theft or financial fraud in the digital realm.

| Strong Passwords | Regular Software Updates | Caution while Sharing Sensitive Information |

| Encryption Technology | Multi-Factor Authentication | Vigilance about Phishing Scams |

Reporting Scams and Seeking Legal Recourse

Detecting and reporting scams is crucial for individuals who have fallen victim to fraudulent activities, as it allows them to seek legal recourse and potentially recover their losses. To effectively report scams and seek compensation, individuals should follow these steps:

Document all evidence: Collect any documents, emails, or other forms of communication that provide proof of the scam.

Report to authorities: File a complaint with local law enforcement agencies, such as the police or the Federal Trade Commission (FTC). Provide them with all relevant information and evidence.

Seek legal assistance: Consult with an attorney who specializes in consumer fraud or financial crimes. They can guide individuals through the legal process and help them understand their rights.

By promptly reporting scams and seeking appropriate legal measures, victims increase their chances of recovering their losses and holding scammers accountable. It is essential for individuals to take action in order to protect themselves and prevent further harm to others.

Spreading Awareness and Educating Others

Raising awareness and educating the public about scams is crucial in combating fraudulent activities and protecting potential victims. By promoting online safety, individuals can become more informed and better equipped to recognize and avoid financial scams.

Spreading awareness involves disseminating information through various channels such as social media platforms, community events, and educational campaigns.

Providing accurate and up-to-date information about common scam tactics, warning signs, and preventive measures empowers individuals to make informed decisions while engaging in online transactions.

Additionally, educating others about the importance of verifying websites’ credibility before disclosing personal or financial information plays a significant role in preventing scams. By fostering a sense of belonging within the community, individuals are encouraged to actively participate in efforts to combat fraud, resulting in a safer online environment for everyone.

Frequently Asked Questions

What are some common tactics used by scammers on the People1st Advantage Website Finance platform?

Common tactics used by scammers on finance platforms include phishing, where they trick users into revealing personal information, and investment scams promising high returns. Warning signs may include unsolicited offers, requests for upfront fees, or pressure to make quick decisions.

How can scammers manipulate online platforms to appear legitimate?

Recognizing red flags is crucial when it comes to online scams. Scammers manipulate online platforms by creating professional-looking websites, using fake testimonials, and offering unrealistic returns. To verify legitimacy, individuals should research the platform’s reputation, check for secure payment options, and seek independent reviews.

Are there any specific steps individuals can take to protect their personal and financial information from scammers?

To protect personal and financial information from scammers, individuals should follow several steps. These include using strong and unique passwords, enabling two-factor authentication, being cautious of phishing attempts, regularly updating software and antivirus programs, and increasing cybersecurity awareness.

What legal actions can victims of the People1st Advantage Website Finance scam take to seek justice?

Victims of scams can pursue legal recourse to seek justice and compensation. They may file a police report, contact their local consumer protection agency, consult with an attorney, or submit a complaint to relevant regulatory authorities for further investigation and potential restitution.

How can individuals raise awareness about the People1st Advantage Website Finance scam and educate others to prevent further victims?

To raise awareness about scams and prevent further victims, individuals can educate others by sharing information through social media platforms, organizing webinars or workshops on scam prevention strategies, and collaborating with local community organizations to spread the message about potential scams.

Conclusion

In conclusion, it is crucial to be aware of the People1st Advantage Website Finance Scam and take necessary precautions to protect oneself.

By identifying red flags and warning signs, conducting thorough research on online platforms, safeguarding personal and financial information, reporting scams, seeking legal recourse, and spreading awareness, individuals can minimize their risk of falling victim to such fraudulent schemes.

It is essential to remain vigilant and educate others about these scams in order to prevent further exploitation in the future.

Also Read

Flexi Knee Patches Reviews – A Natural Solution For Knee Pain Relief?

LLenu Clothing Reviews: Llenu Clothing – Legit Or Scam?

Pearlmoon Shaping Shorts Reviews: Is It Worth Trying?

Also Read

Is Viagogo Legit or a Scam? Viagogo Review

Is Punchmade Dev Legit: Unveiling The Dark Side Of Online Fame

Comcast 50 Off Scam – Scammers Targeting Comcast Xfinity Customers

Also Read

Expedited Financial Help Scam – Is Expeditedfinancialhelp.Org Legit?

Champion Strategy Holdings Scam – Questionable Tactics

Smartyplus.net Scam – Smartyplus.Net Exposed!

Also Read

Is Borodex Legit or a Scam? The Crypto Scam That Traps Investors

Track718 Scam: Is This Logistics Platform Trustworthy Or A Scam?

Is Oldgamesdownload.com Legit? A Hidden Gem For Retro Gaming?

Also Read

Is Tv Boost Legit or a Scam? Is It Too Good To Be True?

Bjux Fashion Reviews – Is Bjux Fashion Legit & Worth It?

Sylvia Hot Clothing Reviews – Is It Legit & Worth The Hype?

Also Read

Tluse Clothing Reviews – Scam Alert And Customer Complaints!

Goldebase Reviews – Is Goldebase.Com The Real Deal?

Lampsoccer Reviews – Is Lampsoccer.Com The Real Deal?

Also Read

Ghjoeij Store Reviews – Is Ghjoeij Store A Legit Source For Luxury Watches?

Pure Leaf Grant Scam – Is Pure Leaf Grant Legit? Find Out!

United Refund Scam – How to Protect Yourself?

Also Read