Harris and Harris Debt Collector Scam Explained – Are you receiving suspicious text messages and phone calls from someone claiming to be Harris and Harris Debt Collector? Beware, as you might be targeted by a scam.

In this article, we will explore how the Harris and Harris Debt Collector Scam operates, the tactics used by scammers, and how to recognize the signs of a potential scam.

If you have fallen victim to this scam, we will also provide steps to take and how to report it.

Stay informed and protect yourself from this fraudulent scheme.

Table of Contents

How the Harris and Harris Debt Collector Scam Operates

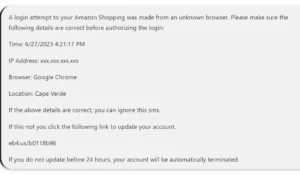

The Harris and Harris debt collector scam operates by sending text messages and making phone calls to unsuspecting individuals. They use a variety of tactics to create a sense of urgency and fear, trying to intimidate you into paying a debt that may not even exist.

They often claim to be representing a legitimate debt collection agency, using official-sounding names and logos to deceive you.

These scammers rely on your lack of knowledge about your actual debts and the laws surrounding debt collection. They may threaten legal action, wage garnishment, or even arrest if you don’t comply with their demands.

Common Tactics Used by the Scammers

One common tactic scammers use is pretending to be a legitimate company in order to gain your trust. They will go to great lengths to create a convincing façade, using the name, logo, and even the contact information of a well-known company.

They may send you emails or make phone calls, claiming to be representatives from that company, and they will sound very professional and knowledgeable.

They will ask for personal information, such as your social security number or credit card details, under the pretense of verifying your account or resolving an issue.

However, it’s important to remember that legitimate companies will never ask for sensitive information in this manner. If you ever receive such requests, it’s best to independently verify the authenticity of the company before providing any information.

Recognizing the Signs of a Potential Scam

Recognizing the signs of a potential scam can be difficult, but there are certain red flags to watch out for. When it comes to identifying a scam, trust your instincts. If something feels off or too good to be true, it probably is.

One common red flag is receiving unsolicited calls or messages asking for personal information or money. Legitimate organizations would not contact you out of the blue and request sensitive data.

Another warning sign is pressure tactics or a sense of urgency. Scammers often try to create a sense of panic or fear to get you to act quickly without thinking.

Additionally, be cautious of requests for payment through unconventional methods, like gift cards or wire transfers. These are often preferred by scammers because they are difficult to trace.

Stay vigilant and don’t hesitate to report any suspicious activity.

Steps to Take if You’ve Been Targeted by the Scam

If you’ve fallen victim to the scam, don’t panic, but take immediate steps to protect yourself and report the incident.

First, contact your bank or credit card company to alert them of the fraudulent activity. They can help freeze your accounts and prevent any further unauthorized transactions.

Next, file a complaint with your local law enforcement agency and provide them with all the relevant information, such as the phone number or email address used by the scammers.

Additionally, report the incident to the Federal Trade Commission (FTC) at ftc.gov/complaint. This will help the authorities track down the scammers and potentially prevent others from becoming victims.

Remember to keep all evidence, such as text messages or call logs, as it may be useful during the investigation.

Stay vigilant and take these steps to protect yourself from further harm.

Reporting the Harris and Harris Debt Collector Scam

When reporting the scam, make sure to gather all relevant information and provide it to the appropriate authorities.

Start by noting down the date and time of the scam attempt, as well as the phone number or email address used by the scammers.

If you received a text message, take a screenshot of it for evidence. Keep any voicemails or recorded phone conversations as well.

Next, contact your local law enforcement agency or the Federal Trade Commission (FTC) to report the scam.

Provide them with all the details you have collected, including the scammer’s contact information and any evidence you have gathered.

Frequently Asked Questions

How Much Money Have People Lost to the Harris and Harris Debt Collector Scam?

You might be wondering how much money people have lost to the Harris and Harris debt collector scam.

It’s important to be aware of this scam and take necessary precautions to protect yourself from financial losses.

Are There Any Legal Actions Being Taken Against the Scammers?

Yes, legal actions are being taken against the scammers. Authorities are actively investigating and working to bring them to justice.

If you have any information, please report it to the authorities.

Can the Scammers Acquire Personal Information Through Their Text Messages or Phone Calls?

Yes, scammers can acquire personal information through their text messages or phone calls. They may ask for sensitive details like your social security number or bank account information.

Be cautious and never share such information.

Are There Any Specific Demographics That the Scammers Target?

The scammers may target individuals from various demographics. They exploit vulnerabilities and use persuasive tactics to manipulate unsuspecting victims.

It is important to stay vigilant and protect your personal information from such scams.

Is It Possible for the Scammers to Change Their Tactics Over Time?

Yes, scammers can change their tactics over time. They may adapt to new technology or develop new strategies to deceive their targets.

It’s important to stay vigilant and be aware of these changes.

Conclusion

In conclusion, if you receive a text message or phone call from Harris and Harris Debt Collector, be cautious. This scam operates by pressuring individuals into paying fake debts. By recognizing the signs, such as aggressive tactics and demands for immediate payment, you can protect yourself from falling victim to this scam.

If you have been targeted, take steps to report the incident to the appropriate authorities. Stay vigilant and remember, it’s important to always verify the legitimacy of any debt collector before taking any action.

Also Read

Dropbox Email Scam Exposed: Don’t Fall for Their Tricks!

Capquest Scam – Don’t be a Victim of This Deceitful Debt Recovery Scam

Evri Book Redelivery Scam – Don’t Fall Victim to Fake Delivery Schemes

Also Read

Lidl Scam Email Exposed – Everything You Need to Know

Peyarpark Scam or Legit? Don’t Let Yourself be the Next Victim!

Lana Del Rey Tickets Scam Exposed: Don’t Get Duped!

Also Read

Crypteh Legit or Scam? – Exposing the truth about Crypteh.Com

Is Pure Cotton Times Legit or Scam? – Purecottontimes.com Exposed

Info@Turnerm-Has.Com Scam Exposed – Cunning Cyber Threat

Also Read

Noreply@Icarol.Com Scam – Don’t Be a Victim, Discover the Truth

Fashionshops10 Scam or Legit? – Fashionshops10.Com Exposed

Device Help Test for Ricardo Scam Explained – Don’t Be Fooled

Also Read

Dermoia Shampoo Reviews – Is Dermoia Shampoo Legit or Scam?

8664974781 Scam Exposed: Don’t Fall for Their Tricks

Test for Ricardo Notification Scam – Motorola Phones Receiving Random Notification

Also Read

Space Speaker Scam or Legit? Space-Speaker.Co Reviews

Nsgames.Pro Scam – FREE Nintendo Games Scam or Legit?

Riseproof.Com Scam or Legit? Beware of Fake Wilko Store Online

Also Read