Credit Score IQ, a reputable credit monitoring and identity theft protection company, has gained recognition in the industry since its establishment in 2014.

With over 1.5 million satisfied customers and affordable monthly rates starting at just $9.99, Credit Score IQ offers comprehensive services such as credit report monitoring, dark web monitoring, and access to full credit reports from all major bureaus.

With positive customer reviews, a high rating on Trustpilot, and an A+ rating from the Better Business Bureau, Credit Score IQ is a legitimate choice for reliable credit monitoring and identity protection services.

The Truth Behind Credit Score IQ: Legit or Scam

There have been ongoing debates and discussions regarding the legitimacy of Credit Score IQ, with some individuals questioning its credibility as a credit monitoring and identity theft protection service. However, a closer examination of Credit Score IQ pricing, features, and benefits reveals that it is indeed a legitimate and reliable option for individuals seeking comprehensive credit monitoring and identity protection.

One of the key factors that contribute to Credit Score IQ's legitimacy is its affordable pricing. Starting at just $9.99 per month, Credit Score IQ offers access to a range of valuable features and benefits. These include credit report monitoring from TransUnion and Equifax, unlimited access to full credit reports from all three major credit bureaus, daily dark web monitoring, and credit score tracking to monitor changes over time.

Additionally, Credit Score IQ provides identity restoration assistance from a team of trained professionals, ensuring that customers have the necessary support in case of identity theft.

Uncovering Credit Score IQ: Reviews and Ratings

Based on over 40,000 reviews on Trustpilot, Credit Score IQ has received an impressive 4.5 out of 5-star rating, indicating high customer satisfaction. Customers praise the company for its affordable prices and responsive customer service.

Additionally, Credit Score IQ has a 4.3 out of 5 rating on ConsumerAffairs, with over 1,000 reviews. The company has also earned an A+ rating from the Better Business Bureau, which confirms its commitment to resolving any consumer problems promptly.

Credit Score IQ offers comprehensive credit monitoring services, including credit report monitoring from TransUnion and Equifax, daily dark web monitoring, and unlimited access to full credit reports. They also provide credit score tracking and identity restoration assistance.

While it's important to conduct thorough research and fact-check any company before sharing personal details, Credit Score IQ appears to be a reliable choice for credit monitoring and identity protection.

Tips to Avoid Credit Score Scams: Protect Yourself

To effectively protect yourself from credit score scams, it is crucial to thoroughly research and fact-check any company before providing personal details, ensuring your financial security. Here are some important tips to avoid falling victim to common credit score scams:

- Importance of credit monitoring:

- Regularly monitoring your credit score can help you detect any suspicious activity or unauthorized changes to your credit report.

- It allows you to take proactive measures to prevent identity theft and fraudulent activities.

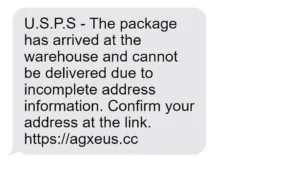

- Common credit score scams:

- Phishing schemes: Be cautious of unsolicited emails or calls asking for your personal information. Only access official company websites directly.

- Offers of free credit reports: Stick to trusted sources like AnnualCreditReport.com to obtain your credit reports.

- Fake credit repair companies: Thoroughly research any company before signing up and verify their authenticity before providing personal details.

Proactive Defense: Safeguarding Against Credit Scams

In order to effectively safeguard against credit scams, individuals must implement proactive defense strategies such as thorough verification of companies and avoidance of unsolicited offers.

The importance of credit monitoring cannot be overstated, as it allows individuals to stay informed about any suspicious activities on their credit reports.

Common credit scams include phishing schemes, where scammers pose as legitimate companies to trick individuals into revealing their personal information, and offers of free credit reports outside of official channels.

It is crucial for individuals to fact check any company thoroughly before sharing private details, as clever scams are becoming increasingly common.

By staying informed and verifying the legitimacy of companies, individuals can protect themselves and their sensitive data.

Credit Score IQ is presented as a legitimate choice for credit monitoring and identity protection, offering comprehensive and affordable services.

Contacting Regulators: Ensuring Online Business Authenticity

Contacting regulators is essential for ensuring the authenticity of online businesses and protecting consumers from potential fraud. By reaching out to regulatory bodies such as the Consumer Financial Protection Bureau and the Attorney General consumer protection division, individuals can play an active role in identifying deceptive business practices and preventing financial scams.

Verifying online businesses is of utmost importance, as the digital landscape provides ample opportunities for fraudsters to exploit unsuspecting consumers. To engage readers, here is a nested bullet point list:

- Why is verifying online businesses important?

- Protects consumers from financial fraud

- Ensures authenticity and legitimacy of businesses

By staying informed and proactive, individuals can contribute to a safer online environment and safeguard their personal and financial information. It is crucial to be aware of the latest developments and connect with others who have experiences in the online business world.

Together, we can navigate the digital landscape with confidence and protect ourselves from deceptive practices.

Frequently Asked Questions

What Are the Pricing Options for Credit Score Iq's Services?

Credit Score IQ offers affordable pricing options for their credit monitoring and identity theft protection services. Subscription plans start at just $9.99 per month, providing comprehensive credit monitoring from all three major credit bureaus.

How Does Credit Score IQ Compare to Other Credit Monitoring Companies?

Credit Score IQ offers comprehensive and affordable credit monitoring services, comparable to other reputable companies like Credit Karma and Identity Guard. They provide credit report monitoring, dark web monitoring, credit score tracking, and identity restoration assistance.

Can I Access My Credit Reports From All Three Major Credit Bureaus With Credit Score Iq?

Yes, Credit Score IQ allows you to access your credit reports from all three major credit bureaus. This feature provides comprehensive insight into your credit history and allows you to monitor any changes or discrepancies.

What Services Does Credit Score IQ Offer to Help With Identity Restoration?

Credit Score IQ offers identity restoration assistance through their team of trained professionals. This service helps customers in recovering and restoring their identity in case of any identity theft or fraudulent activity. Additionally, Credit Score IQ's highly rated customer service team is available to provide support and guidance throughout the process.

How Do I Contact Credit Score Iq's Customer Service Team?

To contact Credit Score IQ's customer service team, you can reach out to their dedicated support line at [phone number] or send an email to [email address]. Their knowledgeable team is available to assist you with any inquiries or concerns you may have.

Conclusion

In conclusion, Credit Score IQ is a legitimate credit monitoring and identity theft protection company with a strong reputation in the industry.

With positive reviews from customers and a high rating from the Better Business Bureau, the company offers comprehensive services at affordable rates.

By providing credit report monitoring, dark web monitoring, and unlimited access to credit reports, Credit Score IQ proves to be a reliable choice for individuals seeking effective credit monitoring and identity protection services.