Unifin Text Scam Exposed – Are you receiving suspicious debt collection texts from Unifin? Be cautious, as you may be targeted by the Unifin Text Scam. In this article, we will outline how this scam works and provide you with signs to watch out for.

We will also guide you on the steps to take if you receive a suspicious text from Unifin, as well as offer tips on protecting yourself from these scams.

Don’t fall victim – stay informed and report any Unifin Text Scams to the authorities.

Table of Contents

How the Unifin Text Scam Works

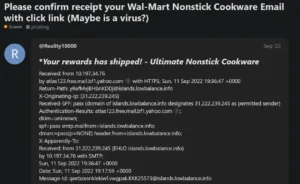

The Unifin Text Scam works by sending fraudulent text messages to individuals in an attempt to collect fake debts. You may receive a text claiming that you owe a certain amount of money to a company or organization.

The message will often create a sense of urgency, pressuring you to pay immediately to avoid legal consequences. They may even provide a link to a website where you can make the payment.

However, this is all part of the scam. Clicking on the link can lead to malware installation on your device or unauthorized access to your personal information.

It’s important to remember that legitimate debt collectors will never ask for payment through text messages. If you receive such a message, it’s best to ignore it and report it to the authorities.

Stay vigilant and protect yourself from falling victim to this scam.

Signs of a Scam Debt Collection Text

Watch out for certain signs that indicate you might be dealing with a scam when receiving debt collection messages.

First, if the message asks for immediate payment through unusual methods like gift cards or wire transfers, be cautious. Legitimate debt collectors usually provide multiple payment options, such as credit cards or online payments.

Second, be wary of messages that contain grammatical errors or spelling mistakes. Reputable companies take pride in their professional communication and are unlikely to make such errors.

Third, if the message threatens you with legal action or promises to have you arrested, it could be a red flag. Legitimate debt collectors follow legal procedures and do not resort to intimidation tactics.

Remember to verify the message’s authenticity by contacting the original creditor directly before taking any action.

Steps to Take if You Receive a Suspicious Text From Unifin

If you receive a suspicious message, don’t panic, but take immediate steps to protect yourself.

The first thing you should do is refrain from responding to the text. Engaging with the sender could potentially give them access to your personal information or even lead to financial loss.

Next, report the message as spam or phishing to your mobile service provider. They have the ability to block the sender and prevent further messages from reaching you.

It’s also important to document the message by taking screenshots or writing down any relevant details. This information can be helpful if you need to report the incident to the authorities or your financial institution.

Lastly, educate yourself about common scams and stay informed about the latest tactics used by scammers. By being proactive and vigilant, you can minimize the risk of falling victim to these fraudulent schemes.

Protecting Yourself From Unifin Text Scams

To protect yourself from potential fraudulent messages, you’ll want to be aware of common tactics used by scammers and stay informed about the latest scams.

When it comes to Unifin text scams, scammers often use fear tactics to make you believe that you owe a debt and need to pay it immediately. They may threaten legal action or claim to have your personal information.

Remember, Unifin will never send unsolicited text messages about debts or ask for payment over text. If you receive a suspicious text, do not respond or provide any personal or financial information.

Instead, report the message to your mobile carrier and the Federal Trade Commission (FTC).

Reporting Unifin Text Scams to Authorities

When reporting suspicious messages, make sure to include as much information as possible in your report to authorities. This will help them investigate the Unifin Text scam and take appropriate action against the scammers.

Start by providing the complete text message, including any URLs or phone numbers mentioned. Be sure to mention the date and time you received the message, as well as your own contact information.

If you have already responded to the message or provided any personal information, make sure to mention that in your report as well. Additionally, if you have any screenshots or other evidence related to the scam, include those in your report too.

The more details you provide, the better equipped the authorities will be to combat these scams and protect others from falling victim to them.

Frequently Asked Questions

What Is the Legal Action Taken Against Unifin for Their Involvement in the Text Scam?

The legal action taken against Unifin for their involvement in the text scam is still ongoing.

It is important to report any suspicious activity to the authorities and protect yourself from falling victim to scams.

Can Unifin Access My Personal Information Through the Text Scam?

Yes, Unifin can access your personal information through the text scam. They may use this information for fraudulent activities. It’s important to be cautious and report any suspicious messages to the authorities.

Are There Any Financial Institutions Collaborating With Unifin in the Scam?

No, there aren’t any financial institutions collaborating with Unifin in the scam. It’s important to be cautious and not share any personal information with them.

How Can I Identify if a Debt Collection Text Is Legitimate or a Scam?

To identify if a debt collection text is legitimate or a scam, you should be cautious. Check for red flags like spelling errors, urgent demands, and requests for personal information or payment through unconventional methods.

Be wary of any text that contains spelling errors or grammatical mistakes. Legitimate debt collection agencies typically have professional communication standards and would not make such mistakes.

Another red flag to watch out for is urgent demands. Scammers often try to create a sense of urgency to pressure you into taking immediate action. Legitimate debt collection agencies understand that resolving debts takes time and would not use aggressive or threatening language.

Additionally, be cautious if the text requests personal information or payment through unconventional methods. Legitimate debt collection agencies would already have your information and would not need to ask for it again. They would also provide secure and traditional payment methods, such as credit card or bank transfers.

If you encounter any of these red flags, it is important to verify the legitimacy of the text before taking any action. Contact the debt collection agency directly using the contact information you already have on file to confirm the authenticity of the text.

Is There a Way to Track the Origin of the Scam Texts Sent by Unifin?

To track the origin of the scam texts sent by Unifin, you can try reporting them to your mobile carrier. They may be able to investigate and trace the source for you.

Conclusion

In conclusion, if you ever receive a suspicious text from Unifin claiming to be a debt collection agency, it’s important to remain cautious and take the necessary steps to protect yourself.

By being aware of the signs of a scam and reporting any suspicious texts to the authorities, you can help prevent others from falling victim to these fraudulent activities.

Remember to always verify the legitimacy of any debt collection agency before providing any personal information or making any payments.

Stay vigilant and stay safe.

Also Read

Is Runspeeshoppin Scam or Legit? Dick’s Sporting Goods Warehouse Sale Store Scam

Is Everyjobforme Scam or Legit? Everyjobforme.Com Exposed

Zelle Customer Service Scam Exposed: Don’t Fall Victim!

Also Read

Bt Alerts Scam – Bt Verify Email Account Scam Phishing Email

Axiom Utilities Scam or Legit?Anybis@Axiomutilities.Com Exposed

Punch Method Scam Exposed: Uncover Their Sneaky Tricks

Also Read

Seasons Clearance Com Scam or Legit? Seasonsclearance.Com Exposed

Berghaus Uk Mall Scam or Legit? Berghaus Factory Shop Berghausukmall.Com Exposed

Montane Deals Scam or Legit? Montanedeals.Com Exposed

Also Read

Wilko Sale Scam or Legit? Uncover the Shocking Truth

833 Area Code Scam Explained: Don’t Be the Next Target!

Chime Scam Method 2023 Explained: Chime Bank Phishing Scam

Also Read

Fgcustomerfeedback@Fiveguys.Com Scam or Legit?

Established Titles Scam or Legit? The Shocking Truth Exposed

Northwest Federal Credit Union Scam Exposed: Stay Informed

Also Read

Bank of America 70th Anniversary Scam: Don’t Be a Victim

Best Buy Geek Squad Scam Email Exposed: Don’t Fall Victim

Epn Supplements Scam Exposed: Discover the Shocking Truth

Also Read

How Do I Know if an Email From Bt Is Genuine?

Santander Scam Emails Exposed: Unveil the Scam Tactics!

Evri Rebook Scam: Evri@Evri.Re Email & Evri Missed Delivery Scam Text

Also Read

Joules 90 Off Sale Scam or Legit? Don’t Fall Victim to this Sneaky Scam