Cusocal Scam Explained – Are you concerned about the Cusocal scam? Well, you’re in the right place. In this article, we will provide you with all the information you need to know about this text message scam targeting credit union members.

We’ll also help you identify the scam, protect your finances, and take necessary steps if you become a victim. Don’t worry, we’ve got you covered when it comes to reporting and preventing the Cusocal scam.

Let’s get started!

Table of Contents

The Cusocal Scam: What You Need to Know?

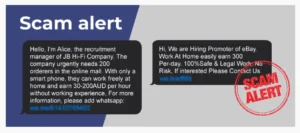

The Cusocal scam is a text message credit union scam that you need to be aware of. Scammers are clever and always finding new ways to deceive innocent people like you.

They send you a text message claiming to be from your credit union, asking for personal information such as your account number and social security number. They may even use fear tactics, saying that your account has been compromised and you need to act immediately. But don’t fall for it!

Your credit union will never ask for personal information through text messages. Remember, always verify the legitimacy of any communication you receive. If you’re unsure, contact your credit union directly using a trusted phone number or visit them in person.

Stay vigilant and protect yourself from falling victim to this scam.

How to Identify the Cusocal Text Message Scam

To identify the Cusocal text message scam, you should be wary of any suspicious texts claiming to be from your bank. These messages may ask you to provide personal information, such as your account number or social security number. Remember, your bank will never ask you to provide this kind of information through a text message.

Another red flag is if the message contains grammatical errors or misspellings. Legitimate messages from your bank are usually well-written and professional.

Additionally, be cautious if the text message includes a link that you are asked to click on. This could lead you to a fake website designed to steal your information.

If you receive a suspicious text message, it is best to contact your bank directly to verify its legitimacy. Stay vigilant and protect your personal information from scammers.

Protecting Your Finances From the Cusocal Scam

Protecting your finances from the Cusocal scam involves being cautious of any suspicious texts claiming to be from your bank. These scammers often send messages that appear to be legitimate, asking you to provide personal information or click on a link. Remember, your bank will never ask for sensitive information via text message.

If you receive a text that seems suspicious, do not respond or click on any links. Instead, contact your bank directly using a trusted phone number or visit their official website.

It’s also important to regularly monitor your bank accounts for any unauthorized transactions. By staying vigilant and taking these precautions, you can safeguard your finances and avoid falling victim to the Cusocal scam.

Steps to Take if You Fall Victim to the Cusocal Scam

If you’ve fallen victim to the Cusocal scam, the first step is to contact your bank immediately. Call your bank’s customer service hotline and inform them about the fraudulent activity on your account.

It is crucial to act swiftly to minimize any potential financial losses. Provide them with all the necessary information, such as the fraudulent transactions, the messages you received, and any other relevant details.

The bank will guide you through the process of securing your account and initiating an investigation. They may also advise you to change your online banking passwords and monitor your account for any further suspicious activity.

Remember to stay calm and follow your bank’s instructions to ensure a swift resolution to the Cusocal scam incident.

Reporting and Preventing the Cusocal Scam

When reporting and preventing the Cusocal scam, remember to regularly review your bank statements for any suspicious activity. It is crucial to stay vigilant and take immediate action if you notice any unauthorized transactions or unfamiliar charges.

Contact your bank or credit union immediately to report the fraudulent activity and request a freeze on your account. Provide them with all the necessary details, such as the date, time, and amount of the suspicious transaction.

Additionally, file a complaint with your local law enforcement agency and report the scam to the Federal Trade Commission (FTC) through their online reporting system. By taking these steps promptly, you can help protect yourself and prevent further financial loss.

Frequently Asked Questions

How Much Money Have People Lost to the Cusocal Scam?

You may be wondering how much money people have lost to the cusocal scam.

It’s unfortunate that many individuals have fallen victim to this scheme, resulting in significant financial losses.

Are There Any Legal Actions Being Taken Against the Perpetrators of the Cusocal Scam?

Yes, there are legal actions being taken against the perpetrators of the Cusocal scam.

Law enforcement agencies and authorities are actively investigating the matter and working towards holding them accountable for their actions.

Can the Cusocal Scam Affect People Who Are Not Customers of Credit Unions?

The Cusocal scam can affect anyone, even if you’re not a customer of credit unions.

It’s important to stay vigilant and avoid clicking on suspicious texts or providing personal information to unknown sources.

Are There Any Warning Signs or Red Flags That Can Help Individuals Identify the Cusocal Scam?

Watch out for warning signs or red flags that can help you spot the Cusocal scam.

Look for suspicious text messages from unknown numbers claiming to be from credit unions.

Stay vigilant and protect yourself.

Is There Any Government Agency or Organization That Is Actively Working to Prevent the Cusocal Scam?

Yes, there is a government agency actively working to prevent scams like the cusocal scam. They have implemented measures and regulations to protect individuals from falling victim to fraudulent activities.

They are dedicated to investigating and prosecuting those involved in scams and other fraudulent schemes. Their goal is to ensure the safety and security of consumers and to hold scammers accountable for their actions.

In addition to their enforcement efforts, the agency also provides resources and information to help educate the public about common scams and how to avoid them. They offer tips on how to recognize the warning signs of a scam and what steps to take if you believe you have been targeted.

Conclusion

In conclusion, it’s crucial to stay vigilant and informed about scams like the Cusocal scam.

By being aware of the signs and taking steps to protect your finances, you can minimize the risk of falling victim to such fraudulent activities.

Remember to report any suspicious messages and take immediate action if you do become a target.

Stay proactive in preventing scams and safeguarding your financial well-being.

Also Read

Dermoia Shampoo Reviews – Is Dermoia Shampoo Legit or Scam?

8664974781 Scam Exposed: Don’t Fall for Their Tricks

Test for Ricardo Notification Scam – Motorola Phones Receiving Random Notification

Also Read

Space Speaker Scam or Legit? Space-Speaker.Co Reviews

Nsgames.Pro Scam – FREE Nintendo Games Scam or Legit?

Riseproof.Com Scam or Legit? Beware of Fake Wilko Store Online

Also Read

Is Viagogo a Scam or Legit? – Unveiling the Shocking Truth

Harcus Parker Scam: Don’t Fall for Scammers Schemes

Harris and Harris Debt Collector Scam Explained – Don’t Fall Victim

Also Read

Reeracoen Singapore Scam: Unmasking the Fake Job Scammers

Manlo Business Analytics Corp Scam Explained: Don’t Fall Victim

IA Financial Group Scam Exposed: Discover the Shocking Truth

Also Read

Flaxmaker Reviews – Is Flaxmaker Legit or a Scam?

Glodence Bras Reviews – Is Glodence Bras True to Its Claim?

Shoe Clearance Sale Com Scam or Legit? – Shoeclearancesale.Com Exposed