Is Capital One Settlement Epiqpay Legit? Are you wondering if the Capital One settlement email from Epiqpay is legit? Have you received an offer for a significant settlement amount?

Before you dive into the details, it’s crucial to evaluate the legitimacy of Epiqpay and identify any red flags.

In this article, we will unravel the details of the Capital One settlement, help you verify the offer, and ensure you are taking the necessary steps to protect yourself.

Table of Contents

Understanding the Capital One Settlement Email

Are you confused about the Capital One settlement email? Don’t worry, you’re not alone. Many people have received this email and are uncertain about what it means and how it affects them.

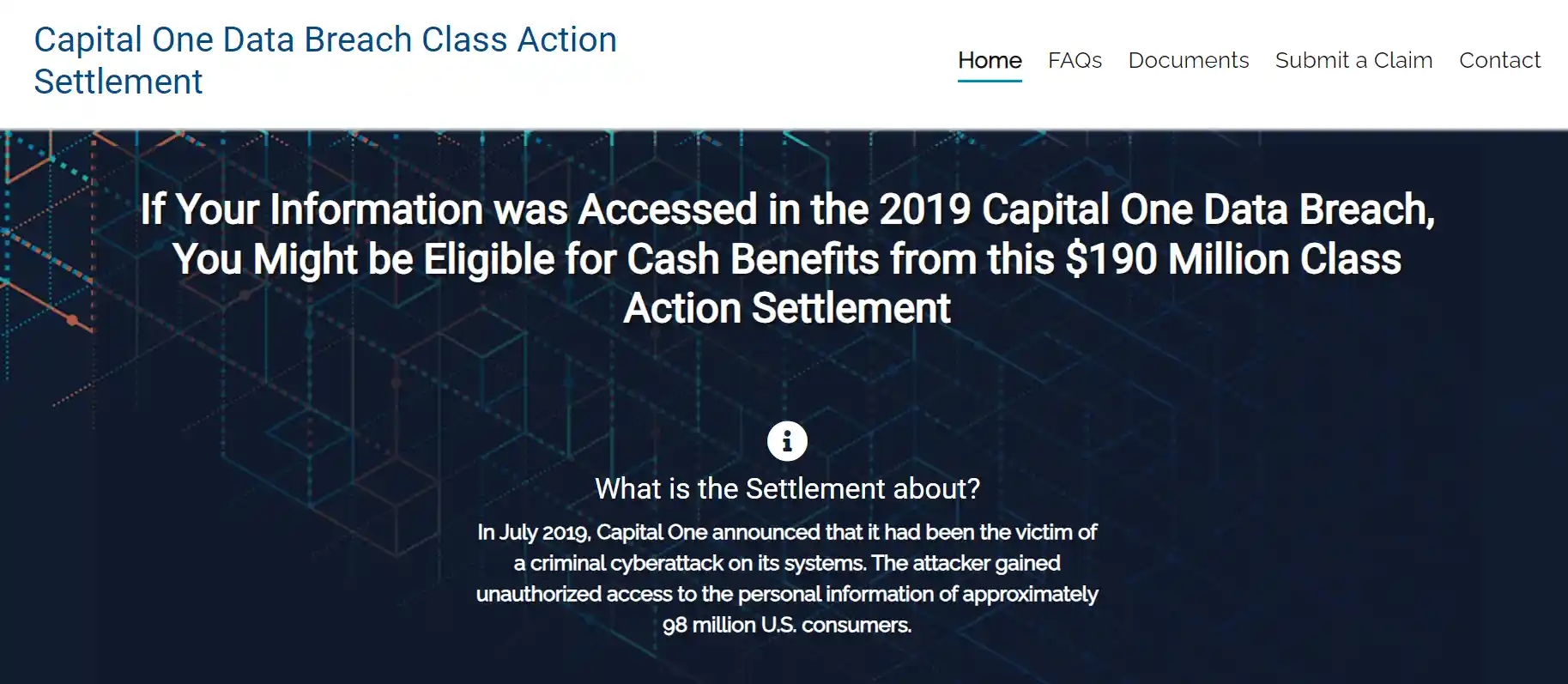

The Capital One settlement email is a notification sent to customers who may be eligible for compensation due to a data breach that occurred in 2019. The email provides information about the settlement agreement, including the amount of money that will be paid out to affected individuals.

It also outlines the steps you need to take in order to participate in the settlement and receive your compensation. If you have received the Capital One settlement email, it’s important to carefully read through the information provided and follow the instructions to ensure that you don’t miss out on the opportunity to be compensated for any losses or damages you may have incurred as a result of the data breach.

Evaluating the Legitimacy of Epiqpay

If you’re wondering whether Epiqpay is a legitimate platform, there are several factors you can consider to evaluate its legitimacy.

First, look for the presence of a secure website. Check if the website address starts with ‘https’ instead of ‘http’ and if there’s a lock icon in the address bar. This indicates that the website has implemented security measures to protect your personal and financial information.

Additionally, research the company behind Epiqpay. Look for information about their reputation, history, and any legal or regulatory issues.

It’s also a good idea to read reviews and feedback from other users who’ve used Epiqpay. This can give you insights into their experiences and help you determine if the platform is trustworthy.

Lastly, consider reaching out to customer support with any questions or concerns you may have. Their responsiveness and helpfulness can also be indicators of a legitimate platform.

Unraveling the Details of the Capital One Settlement

To understand the intricacies of the Capital One settlement, let’s delve into the details and uncover the key aspects.

The Capital One settlement stems from a data breach incident that occurred in 2019, where millions of customers’ personal information was compromised. As a result, Capital One agreed to pay a settlement amount to affected individuals.

The settlement aims to compensate victims for any financial losses and provide them with credit monitoring and identity theft protection services. It’s important to note that the settlement amount may vary depending on various factors, such as the extent of the damage suffered by each individual.

Additionally, the settlement also includes provisions for reimbursement of certain out-of-pocket expenses incurred as a result of the data breach.

Identifying Red Flags in the Settlement Email

You should be wary of any suspicious or unusual elements in the settlement email, as they could be red flags indicating a potential scam.

When reviewing the email, pay attention to the sender’s email address. Scammers often use email addresses that resemble legitimate ones but contain slight variations.

Additionally, be cautious if the email asks for personal information or payment details. Legitimate settlement emails typically don’t require you to provide such information upfront.

Another red flag to watch out for is poor grammar or spelling errors in the email. Reputable organizations usually have high standards for communication and wouldn’t send out emails with obvious mistakes.

Lastly, if the email contains urgent or threatening language, it’s important to proceed with caution. Legitimate settlement emails shouldn’t pressure you into immediate action or make you feel threatened.

Taking the Necessary Steps to Verify the Settlement Offer

To ensure the legitimacy of the settlement offer, you should take the necessary steps to verify the details provided in the email.

Start by researching the settlement case or class action lawsuit to confirm that it’s indeed legitimate. Look for official announcements or news articles from reputable sources that validate the existence of the settlement.

Additionally, check the sender’s email address and verify if it matches the official email addresses associated with the settlement administrator or law firm handling the case.

Beware of any grammatical errors or spelling mistakes in the email, as legitimate settlement offers are usually professionally written.

Finally, contact the settlement administrator or law firm directly using their official contact information to confirm the settlement details and ask any questions you may have.

Taking these steps will help ensure that the settlement offer is genuine and not a scam.

Frequently Asked Questions

How Long Do I Have to Respond to the Capital One Settlement Email?

You should respond to the Capital One settlement email as soon as possible.

The time frame may vary, so it’s important to read the email carefully and follow any instructions provided.

Can I Opt Out of the Settlement and Pursue My Own Legal Action Against Capital One?

Yes, you can choose to opt out of the settlement and pursue your own legal action against Capital One.

It’s your right to make that decision based on what you believe is best for your situation.

Will Accepting the Settlement Affect My Credit Score?

Accepting the settlement won’t directly affect your credit score.

However, if you have outstanding debts with Capital One, resolving them through the settlement may have a positive impact on your credit.

Are There Any Additional Fees or Costs Associated With Accepting the Settlement Offer?

There aren’t any additional fees or costs associated with accepting the settlement offer.

It’s a straightforward process that won’t impact your finances negatively.

What Happens if I Don’t Receive the Settlement Payment Within the Specified Timeframe?

If you don’t receive the settlement payment within the specified timeframe, you should contact the appropriate parties involved in the settlement process.

They can provide you with information on what steps to take next.

Conclusion – Is Capital One Settlement Epiqpay Legit?

In conclusion, it’s important to exercise caution when receiving emails about settlement offers, such as the Capital One settlement email.

While Epiqpay may appear legitimate, it’s crucial to thoroughly evaluate the email and look for any red flags.

Take the necessary steps to verify the offer and ensure its legitimacy before providing any personal information or taking further action.

Stay vigilant and protect yourself from potential scams.

Also Read

Manpower Recruitment Agency Scam – Don’t Fall Victim!

Revgovca Scam or Legit? Discover the Shocking Truth

Horner Recruitment Scam Exposed – Don’t Fall Victim

Also Read

Worldxio Legit or a Scam? Don’t Fall Victim to This Elaborate Hoax

Repack Usps Scam – Repack-Usps.Com Exposed

Rethink Advertising Media Scam – Unveiling the Hidden World of Scam

Also Read

Viaresorts Scam or Legit? Don’t Fall Victim!

Zipmex Australia Pty Ltd Scam – Don’t Fall Victim to Crypto Cons

Seeking Human Resources Scam – Don’t Fall Victim!

Also Read

Spectrum Scam Calls – Don’t Fall for the Lure of 50% Off Deals