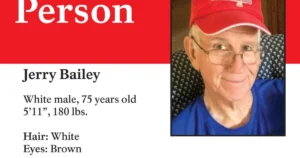

Shan Hanes Scam: The closure of Heartland Tri-State Bank in Elkhart, Kansas, following the devastating loss of millions of dollars due to a cryptocurrency scam by its CEO, Shan Hanes, has sent shockwaves through the community.

This unfortunate event, which adds to the growing list of failed banks in 2023, raises concerns about the stability of the financial system.

With limited banking options and enduring financial uncertainty, depositors and the community are left grappling with the aftermath of this distressing incident.

Table of Contents

The Bank’s Closure and Community Impact

The closure of Heartland Tri-State Bank has had a significant impact on the community of Elkhart, Kansas. The economic repercussions on the local community are far-reaching.

As the only bank in town, its closure has left residents with limited banking options, creating a sense of financial uncertainty. The loss of the bank has not only affected individuals but also local businesses that relied on its services for loans and financial support.

Moreover, the closure has undermined the trust and reputation of the banking sector in Elkhart. The community trusted Heartland Tri-State Bank to safeguard their deposits and provide reliable financial services. The bank’s failure has shattered this trust, leaving residents wary of future banking relationships.

Rebuilding the trust and reputation of the banking sector in Elkhart will be a considerable challenge moving forward.

Investigation Into the Crypto Scam

Law enforcement agencies, including the FBI, are actively investigating the circumstances surrounding the crypto scam that resulted in the CEO of Heartland Tri-State Bank, Shan Hanes, losing millions of dollars.

The progress of the ongoing investigation has not been publicly disclosed, but it is expected that law enforcement agencies will utilize their expertise to uncover the details of the scam.

The role of these agencies is crucial in gathering evidence, conducting interviews, and collaborating with other financial institutions to trace the flow of funds involved in the scam.

By meticulously analyzing digital footprints and conducting forensic audits, law enforcement agencies aim to identify the perpetrators and bring them to justice.

The investigation is likely to be complex and time-consuming, as it requires expertise in digital forensics, financial crimes, and cybersecurity.

Other Failed US Banks in 2023

Four major US banks have failed this year, raising concerns about the stability of the financial system. In addition to the closure of Heartland Tri-State Bank, other failed banks in 2023 include Silvergate Bank, Signature Bank, Silicon Valley Bank, and First Republic Bank.

The failures of Silvergate and Signature Bank were partly attributed to the 2022 crypto meltdown. These bank failures highlight the vulnerability of the banking sector and have sparked worries about the overall stability of the financial system.

The impact of these failures on the banking industry is significant, as it erodes public confidence and raises questions about the effectiveness of regulatory measures in preventing future bank failures. It is crucial for regulators to evaluate and implement stronger measures to safeguard the financial system and prevent such failures from occurring in the future.

Implications for Depositors and the Community

Significantly, the closure of Heartland Tri-State Bank has left depositors and the community of Elkhart with limited banking options. The implications for depositors and the community are far-reaching and include:

- Financial stability of the community: The closure of Heartland Tri-State Bank has created financial uncertainty for the residents of Elkhart. The loss of a trusted local bank can impact the overall economic stability of the community and may hinder the ability of individuals and businesses to access essential banking services.

- Future of banking in Elkhart: With the closure of Heartland Tri-State Bank, the community is now left with limited banking options. The absence of a local bank may force residents to seek banking services from neighboring towns, resulting in inconvenience and potential economic leakage. The future of banking in Elkhart is uncertain, and it remains to be seen if another financial institution will step in to fill the void left by the closure of Heartland Tri-State Bank.

Conclusion – Shan Hanes Scam

In conclusion, the closure of Heartland Tri-State Bank in Elkhart, Kansas, due to the CEO’s loss in a cryptocurrency scam has had significant implications for the community.

The loss of millions of dollars has not only affected depositors and shareholders but has also raised concerns about the stability of the financial system. The ongoing investigation into the scam highlights the need for increased vigilance and regulation in the cryptocurrency space.

The closure of the bank further exacerbates the limited banking options and financial uncertainty faced by the community.

Also Read

Manpower Recruitment Agency Scam – Don’t Fall Victim!

Revgovca Scam or Legit? Discover the Shocking Truth

Horner Recruitment Scam Exposed – Don’t Fall Victim

Also Read

Worldxio Legit or a Scam? Don’t Fall Victim to This Elaborate Hoax

Repack Usps Scam – Repack-Usps.Com Exposed

Rethink Advertising Media Scam – Unveiling the Hidden World of Scam

Also Read

Viaresorts Scam or Legit? Don’t Fall Victim!

Zipmex Australia Pty Ltd Scam – Don’t Fall Victim to Crypto Cons

Seeking Human Resources Scam – Don’t Fall Victim!

Also Read

Spectrum Scam Calls – Don’t Fall for the Lure of 50% Off Deals

Is Capital One Settlement Epiqpay Legit? Unveiling the Truth

Is Capitalonesettlement.Com Legit? Discover the Truth

Also Read

Smtx.Mcafee.Com Scam – Don’t Fall for This Cunning Phishing Email

Acasa Manila Scam Exposed: Maggie Wilson Links Rachel Carrasco to a Smear Campaign