This article titled ‘$6400 Subsidy Is It Legit? Health Subsidy Scam Exposed‘ aims to provide an objective and evidence-based analysis of the health subsidy program.

It delves into the workings of the program, its pros, and cons, and highlights red flags and warning signs to watch out for.

Additionally, customer reviews and scams surrounding health subsidies are discussed.

The legitimacy of the program is examined, and the article concludes by emphasizing the importance of verifying health subsidy claims and reporting any suspicious activities.

Table of Contents

What is the $6400 Subsidy Health Subsidy Program?

The Health Subsidy Program is a financial aid initiative aimed at assisting individuals with their medical expenses, mandated by the Affordable Care Act, and offering benefits such as the Premium Tax Credit (PTC) to help cover insurance premiums.

This program has both pros and cons. On one hand, it provides financial assistance to individuals who may struggle to afford health insurance on their own. The Premium Tax Credit (PTC) can significantly reduce the burden of insurance premiums for eligible individuals.

On the other hand, there have been instances of scams and fraudulent websites claiming to offer health subsidies. It is important for individuals to be cautious and verify the authenticity of these programs before sharing personal information or making any financial dealings.

Customer reviews can provide insights into the legitimacy and effectiveness of these programs, helping individuals make informed decisions.

How Does the $6400 Subsidy Health Subsidy Program Work?

One aspect to consider when analyzing the workings of the health subsidy program is its eligibility criteria and the various factors that determine an individual’s qualification for financial aid.

Eligibility criteria for health subsidy programs are primarily based on income and household size. To be eligible, individuals must fall within a certain income range, typically between 100% and 400% of the federal poverty level. Additionally, applicants must be U.S. citizens or lawfully present immigrants.

The impact of health subsidy programs on healthcare affordability is significant. By providing financial assistance to eligible individuals, these programs help reduce the burden of healthcare costs, making insurance coverage more affordable and accessible. This, in turn, promotes better healthcare utilization and overall health outcomes for individuals and communities.

Pros & Cons of $6400 Subsidy Health Programs

This discussion will focus on the pros and cons of health subsidy programs.

On the positive side, health subsidy programs provide financial aid for medical expenses, making healthcare more affordable for individuals who may not be able to afford it otherwise. They can help ensure that more people have access to necessary healthcare services.

However, there are also some drawbacks to consider. Health subsidy programs can put a strain on government finances, potentially leading to increased taxes or reduced funding for other important programs. Additionally, there may be challenges with eligibility criteria or administrative issues that could hinder the effectiveness of these programs.

Pros and Cons

The pros and cons of health subsidies should be carefully considered before making any decisions regarding eligibility and benefits. Here are three key points to consider:

Potential Impact on Affordability: Health subsidies, such as the Premium Tax Credit, can help individuals and families afford health insurance by reducing monthly premium costs. This can make healthcare more accessible and affordable for those who may otherwise struggle to afford coverage.

Increased Access to Healthcare: Subsidies can expand access to healthcare services by providing financial assistance for medical expenses. This can allow individuals to seek necessary medical care without the burden of high out-of-pocket costs, promoting overall wellness and preventive care.

Potential for Dependence: While subsidies can be beneficial, some argue that they may create a dependency on government assistance. Critics argue that individuals may become reliant on subsidies and be less motivated to seek employment or improve their financial situations.

Considering these pros and cons can help individuals make informed decisions about health subsidies and their potential impact on their financial and healthcare situations.

Cons of Health Subsidy Programs

A potential drawback of health subsidy programs is the concern that they may inadvertently discourage individuals from seeking employment or taking steps to improve their financial situations.

While these programs aim to provide financial assistance for healthcare expenses, they could create a dependency on government funding and discourage individuals from actively participating in the workforce.

The impact of health subsidy programs on the economy can be significant. Here are four key considerations:

Decreased workforce participation: Individuals may choose to rely on health subsidies instead of seeking employment, resulting in a decline in overall workforce productivity.

Increased government expenditure: Health subsidy programs require substantial government funding, which can strain the economy and lead to higher taxes or increased public debt.

Potential disincentive for employers: Employers may be less motivated to offer health insurance benefits if their employees have access to government-funded healthcare options.

Market distortion: Government-funded healthcare can disrupt the private insurance market, potentially limiting competition and innovation.

While health subsidy programs provide important support for those who are unable to afford healthcare, it is essential to carefully consider their potential impact on the economy and individual incentives.

$6400 Subsidy Red Flags and Warning Signs

Red flags indicating the possible falsity of the health subsidy claims include the requirement of website registration for the alleged $6400 subsidy and the absence of any official announcement by President Biden regarding a $5000 health subsidy program.

These warning signs should prompt individuals to exercise caution and engage in a thorough verification process before providing any personal information or engaging in financial dealings.

To protect oneself from potential scams, it is crucial to familiarize oneself with the reporting procedures and promptly report any doubtful websites or suspicious calls to the authorities. By being vigilant and proactive, individuals can help ensure their safety and avoid falling victim to fraudulent schemes.

Remember, verification is key when it comes to financial matters, and it is always better to be safe than sorry. Stay informed and protect your freedom.

- Beware of websites requiring registration for alleged subsidies

- Lack of official announcement by President Biden regarding a $5000 health subsidy program

- Engage in a thorough verification process and report any doubtful websites or suspicious calls promptly

Customer Reviews and Scams

Positive customer reviews can provide valuable insights into the effectiveness and reliability of a product or service. They offer a sense of reassurance and can help potential customers make informed decisions.

In the context of health subsidies, positive customer reviews can highlight the benefits and support provided by such programs, giving individuals confidence in their ability to access affordable healthcare.

Negative customer reviews and scams, on the other hand, serve as cautionary tales, warning individuals about potential pitfalls and fraudulent activities.

These reviews shed light on the deceptive tactics employed by scammers who may falsely promise substantial health subsidies in order to deceive people and steal their money.

By highlighting these negative experiences, individuals can become more aware and cautious when navigating the landscape of health subsidies, protecting themselves from falling victim to scams.

In summary, customer reviews play a crucial role in informing individuals about the effectiveness and legitimacy of health subsidies.

Positive reviews instill confidence and highlight the benefits of such programs, while negative reviews and scams serve as reminders to exercise caution and verify the authenticity of claims.

Positive Customer Reviews

Customer reviews play a significant role in evaluating the credibility and reliability of health subsidy claims. Positive customer experiences can provide valuable insights into the impact of health subsidy programs. Here are three key points to consider:

Improved Access to Healthcare: Many customers have reported that health subsidies have allowed them to afford the necessary medical care that they previously couldn’t access. This increased affordability has positively impacted their overall health and well-being.

Financial Relief: Positive customer reviews highlight how health subsidies have provided significant financial relief for individuals and families burdened by high healthcare costs. These subsidies have helped reduce the financial strain associated with medical expenses, allowing customers to allocate their resources to other essential needs.

Peace of Mind: Health subsidy programs have provided customers with peace of mind, knowing that they have access to affordable healthcare coverage. This has alleviated stress and anxiety about potential medical emergencies or unexpected healthcare expenses.

Overall, these positive customer experiences demonstrate the tangible benefits of health subsidy programs in improving access to healthcare, providing financial relief, and offering peace of mind to individuals and families.

Negative Customer Reviews and Scams

Transitioning from the previous subtopic of Positive Customer Reviews, it is important to also consider the Negative Customer Reviews and Scams associated with health subsidy claims.

While positive customer reviews can provide reassurance, negative reviews shed light on potential pitfalls and deceptive practices. Numerous individuals have reported falling victim to scams related to health subsidy claims, highlighting the need for caution and vigilance.

Common scam tactics include false promises of large cash subsidies, requests for personal information on unsecured websites, and unauthorized access to individuals’ bank accounts. Scammers often exploit the desperation and vulnerability of those seeking financial assistance for medical expenses.

To protect oneself, it is crucial to exercise skepticism and verify the authenticity of websites and individuals involved in health subsidy claims. Being aware of these common scam tactics can help individuals avoid becoming victims and ensure their financial and personal information remains secure.

Negative Customer Reviews and Scams:

- False promises of large cash subsidies

- Requests for personal information on unsecured websites

- Unauthorized access to individuals’ bank accounts

Is the $6400 Subsidy Health Program Legitimate or a Scam?

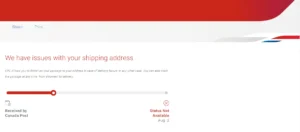

The legitimacy of the health subsidy program is currently being questioned due to false claims made by a website and the lack of affiliation with official government sites. To determine whether the program is a scam or legitimate, it is important to verify the authenticity of health subsidy claims.

Here are some steps to follow:

Check the website’s credibility: Look for official government sites ending with .gov in their addresses. Avoid sharing personal details on random sites.

Research government announcements: Verify if there have been any official announcements regarding the health subsidy program. President Biden has not announced a $5000 health subsidy program.

These precautions will help individuals avoid falling victim to scams and make informed decisions about their health subsidies. It is crucial to report doubtful websites or suspicious calls to the authorities to prevent others from being deceived.

Conclusion: Importance of Verifying Health Subsidy Claims

In the previous subtopic, we discussed tips for secure online shopping in new stores, emphasizing the importance of cybersecurity. Now, let’s shift our focus to the conclusion and highlight the significance of verifying health subsidy claims to ensure financial security.

When it comes to health subsidies, it is crucial to engage in a thorough verification process. Scammers often exploit individuals by using enticing offers and false claims, aiming to steal money or personal information. By verifying the authenticity of government officials, websites, and communication channels, individuals can safeguard themselves against potential fraud.

Maintaining financial security requires diligence and caution when dealing with financial matters. It is essential to check and get assured before making any financial transactions or sharing personal details. Remember, tempting and seemingly easy finance offers may often turn out to be traps.

In case of any doubts or suspicions, promptly report doubtful websites or suspicious calls to the appropriate authorities. By staying vigilant and practicing the verification process, individuals can protect themselves from falling victim to scams and maintain their financial well-being.

Frequently Asked Questions

How can I apply for the Health Subsidy Program?

The application process for the health subsidy program involves meeting eligibility criteria, such as being uninsured or having employer insurance. Applicants must provide relevant tax information and may qualify for the Premium Tax Credit to help cover insurance premiums.

What are the income limits for eligibility in the Health Subsidy Program?

Income thresholds and eligibility criteria for the health subsidy program vary based on factors such as household size and income level. These criteria are determined by the Affordable Care Act and are subject to change.

Can I receive a health subsidy if I have employer insurance?

Receiving a health subsidy may be impacted by having employer insurance. The eligibility for subsidies depends on factors such as income and household size, and individuals with employer insurance may not qualify for subsidies under the Affordable Care Act.

Are there any penalties for not having health insurance under the Affordable Care Act?

The Affordable Care Act imposes penalties for not having health insurance, such as a tax penalty or shared responsibility payment. The health subsidy program aims to assist low-income individuals by providing financial assistance for medical expenses.

How can I report a suspicious website or phone call related to health subsidies?

To report a suspicious website or phone call related to health subsidies, individuals should follow these steps: 1) Recognize red flags such as requests for personal information. 2) Report doubtful websites or suspicious calls to the relevant authorities.

Also Read

Zlimpty Reviews – Is Zlimpty Legit & Worth Trying?

Is Blakes Breaks Scam Or Legit? – Blakebreaks.Com Reviews

Is Mersetre Com Scam or Legit? Mersetre.Com Honest Review

Also Read

Uspsfvc.Com Usps Scam – How to Identify & Protect Yourself?

Fadups Scam – Beware of Fadups.Com Fake Usps

Rdfups.Com Scam – Fake Usps Delivery And Tracking Website

Also Read

Is Metawoz Scam Or Legit? – Metawoz.Com Reviews

Warning: Uspsme.Com, A Fake Usps Site, Can Lead To Scams

Ususfast.Com Scam: A Fake Usps Site That Endangers Your Data

Also Read

Deloitte Headhunters Scam – Recognizing Job Scams

August Cash 2023 Scam Exposed: Quick Cash Offers With Hidden Dangers

Ticket Facil Scam – Everything You Need to Know

Also Read