Are you aware of the Punch Method Scam? This carding scam has been causing havoc for unsuspecting victims.

In this article, we will delve into the origins of the scam and how it operates. You will also learn about the common targets of this scam and red flags to watch out for.

Most importantly, we will provide you with valuable tips and best practices to protect yourself from falling victim to carding scams.

Stay informed and stay safe!

Table of Contents

The Origins of the Punch Method Scam

You’ll be interested to know that the punch method scam originated in the early 2000s as a form of carding scam. It was a clever technique used by cybercriminals to exploit weaknesses in credit card systems.

The scam got its name from the way it was carried out. Criminals would use a ‘punch’ device to extract the necessary information from credit cards, such as the card number, expiration date, and CVV code. This information would then be used to make unauthorized purchases or create counterfeit cards.

The punch method scam quickly gained popularity among fraudsters due to its effectiveness and simplicity. However, as credit card security measures improved, the scam gradually declined. Nowadays, with advancements in technology and increased awareness, it is much harder for scammers to pull off the punch method scam.

How the Punch Method Scam Works

The way this scheme operates is by exploiting vulnerabilities in card payment systems. When you use your card to make a payment, scammers secretly attach a small device to the card reader or ATM machine. This device is designed to record your card details, including the magnetic strip information and PIN number.

As you unsuspectingly go about your transaction, the device discreetly collects all the necessary data. Once the scammers retrieve the device, they can easily clone your card and use it for fraudulent purchases or withdrawals.

The punch method scam is particularly dangerous because it is difficult to detect. The device is usually very discreet and blends in with the card reader, making it virtually impossible for you to notice.

It’s important to regularly check your bank statements and report any suspicious activity immediately to avoid falling victim to this scam.

Common Targets of the Punch Method Scam

Be cautious when using card payment systems at ATMs, gas stations, and other public places where scammers may target unsuspecting individuals. These scammers are always on the lookout for easy targets to carry out their carding scams, and you could be their next victim.

They often target busy areas with high foot traffic, where people are distracted and less likely to notice any suspicious activity. ATMs located in dimly lit or secluded areas are also common targets. Gas stations, especially those with outdated or poorly maintained card readers, are prime targets as well.

Red Flags to Watch Out for in Carding Scams

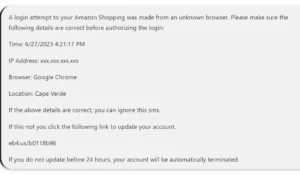

Watch out for red flags like unfamiliar charges on your bank statement, suspicious emails or text messages asking for your personal information, and unexpected phone calls from individuals claiming to be from your bank or credit card company. These are common tactics used in carding scams, where fraudsters try to steal your financial information and make unauthorized transactions.

If you notice any charges on your bank statement that you don’t recognize, it could be a sign that someone has gained access to your account. Be cautious of any emails or text messages that ask for your personal information, such as your Social Security number or credit card details. Legitimate financial institutions will never ask for this information via email or text.

Additionally, if you receive a phone call from someone claiming to be from your bank or credit card company, be skeptical and don’t provide any personal information over the phone. Stay alert and report any suspicious activity to your bank or credit card issuer immediately.

Protecting Yourself From Carding Scams: Tips and Best Practices

Stay vigilant and regularly monitor your bank statements for any suspicious activity, such as unauthorized charges or unfamiliar transactions. It’s essential to protect yourself from carding scams by implementing various tips and best practices.

Firstly, never share your sensitive information, such as your card details or PIN, with anyone. Be cautious when using your card in public places, as scammers can easily install skimming devices to steal your information.

Additionally, regularly update your passwords and enable two-factor authentication for added security. Keep an eye out for phishing emails or messages that may trick you into providing personal information.

Lastly, educate yourself about the latest carding scams and stay informed about the common tactics used by scammers. By following these precautions, you can significantly reduce the risk of falling victim to carding scams and protect your hard-earned money.

Frequently Asked Questions

What Are the Legal Consequences for Individuals Involved in the Punch Method Scam?

If you’re involved in the punch method scam, be prepared for serious legal consequences. The law takes this type of fraud very seriously. You could face charges such as identity theft and financial fraud.

Are There Any Specific Measures Taken by Law Enforcement to Combat the Punch Method Scam?

Law enforcement takes specific measures to combat the punch method scam. They track down the perpetrators, investigate their activities, and work with financial institutions to identify and prevent fraudulent transactions.

These efforts involve a combination of proactive and reactive strategies. Law enforcement agencies actively monitor online forums and social media platforms to gather intelligence on potential scammers. They also collaborate with international law enforcement agencies to share information and coordinate efforts across borders.

Once a scammer is identified, law enforcement agencies launch investigations to gather evidence and build a case against them. This may involve conducting surveillance, gathering witness statements, and analyzing financial records.

In addition to their investigative work, law enforcement agencies work closely with financial institutions to identify suspicious transactions and prevent fraudulent activity. They share information about known scam techniques and provide training to bank employees to help them recognize and report potential scams.

How Does the Punch Method Scam Compare to Other Carding Scams in Terms of Frequency and Success Rate?

In terms of frequency and success rate, the punch method scam is comparable to other carding scams.

It is important to stay vigilant and take precautions to protect yourself from falling victim to these scams.

Are There Any Known Cases of Individuals Successfully Recovering Their Funds After Falling Victim to the Punch Method Scam?

Have you ever wondered if someone was able to get their money back after falling for a scam?

Well, in the case of the punch method scam, there have been no known successful recovery cases.

Are There Any Online Platforms or Forums Where Victims of the Punch Method Scam Can Seek Support or Share Their Experiences?

You can find online platforms or forums where victims of scams can seek support or share their experiences. These platforms provide a safe space for discussion and can offer helpful advice.

Conclusion

In conclusion, it’s crucial to stay vigilant and protect yourself from scams like the Punch Method.

By being aware of common red flags and following best practices, such as not sharing your personal information with unknown sources, you can reduce the risk of falling victim to carding scams.

Remember, your financial security is in your hands, so stay informed and stay safe.

Also Read

Is SHOPS1000 Scam or Legit? Don’t Fall for Their Deceit!

Vinted Scam Exposed: Sneaky Fraudsters Infiltrate the Popular Marketplace

Little Tikes Wholesale Store Clearance Sale Scam: Don’t Be Fooled!

Also Read

Xfinity Target Scam Exposed: Don’t Fall Victim to Call Phishing!

Outdoor Research Store Scam: Outdoorresearch.Shop Exposed

Brown and Joseph LLC Scam Exposed: Don’t be Their Next Victim!

Also Read

Softsfeel Shoes Reviews: Is Softsfeel Shoes Legit or a Scam?

Brezzey Fashion Boutique Reviews – Is It Legit or a Scam?

Wennie Jewelry Reviews: Is Wennie Jewelry Legit or a Scam?

Also Read

Is Brooks Clearance Store Legit or a Scam? Unveiling the Truth

Is Expert Analytical Solutions Legit or a Scam? Unveiling the Truth

Is Asos Sample Sale Legit or a Scam? Discover the Truth!

Also Read

Is Gamecards.Net Legit or a Scam? Don’t Be Fooled!

Procom Recruiting Scam Exposed: Don’t Be Fooled!

Is Ait Airdrop Legit or a Scam? Don’t Fall for Ait Airdrop!

Also Read

Provitalize Reviews Scam Exposed: Uncover the Shocking Reality!

Cavity Colors Scam Exposed: Don’t Be Fooled Fake Online Store!

Moln & More Scam or Legit? Molnshop.Com Furniture Sale Exposed

Also Read

Is Runspeeshoppin Scam or Legit? Dick’s Sporting Goods Warehouse Sale Store Scam

Is Everyjobforme Scam or Legit? Everyjobforme.Com Exposed

Zelle Customer Service Scam Exposed: Don’t Fall Victim!

Also Read

Bt Alerts Scam – Bt Verify Email Account Scam Phishing Email

Axiom Utilities Scam or Legit?Anybis@Axiomutilities.Com Exposed