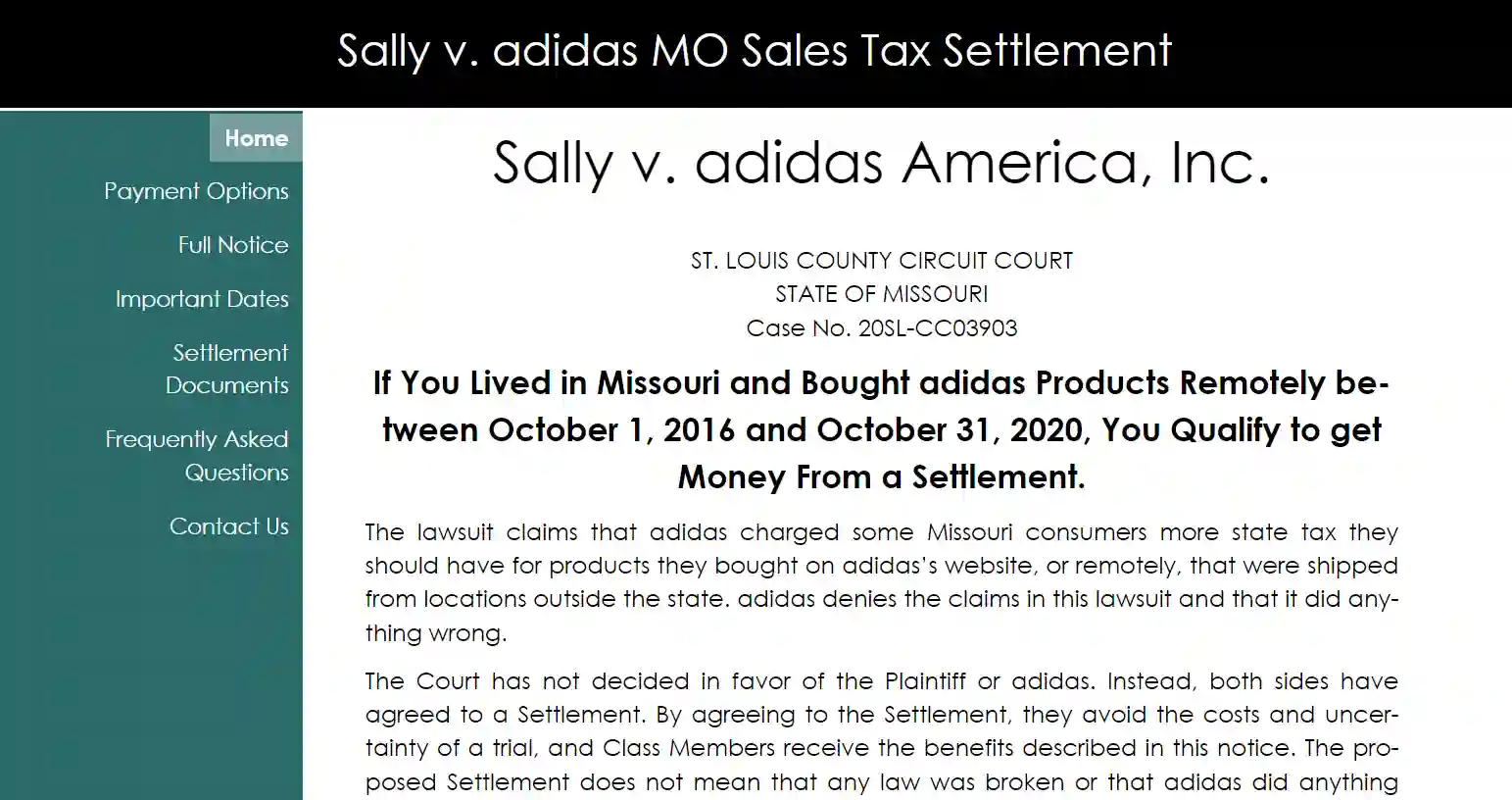

Are you curious about the Sally V. Adidas Legit case and the recent settlement regarding MO sales tax? Well, we’ve got you covered!

In this article, we’ll delve into the background of the case, highlight key points of the settlement, and explore the implications for both Sally and Adidas.

We’ll also discuss the impact on Missouri sales tax collection and remittance.

So, let’s jump right in and see what this settlement means for all parties involved.

Background of the Sally V. Adidas Legit Case

In the Sally V. Adidas Legit case, you’ll learn about the background and circumstances leading up to the settlement of the MO sales tax dispute.

It all started when Sally, a Missouri resident and avid Adidas shopper, noticed discrepancies in the sales tax she was being charged for her purchases. She realized that she was paying a higher sales tax rate compared to other customers in different states.

Perplexed, Sally decided to investigate further and discovered that Adidas had been incorrectly calculating and collecting sales tax in Missouri for several years. Feeling that this was unfair and potentially affecting many other customers, Sally filed a lawsuit against Adidas, seeking reimbursement for the excessive sales tax she’d paid.

This case gained significant attention and eventually led to a settlement between Sally and Adidas, resolving the MO sales tax dispute.

Key Points of the Sally V. Adidas MO Sales Tax Settlement

Now let’s delve into the key points of the Sally V. Adidas MO Sales Tax Settlement.

The settlement, which resolved the lawsuit between Sally and Adidas, involved the issue of sales tax collection on online purchases.

One of the key points is that Adidas agreed to start collecting sales tax on all online purchases made by customers in the state of Missouri. This was a significant development as it addressed the concern raised by Sally and other plaintiffs regarding the unfair advantage Adidas had over brick-and-mortar retailers who were required to collect sales tax.

Another important point is that the settlement also included provisions for Adidas to pay a certain amount of money as reimbursement for past sales tax that should have been collected.

Implications for Sally and Adidas

Addressing the implications for Sally and Adidas, it’s important to consider the impact of the sales tax settlement on both parties involved.

For Sally, the settlement brings relief from the legal battle and potential financial burden. It allows her to move forward without the risk of further litigation expenses and the uncertainty of the outcome. Additionally, the settlement may enhance Sally’s reputation, as it demonstrates her commitment to resolving legal disputes in a fair and timely manner.

On the other hand, Adidas also benefits from the settlement. It avoids the negative publicity and potential damage to its brand that could have resulted from a prolonged and public legal battle. Furthermore, the settlement allows Adidas to maintain its focus on its core business activities and strategic initiatives.

Impact on Missouri Sales Tax Collection and Remittance

The settlement between Sally and Adidas has a significant impact on the collection and remittance of Missouri sales tax. As a result of the settlement, Adidas has agreed to collect and remit sales tax on all purchases made by Missouri residents.

This means that Missouri will now receive the appropriate amount of sales tax revenue from Adidas sales within the state. The settlement also sets a precedent for other online retailers, as it demonstrates the importance of properly collecting and remitting sales tax.

This could lead to an increase in sales tax collection overall, as more companies may follow suit and ensure compliance with Missouri’s sales tax laws. Ultimately, the settlement helps to level the playing field for local retailers who’ve long been burdened with collecting and remitting sales tax, while online retailers have often been able to avoid these obligations.

Conclusion and Future Considerations

Looking ahead, you should consider the long-term implications of the Sally v. Adidas MO sales tax settlement and its effects on the future of sales tax collection and remittance in Missouri.

This case has set a precedent that could potentially impact how businesses handle sales tax obligations in the state. With the court ruling that Adidas is responsible for collecting and remitting sales tax on its online sales to customers in Missouri, it raises questions about the broader application of this decision. Will other states follow suit and require businesses to collect and remit sales tax on online purchases made by their residents?

This settlement highlights the need for clearer guidelines and regulations regarding sales tax collection in the digital economy. As businesses continue to expand their online presence, it’s crucial to consider the implications and potential changes in sales tax policies to ensure compliance and fairness in the future.

Conclusion

In conclusion, the Sally V. Adidas MO Sales Tax Settlement has significant implications for both Sally and Adidas.

The settlement marks a resolution to the case, providing clarity and closure. Additionally, it highlights the importance of companies adhering to state sales tax laws.

Going forward, this settlement may have a positive impact on Missouri’s sales tax collection and remittance, ensuring fair and accurate tax revenue for the state.

Overall, this case serves as a reminder of the importance of compliance and the consequences of noncompliance.

Also Read:

Caldwell Recruitment Scam Exposed – Don’t Fall for Cunning Tricks

Outdoorwearnz Scam or Legit? Outdoorwearnz.Com Reviews

Also Read

Kathmandu NZ Scam – Don’t Get Fooled by Enticing Deals

Flintex Consulting Scam – Discover the Shocking Truth

Also Read

Filson Outlet Scam or Legit? Don’t be Fooled by Usfilsonoutlet.Shop

Is Amzdeal Legit or a Scam – Don’t Be Fooled by Amzdeals.Shop

Also Read: