As a victim of the Wells Fargo Card Declined Scam, I know firsthand the devastating consequences. In this article, I’ll explain how the scam works and what warning signs to watch for.

It starts with an unsolicited email, text, or call claiming to be from Wells Fargo. The scammers gain trust, spin elaborate stories, and ultimately steal funds and sensitive information.

By sharing my experience and offering tips, I hope to empower others to protect themselves from this scam.

Table of Contents

Overview of the Wells Fargo ‘Card Declined’ Scam

As a victim of the Wells Fargo ‘Card Declined’ scam, I was targeted through an unsolicited email, text message, or robocall. Scammers employ common tactics to deceive unsuspecting individuals. They impersonate Wells Fargo and claim there’s an issue with your card, such as a declined transaction or account hold.

To appear legitimate, they use Wells Fargo branding and provide partial account and card numbers. Urgent action is required, and victims are instructed to call a customer service number. However, this number actually connects to a fake support call center run by scammers.

To protect yourself from this scam, be cautious of unsolicited communications, verify the legitimacy of any alerts with Wells Fargo directly, and never share personal or financial information over the phone with unknown individuals.

How the Wells Fargo ‘Card Declined’ Scam Works Step-by-Step

I fell victim to the Wells Fargo ‘Card Declined’ scam after receiving an unsolicited email, text message, or robocall impersonating Wells Fargo and claiming an issue with my card. Here is how the scam works step-by-step:

- Sending Fraudulent Declined Transaction Alerts: Scammers distribute fake emails, texts, and robocalls en masse, using Wells Fargo branding and plausible details. They provide urgent instructions to call Wells Fargo or risk having their account frozen.

- Building Trust and Rapport as Fake Support Agents: Scammers pose as Wells Fargo agents and verify your identity. They review recent authorized transactions to seem credible and claim they see suspicious activity that caused the decline. They use technical jargon to build authority and express concern for your security and funds.

- Spinning Elaborate Stories to Justify Requests: Scammers claim unauthorized access or data breach occurred, pretending your funds and identity are at risk. They aim to trigger fear and create a sense of urgency to manipulate victims into compliance. They shift the narrative from declined transaction to urgent crisis.

- Instructing Victims to Install Remote Access Software: Scammers insist victims download and install remote access software, providing step-by-step instructions. They adjust security settings to enable remote control and request user ID and passwords to gain complete control. This enables theft of login credentials, bank account numbers, and more.

To prevent remote access scams, it’s crucial to understand social engineering tactics used by scammers. By being aware of these steps, we can better protect ourselves from falling victim to such scams.

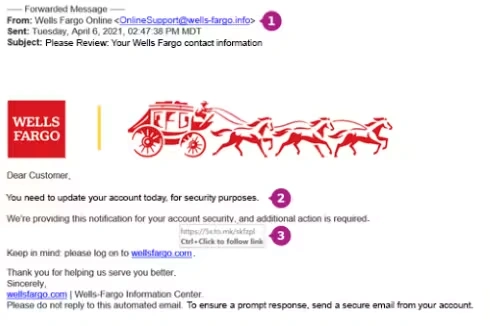

How to Spot Scam Emails

To spot scam emails, look for suspicious signs such as unfamiliar sender addresses, urgent subject lines, and poor grammar and formatting. These are common red flags that indicate a potential phishing attack.

By being vigilant and paying attention to these indicators, you can protect yourself from falling for scam emails. It’s important to avoid clicking on any links or downloading attachments from unknown senders. Instead, independently verify the information by contacting the institution or organization directly through their official website or customer service number.

Additionally, regularly update your antivirus software and be cautious about sharing personal information online. Remember, staying informed and following these tips for protecting yourself from phishing attacks is crucial in safeguarding your personal and financial information.

Identifying Scam Text Messages

Spotting scam text messages is essential in protecting yourself from fraudsters and their deceptive tactics. Here are four key factors to consider when analyzing scam text messages:

- Unknown numbers: If you receive a text message from an unfamiliar number, be cautious as it could be a scam. Legitimate organizations usually use recognizable numbers.

- Threatening language: Pay attention to the tone of the message. Scammers often use fear and urgency to manipulate victims into complying with their requests.

- Requests for account details: Be wary of any text message that asks for your account details, such as passwords or personal identification numbers (PINs). Legitimate organizations will never ask for this information via text message.

- Odd phrasing: Scammers may use unusual or unnatural language in their messages. Look out for spelling or grammatical errors, as these can be red flags.

Understanding the psychology behind scam tactics can help you identify and avoid falling victim to scam text messages.

Actions to Take If You Fell Victim to the Scam

If you have fallen victim to the Wells Fargo ‘Card Declined’ scam, it’s crucial to take immediate action to mitigate the damage and protect your finances.

The first step is to alert Wells Fargo of the compromised accounts and inform them about the fraudulent activity.

Next, closely monitor your accounts for any further fraudulent transactions or suspicious activity.

It’s also important to scan all your devices for malware and keyloggers that may have been installed by the scammers.

Resetting all your account passwords is essential to prevent unauthorized access.

Additionally, file reports with the Federal Trade Commission (FTC), Internet Crime Complaint Center (IC3), and local authorities to help track down the scammers.

Finally, take steps to recover possible funds by contacting your banks to reverse or recover fraudulent transactions, placing fraud alerts and freezing your credit reports, and disconnecting any remote access software that may have been installed.

Also Read:

Yaguan Herbal Shampoo Reviews – Its Effectiveness On Gray Hair

LabCharge Ionic Air Purifier Reviews- The Magic Behind Clean Air

Aiosigd.Shop Reviews – Is Aiosigd.Shop Legit or a Scam?

Read More: