Is Fraavy.com Scam or Legit? – Fraavy.com, a deceptive website, has been causing individuals to incur unauthorized bank fees through its misleading practices. Despite claiming to offer unlimited access to various forms of entertainment, Fraavy.com has been found to engage in deceptive tactics, leading to numerous complaints from individuals who have been charged for services they never signed up for or intended to use.

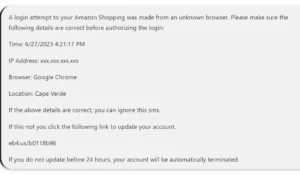

The platform presents a five-day free trial, but in reality, it is a paid service. The scam occurs when a pop-up from Fraavy.com appears while scanning a QR code, resulting in individuals being charged without their consent. Even after unsubscribing, individuals who provided credit card information continue to be charged a monthly fee.

To protect oneself, it is advised to contact the bank or credit card provider for a chargeback, consider closing the associated account, enable text notifications for transactions, and review Google account settings for added security measures. It is crucial to exercise caution when sharing credit card information online and verify the legitimacy of websites before making payments.

Table of Contents

What is Fraavy.com?

Fraavy.com is a website that presents itself as a platform offering unlimited access to various forms of entertainment content, but recent complaints have revealed its deceptive practices of unauthorized bank charges.

The website operates under the guise of a five-day free trial, but in reality, it is a paid service that charges users without their consent or knowledge. Individuals have reported being debited by Fraavy.com even if they have never visited the website or signed up for any services.

This scam often occurs when a pop-up from Fraavy.com appears while scanning a QR code. Users are charged for a service they never requested or intended to use, and even after unsubscribing, they continue to be charged a monthly fee of $49.99.

It is important for victims to take immediate action by contacting their bank or credit card provider to report fraudulent transactions and request a chargeback. Possible legal actions against Fraavy.com may also be considered to hold them accountable for their deceptive practices.

Fraavy.com Deceptive Practices

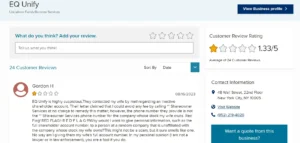

Many users have reported experiencing fraudulent practices involving unauthorized charges and misleading information. Fraavy.com, a platform that claims to offer unlimited access to various forms of entertainment, has been found to engage in deceptive practices.

One of the fraudulent practices is fraudulent billing, where individuals are charged for services they never requested or intended to use. Fraavy.com presents itself as offering a five-day free trial, but in reality, it is a paid service. Users have been debited by Fraavy.com even if they never visited the website or signed up for any services.

Additionally, hidden fees are another deceptive practice employed by Fraavy.com. Even after unsubscribing, individuals who provided credit card information continue to be charged a monthly fee of $49.99.

To protect themselves from these deceptive practices, users are advised to take immediate action by contacting their bank or credit card provider to report fraudulent transactions and request a chargeback. It is also recommended to consider closing associated credit cards or accounts to prevent further charges and enable text notifications and alerts for credit card activity.

By being vigilant and informed, individuals can mitigate the risk of falling victim to deceptive practices like those employed by Fraavy.com.

Fraavy.com Unauthorized Charges

Several individuals have reported being charged for services they did not authorize or intend to use. Fraavy.com’s unauthorized charges have had a significant impact on these individuals, causing financial distress and frustration. These charges occur even if the user has never visited the website or signed up for any services.

Despite the website claiming to offer a five-day free trial, it is actually a paid service that deceives users. Users have also reported encountering a pop-up from Fraavy.com while scanning a QR code, which leads to unexpected charges.

Even after unsubscribing, individuals who provided their credit card information continue to be charged a monthly fee of $49.99. To address these unauthorized charges, victims can take legal action against Fraavy.com, report fraudulent transactions to their card issuer or bank, and request a chargeback.

It is crucial for individuals to remain vigilant and informed about online scams like Fraavy.com to protect themselves and others from falling victim to deceptive practices and unauthorized charges.

| Unauthorized Charges from Fraavy.com: | Impact and Legal Action |

| – Individuals charged for services they did not authorize or intend to use | – Financial distress and frustration |

| – Charges occur even without visiting the website or signing up for services | – Legal action against Fraavy.com |

| – Deceptive practices of offering a five-day free trial | – Report fraudulent transactions to card issuer or bank |

| – Pop-up from Fraavy.com while scanning a QR code | – Request a chargeback |

| – Continued monthly charges after unsubscribing | – Spread awareness and protect others from falling victim |

Scam Pop-up

The occurrence of a pop-up from Fraavy.com while scanning a QR code has been reported by individuals, leading to unexpected financial consequences.

Fraavy.com scam techniques involve tricking users into believing they can access entertainment content for free, but then charging them without their consent. This deceptive website debits users with a monthly fee of $49.99, even if they never visited the website or authorized any payments.

To protect against pop-up scams like Fraavy.com, it is important to exercise caution when sharing credit card information online. Verify the authenticity of websites before making payments and be wary of offers that seem too good to be true.

By being proactive and safeguarding financial security, individuals can mitigate the risk of falling victim to online scams.

Canceling Charges

To address the issue of unauthorized charges from Fraavy.com, it is crucial to promptly contact the respective bank or credit card provider and request a chargeback.

It is important to familiarize oneself with Fraavy.com’s refund policy and follow the necessary steps to dispute the charges. This typically involves providing documentation of the unauthorized transactions and explaining the fraudulent nature of the charges.

Additionally, individuals should consider closing the associated credit card or account to prevent further charges from Fraavy.com. Enabling text notifications and alerts for credit card activity can provide an added layer of security.

It is also advisable to review Google account settings for additional security measures.

To mitigate the risk of falling victim to online scams like Fraavy.com, it is essential to exercise caution when sharing credit card information online and to verify the authenticity of websites before making payments.

Prevent Further Charges

In order to prevent additional charges, it is recommended to take proactive measures such as closing the associated credit card or account and enabling text notifications and alerts for credit card activity.

Enhancing fraud protection is crucial in safeguarding personal information and mitigating the risk of falling victim to deceptive charges like those from Fraavy.com. By closing the associated credit card or account, individuals can ensure that no further charges will be made without their consent.

Additionally, enabling text notifications and alerts for credit card activity allows for real-time monitoring and immediate detection of any unauthorized transactions.

It is important to protect personal information by being cautious when sharing credit card details online and verifying the authenticity of websites before making payments.

By taking these steps, individuals can effectively prevent further fraudulent charges and maintain their financial security.

Enhancing Security Measures

Enhancing security measures is essential in protecting against unauthorized transactions and maintaining personal financial security. By implementing certain strategies, individuals can strengthen their defenses against fraud and online scams like the unauthorized bank scam perpetrated by Fraavy.com. Here are some steps to consider:

- Enhancing password protection: Create strong, unique passwords for all online accounts and avoid using the same password for multiple platforms. Consider using a password manager to securely store and generate complex passwords.

- Two-factor authentication: Enable two-factor authentication whenever possible. This adds an extra layer of security by requiring a second form of verification, such as a code sent to your mobile device, in addition to your password.

- Regularly review account activity: Monitor your bank and credit card statements regularly for any suspicious transactions. Promptly report any unauthorized charges to your financial institution.

- Stay informed: Keep yourself updated on the latest security practices and scams. Be cautious when sharing personal and financial information online, and verify the legitimacy of websites before making payments.

By implementing these security measures, individuals can significantly reduce the risk of falling victim to unauthorized transactions and protect their financial well-being.

Online Payment Safety

Implementing secure online payment practices is crucial for safeguarding personal financial information and preventing unauthorized transactions. Online payment fraud is a growing concern, with fraudsters constantly finding new ways to exploit individuals and steal their personal information.

To protect personal information, it is important to follow a few essential steps.

First, ensure that the website you are making a payment on is secure and trustworthy. Look for the padlock symbol in the browser address bar and check for HTTPS in the URL. Avoid making payments on unsecured or suspicious websites.

Second, use strong and unique passwords for your online payment accounts, and enable two-factor authentication whenever possible. This adds an extra layer of security by requiring a verification code in addition to your password.

Lastly, regularly monitor your bank and credit card statements for any unauthorized transactions. If you notice any suspicious activity, report it to your bank or credit card provider immediately.

By taking these precautions, you can protect your personal information and reduce the risk of falling victim to online payment fraud.

Reporting Fraudulent Transactions

To effectively address fraudulent transactions, individuals should promptly report suspicious activity to their bank or credit card provider. Reporting fraudulent transactions is crucial in protecting one’s finances and preventing further unauthorized charges.

However, there are challenges individuals may face when reporting fraud:

Lack of awareness: Some individuals may not realize they have been victims of fraudulent transactions until they notice unauthorized charges on their bank statements. It is important to regularly review account activity to identify any suspicious transactions.

Time-consuming process: Reporting fraudulent transactions often involves contacting the bank or credit card provider, providing detailed information about the unauthorized charges, and filling out necessary forms. This process can be time-consuming and may require patience and persistence.

Financial implications: Fraudulent transactions can have a significant impact on individuals’ finances. Unauthorized charges can lead to financial loss, overdraft fees, and damage to credit scores. It is essential to address fraudulent transactions promptly to minimize the financial consequences.

Emotional distress: Dealing with fraudulent transactions can cause stress, anxiety, and frustration for individuals. It is important to remain calm and focused when reporting fraud, seeking support from financial institutions, and following their guidance.

By promptly reporting suspicious activity and overcoming the challenges in reporting fraud, individuals can protect their finances and minimize the impact of fraudulent transactions.

Frequently Asked Questions

How can I verify the legitimacy of a website before making a payment?

To verify the legitimacy of a website before making a payment, one can take several steps. These include checking for secure payment options, looking for contact information and customer reviews, and ensuring the website has proper security measures such as HTTPS encryption.

What steps can I take to prevent further charges from Fraavy.com?

To prevent further charges from Fraavy.com, you can take the following steps: 1) Contact your bank or credit card provider to report the unauthorized charges and request a chargeback. 2) Consider closing the associated credit card or account.

What are some security measures I can implement to enhance the security of my online transactions?

Two-factor authentication is crucial in enhancing the security of online transactions as it adds an additional layer of verification. Additionally, using strong and unique passwords, following best practices, helps prevent unauthorized access and potential breaches.

How can I protect myself from falling victim to online scams like Fraavy.com?

To protect oneself from falling victim to online scams like Fraavy.com, it is important to recognize common signs of scams and educate others about them. By being vigilant, verifying website authenticity, and avoiding offers that seem too good to be true, individuals can mitigate the risk of being scammed.

What should I do if I have already been charged by Fraavy.com without my consent or knowledge?

If you have already been charged by Fraavy.com without your consent or knowledge, it is recommended to take legal recourse by reporting the fraudulent transactions to the authorities.

Also Read

Sean Kingston Scam – Sean Kingston Faces Prison For Alleged Fraud

Is Shipupsportal.com Legit or a Scam? Website Insights And Reviews

Baby Joy New York Scam – Is Baby Joy New York Legit?

Also Read

Is Bed Bath Warehouse Legit or a Scam? Staying Safe Online

Is Discounts Outlet Com Scam or Legit?

Is Co.lotto.com Legit? Discover the truth about Co.lotto.com

Also Read

Devansy Clothing Reviews: Is Devansy Clothing Legit or a Scam?

Layny Clothing Reviews: Untrustworthy Scam Website To Avoid?

Rei Swiftland Shorts Review – Is It Legit & Worth Trying?

Also Read

Shapermov Ion Shaping Shorts Reviews

Forlest Bra Reviews – Is Forlest Bra Worth Trying?

ProtectSpecial.com Reviews: Is It Legit or a Scam? Unveiling The Truth

Also Read

Clothingta Reviews – Is It Legit or a Scam? Unveiling The Truth

Bynx Studios Clothing Reviews: Is BY-NX Legit Or A Scam?

Is Largeliquidator Com Scam or Legit? Spotting Scam Online Stores

Also Read

Is Launching Deals Legit or a Scam? The Story Of Launchingdeals.Com

Is Romtech Legit? Innovative Solutions & Trustworthy Reviews

Is Hugo Insurance Legit or a Scam? Hugo Car Insurance Reviews

Also Read

Is Stylevana Legit or a Scam? – Your Trusted Source For Asian Beauty?

Is Shipupsonline Scam or Legit? Unveiling The Suspicion

Is Usclarks.Shop Scam or a Legit? Uncovering Concerns

Also Read

Is Fandango Legit or a Scam? Fandango Reviews

Is Marc Jacobs Rack Legit or a Scam? Insider Tips For Authentic Bags

Is Observati Secret Shopper Legit or a Scam? Discover Now

Also Read

Is Dillards Online Shop Legit or a Scam? Beware Of Dillards-Online.Shop

FleetFinder.com Review – Is FleetFinder.com Legit or a Scam?

Hegentry Reviews – Is Hegentry A Legit Women’s Clothing Brand Or A Scam?

Also Read

Combrehythm Reviews – Is Combrehythm A Legit Book Store?

Nev Clothing Reviews – Legit Quality Children’s Fashion or a Scam?

Poppy Lu Clothing Reviews: Pros, Cons, & Red Flags

Also Read

University Cask Scam or Legit? – Uncovering The Truth

Is Closing Store Shop Scam or Legit?: Protect Yourself From Fraud

United Way Scam – Beware Of United Way Impersonation Scam

Also Read

Is Smartycashback.com Scam or Legit? Beware Of Smarty

Is Ccspayment Scam or A Legitimate Portal For Debt Resolution?