Premier Members Credit Union Scam – Are you a member of Premier Members Credit Union? Have you recently noticed a fraudulent charge on your account?

In this article, we will help you understand the Premier Members Credit Union scam and provide you with the necessary steps to report and recover funds from a fraudulent charge.

By knowing the signs of a fraudulent charge and taking proactive measures to protect yourself, you can safeguard your finances from credit union scams.

Table of Contents

Understanding the Premier Members Credit Union Scam

I can’t believe how many people were affected by the Premier Members Credit Union scam. It’s shocking to think that so many innocent individuals fell victim to this fraudulent scheme.

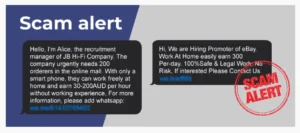

You might wonder how something like this could happen to so many people. Well, it all started when the scammers gained unauthorized access to the credit union’s database. They stole personal information, including credit card details, from hundreds of unsuspecting customers.

Once they had this information, they started making fraudulent charges on the victims’ accounts. People were left confused and angry, not knowing how their hard-earned money had been stolen right under their noses.

It just goes to show that we must always be vigilant and protect ourselves from these types of scams.

Identifying the Signs of a Fraudulent Charge

Be on the lookout for any unusual transactions on your bank statement that you didn’t authorize. It’s important to regularly review your bank statements to catch any fraudulent charges as soon as possible.

If you notice any unfamiliar transactions, such as purchases you didn’t make or withdrawals you didn’t authorize, take immediate action.

Contact your bank or credit union to report the fraudulent charge and notify them of the unauthorized activity. They will guide you through the necessary steps to protect your account and resolve the issue.

Reporting a Fraudulent Charge to Premier Members Credit Union

To report a fraudulent charge, simply contact your bank or credit union. They will guide you through the necessary steps to resolve the issue.

Premier Members Credit Union is committed to assisting you promptly and efficiently in these situations.

When you reach out to them, provide as much information as possible about the fraudulent charge. Include the date, amount, and any other relevant details. This will help their team investigate the matter thoroughly and take appropriate action.

They may ask you to fill out a dispute form or provide additional documentation to support your claim. Rest assured that Premier Members Credit Union has systems in place to protect your account. They will work diligently to resolve the issue and prevent future fraudulent activity.

Steps to Take to Recover Funds From a Fraudulent Charge

If you suspect unauthorized activity on your account, contact your bank or credit union immediately to initiate the process of recovering funds from a fraudulent charge. Acting swiftly is crucial to minimize any potential losses.

Start by explaining the situation to your bank or credit union representative. Provide them with all the necessary details, such as the date and amount of the fraudulent charge. They will guide you through the next steps, which may include filling out a dispute form or affidavit.

Be prepared to provide any supporting documentation, such as receipts or transaction records, to strengthen your case. Remember to keep records of all your communication with the bank or credit union, including dates and names of the representatives you speak with.

Protecting Yourself From Credit Union Scams and Fraudulent Charges

Acting quickly and staying vigilant can help safeguard your finances from scams and unauthorized charges at a credit union.

There are a few key steps you can take to protect yourself.

First, regularly monitor your account activity online or through mobile banking. By keeping a close eye on your transactions, you can quickly spot any suspicious charges and report them to your credit union.

Additionally, be cautious of any unsolicited emails or phone calls requesting personal information. Scammers often pose as legitimate financial institutions to trick you into providing sensitive data. Remember, your credit union will never ask for your account number or social security number over the phone or through email.

Lastly, if you suspect any fraudulent activity, contact your credit union immediately to freeze your account and start the process of recovering your funds.

Frequently Asked Questions

How Long Does It Take for Premier Members Credit Union to Investigate a Fraudulent Charge?

How long does it take for them to investigate a fraudulent charge?

The time it takes for a fraudulent charge to be investigated can vary depending on several factors.

First, the complexity of the case plays a role. If the fraudulent charge is straightforward and easy to trace, the investigation may be completed relatively quickly. On the other hand, if the case involves multiple transactions or requires extensive research, it can take longer to gather the necessary evidence.

What Is the Typical Amount of Money Stolen in a Premier Members Credit Union Scam?

In a Premier Members Credit Union scam, the typical amount of money stolen can vary. It’s important to be vigilant and report any fraudulent charges immediately to protect your funds.

Can I Recover My Funds if I Reported the Fraudulent Charge After 60 Days?

You may not be able to recover your funds if you reported the fraudulent charge after 60 days.

It’s important to report any suspicious activity as soon as possible to increase your chances of getting your money back.

Are There Any Additional Fees or Charges Associated With Recovering Funds From a Fraudulent Charge?

Are there any additional fees or charges to recover funds from a fraudulent charge?

No, if you reported it promptly, Premier Members Credit Union should not charge you any fees. They will work to recover your funds.

What Steps Can I Take to Prevent Becoming a Victim of a Premier Members Credit Union Scam in the Future?

To prevent future scams with Premier Members Credit Union, be cautious of suspicious emails or calls asking for personal information.

Regularly monitor your accounts and report any unauthorized charges immediately.

Stay vigilant and protect your financial information.

Conclusion

In conclusion, it is important for you to stay vigilant and aware of credit union scams and fraudulent charges. By understanding the signs of a scam and knowing how to report it to Premier Members Credit Union, you can take steps to protect yourself and recover any lost funds.

Remember to always monitor your accounts, report any suspicious activity immediately, and take proactive measures to safeguard your financial information.

Stay informed and proactive to prevent falling victim to scams and fraudulent charges.

Also Read

Mamoic Clothing Reviews- Mamoic Clothing Legit or Scam?

Is Findhealthclinics Scam or Legit? Findhealthclinics.Com Review

Usps.Delivcheck.Com Scam – What Is This Scam About?

Also Read

Is Nevexet Legit or Scam? Nevexet.Com Reviews

Is Bayex.io Scam or Legit? Bayex.Io Reviews

Is Meaningful Beauty Scam or Legit? Meaningfulbeauty.Com Review

Also Read

Bed Bath And Beyond Scam On Facebook – Scam Alert

Is Mini Activewear Scam or Legit? Miniactivewear.Com Review

Is Chic Comfort Zone Scam or Legit? Chiccomfortzone.Com Review

Also Read

Is Zenatime Scam or Legit? Zenatime.Com Reviews

Conlarlys Bra Reviews – Legit Or Scam? Unveiling The Truth

Swim Recruiting Scam Exposed – Don’t Fall for Fake Job Scams

Also Read

Hoka Final Clearance Scam or Legit? – Don’t Be Fooled

September Cash 33 Scam or Legit? Uncover the Truth!

Volcom Sale Shop Scam or Legit? Volcomsale.Shop Exposed

Also Read

Nordic Recruitment Scam – Unmasking the Deceit