No Credit Check Loans – Are you looking for a loan but have bad credit? You’re not alone – many people find themselves in this situation, wondering if they can get the money they need without worrying about credit checks or other hassles.

The good news is that there is a solution: no credit check loans direct lender guaranteed approval. These loans provide an easy way to get the money you need, regardless of your credit score.

In this blog post, we’ll explore the benefits of no credit check loans and direct lender-guaranteed approval so that you can make the best decision for your financial needs.

Table of Contents

What Are No Credit Check Loans Online?

No Credit Check Loans Online are an excellent option for those with bad credit or no credit history. They offer a way to get the money you need without worrying about your credit score, making them ideal for those who traditional lenders may have turned down.

Many different types of no-credit-check loans are available online, including payday loans, installment loans, and personal loans. Payday loans are short-term loans designed to be paid back on your next payday, while installment loans are longer-term loans that can be paid back over months or even years.

Personal loans are another option, offering more significant loan amounts and longer repayment terms.

You should know a few things if you’re interested in getting a no-credit-check loan online.

First, finding a reputable lender who offers guaranteed approval is essential. This will ensure you can get the money you need without worrying about being turned down.

When applying online for a no-credit-check loan, provide accurate information about your income and employment history. This will help the lender determine your ability to repay the loan and increase your chances of getting approved.

How Do No Credit Check Loans Work?

No-credit check loans are becoming increasingly popular for those with bad credit or no credit history. These loans are designed to provide financial assistance without needing a credit check, benefiting those who may have been rejected for traditional loans.

The process for obtaining a no-credit-check loan is relatively straightforward. Firstly, the borrower must fill out an online application form asking for personal and financial information. This will typically include employment status, income, and bank account information.

Once the application has been submitted, the lender will review the information provided and decide based on the borrower’s ability to repay the loan. The funds will typically be transferred into the borrower’s checking account within one or two business days if approved.

The repayment terms for no-credit-check loans will vary depending on the lender and the type of loan. Payday loans typically require the borrower to repay the loan plus interest on their next payday, while installment loans may have longer repayment terms.

It’s essential to read and understand the terms and conditions of the loan before signing any contract.

One of the benefits of no credit check loans is that they can be obtained from direct lenders. This means that the borrower will deal with the lender directly throughout the loan process, from application to repayment. This can help streamline the process and ensure that the borrower can get the support they need promptly.

Why Do Lenders Conduct Credit Checks?

Before approving a loan application, lenders conduct credit checks to assess a borrower’s creditworthiness and risk level.

Credit checks provide a lender with information about a borrower’s credit history, credit score, and payment behavior. By reviewing this information, a lender can determine whether or not a borrower is a reliable and responsible borrower.

One of the primary reasons lenders conduct credit checks is to determine a borrower’s ability to repay the loan. If a borrower has a history of missed payments or defaults on their credit report, this may indicate that they have difficulty managing their finances. This may make them high-risk borrowers, which increases the likelihood of defaulting on the loan.

A credit check also helps lenders identify a borrower’s outstanding debts. If a borrower has a significant amount of debt, this may indicate that they are already struggling to manage their finances. Taking on additional debt may increase their financial burden and make it more challenging to repay the loan.

Can I Get a Guaranteed Loan Approval With No Credit Check Loans?

Many borrowers with bad credit need funds but are hesitant to apply for a loan because of their credit history. Fortunately, you can get guaranteed loan approval within minutes with no credit check loans from direct lenders.

It’s important to note that while a direct lender may offer a guaranteed decision on your loan application, they will still check your details and perform a soft credit check to ensure you’re eligible for the loan.

While they are more likely to approve your loan, there is no 100% guarantee that your loan application will be approved.

One of the benefits of no credit check loans is the fast processing time. After submitting your loan application, you can expect to receive a decision within minutes. If approved, you can deposit the funds in your bank account before the next business day.

In contrast, banks conduct a mandatory credit history check through the main credit bureaus, which can take longer. The approval process is also dependent on your credit score, making it difficult for borrowers with bad credit to be approved.

Knowing the different types of loans available and their terms and conditions is essential if you’re considering a no-credit-check loan from a direct lender. Common types of no-credit-check loans include payday, installment, and personal loans.

Before applying for a no-credit-check loan, consider your financial situation and the repayment terms carefully. Choosing a legitimate direct lender with transparent terms and conditions and a good reputation is also crucial.

Do I need No Credit Check Loans Online?

You might feel like you have no loan options if you have a bad credit score or no credit history. But before you give up, consider the possibility of no credit check loans online. These loans do not require a hard credit check, meaning you could still be eligible even with poor credit.

Of course, other options exist, such as using your credit cards or borrowing money from friends or family. However, these options may not be feasible for everyone. If you decide to pursue a no-credit-check loan, it’s essential to understand the terms and interest charges associated with the loan.

It’s important to note that no credit check loans may come with higher interest rates than traditional loans. Lenders see those with bad credit or no credit history as higher-risk borrowers. Make sure to shop around for the best rates and terms before deciding.

Ultimately, deciding to pursue a no-credit-check loan is up to you and your financial situation. Just proceed cautiously and understand the potential risks before making any decisions.

How Can I Get an Online Loan Without a Credit Check?

Many worry that their credit score will hinder their ability to get a loan, but options are available. No credit check loans online can provide an easy solution for those needing quick cash without the hassle of a credit check. Here’s how to get started:

- Fill out a quick online application – Online lenders make the process easy with an application that can be completed from the comfort of your home. The application will require your basic personal and employment information and your desired loan amount.

- Provide bank account information – This is necessary for lenders to deposit your funds and collect repayment.

- Wait for soft credit inquiry – Lenders will typically perform a soft credit inquiry to assess your ability to repay the loan. This will not affect your credit score.

- Read the terms and conditions – Be sure to carefully review the terms and conditions of the loan before signing the contract.

- Receive funding – Once approved, the loan will be funded on the same or the next business day.

It’s important to note that while no credit check loans can provide quick and easy cash, they often come with higher interest rates and fees. Consider the pros and cons before applying for one of these loans.

How to Know if No Credit Check Loans Are Safe?

One of the most significant concerns for borrowers seeking no-credit-check loans is whether or not they are safe.

As with any financial transaction, potential risks are involved, especially when borrowing from online lenders. Therefore, taking precautions to protect yourself from fraud and predatory lenders is crucial.

No credit check loans are safe if you borrow from a reputable, legitimate direct lender. You can verify the lender’s credentials by checking their reviews and ratings on online forums and reading through their website’s privacy and terms of service pages.

These pages should clearly outline their fees, interest rates, repayment terms, and other critical information you need to know before borrowing from them.

However, it’s worth noting that some lenders prey on the vulnerable position of poor or no-credit borrowers. They may attempt to get access to your personal information or take advantage of you by charging exorbitant fees and high-interest rates.

To avoid these fraudulent lenders, there are specific warning signs you should look out for when considering online loans with no credit check.

First, watch out for upfront fees. Legitimate lenders usually deduct the expenses from the loan amount once approved and disbursed. If the lender requests you to pay a fee upfront, it’s a red flag, and you should look for other options.

Secondly, be wary of lenders who claim to offer no credit checks. Although no credit check loans exist, all lenders must perform credit verification checks before approving your loan request. Not checking your credit score does not mean they don’t have access to other information that can help them assess your creditworthiness.

Lastly, avoid dubious lenders who don’t have physical addresses or correct contact information on their websites. Reputable lenders will have a physical location and precise contact details, including phone numbers, email addresses, and live chat options.

In summary, no credit check loans are safe if you borrow from a trustworthy and legitimate lender. To avoid falling prey to fraudulent lenders, be on the lookout for upfront fees, no credit check claims, and dubious lenders without physical addresses or clear contact information.

What Are The Risks Of A No Credit Check Loan?

While no credit check loans may seem like a quick and easy solution to your financial problems, a few risks come with them. Here are some of the most common risks associated with no-credit-check loans:

High-Interest Rate:

Since these loans are given out without a credit check, lenders consider them high-risk. They often charge higher interest rates than traditional loans to compensate for this risk. This means you’ll end up paying back more than you would with a conventional loan.

In addition to high-interest rates, lenders may charge high fees for no-credit-check loans. These fees can include origination fees, late payment fees, and prepayment fees, among others. Ensure you understand all the costs of your loan before signing any paperwork.

Short Repayment Period:

No credit check loans often come with short repayment periods, sometimes as little as a few weeks. This can make it challenging to repay the loan on time, especially if you’re already struggling financially.

Repayment Not Reported:

Finally, since no credit check loans often don’t require a credit check, they also may not report your repayment to the credit bureaus. This means that even if you repay the loan on time, it won’t help improve your credit score.

Before applying for a no-credit-check loan, understand all the risks involved. If possible, explore other loan options, such as traditional loans or credit cards. If you choose a no-credit-check loan, research and find a reputable lender who offers fair terms and fees.

Why Do You Need To Know Your Credit Score?

Knowing your credit score is essential when applying for loans, credit cards, or any form of credit. It represents your creditworthiness and helps lenders determine how much risk they would take by lending you money.

Your credit score is based on various factors, including your payment history, credit utilization, length of credit history, and types of credit accounts you have. A higher credit score typically means you are a lower-risk borrower, so that you may qualify for better loan terms and interest rates.

On the other hand, a lower credit score may make it more difficult for you to qualify for loans or credit, and you may end up paying higher interest rates and fees. In some cases, lenders may even reject your loan application altogether.

Knowing your credit score can help you better understand your financial health and what types of loans and credit you may qualify for. It can also help you identify areas where you need to improve your credit, such as paying off outstanding debts or reducing your credit utilization.

How To Check Your Credit Score?

Before considering a no-credit-check loan, knowing your credit score is essential. Your credit score is a number that represents your creditworthiness, and it’s determined by factors such as payment history, credit utilization, length of credit history, and types of credit used.

You can check your credit score for free at websites such as Credit Karma or Credit Sesame. These sites provide a free credit score based on credit bureaus Equifax and TransUnion data. You can also get your credit score directly from the bureaus for a fee.

Once you have your credit score, you can determine if a no-credit-check loan is your best option. If your credit score is low, you may want to work on improving it before applying for a loan. This can include paying off outstanding debt, making on-time payments, and avoiding opening new lines of credit.

5 Best No Credit Check Loans Online for Guaranteed Approval & Bad Credit

1. ClearViewLoans: Best Lender for Fast and Easy Approval

If you’re in a tight financial spot and need cash fast, ClearViewLoans may be the answer. Their extensive network of lenders makes finding a loan that fits your needs and qualifications easy.

Their service is fast and convenient, allowing you to complete a simple loan request form and get matched with a lender in just minutes.

ClearViewLoans’ network of lenders includes both lousy credit and no-credit-check lenders, meaning that even if your credit score is less than ideal, you may still qualify for a loan.

However, as with any loan, it’s essential to understand the risks and potential consequences before taking out a loan. No-credit-check loans may have higher interest rates and fees than traditional loans, and failure to repay can further damage your credit score and even legal action.

That being said, if you’re in a situation where you need fast cash and can confU.S.tly repay the loan on time, ClearViewLoans may be an excellent option for you.

How to Qualify for ClearViewLoans?

If you’re looking for fast and easy approval on a no-credit-check loan, ClearViewLoans may be an excellent option. But before you apply, it’s essential to understand the qualifications necessary to be considered for a loan.

To qualify for a loan from ClearViewLoans, you must be over 18 years old and a U.S. citizen or permanent resident. You must also have a job where you’ve worked for a minimum of 90 days and have at least $1,000 of income per month after taxes.

Additionally, you must have a checking account in your name and a valid email address, home phone number, and work phone number. These qualifications ensure that you have the means to pay back the loan and can be contacted in case of any issues.

It’s important to note that while ClearViewLoans may not perform a credit check, they consider other factors when evaluating your application. This includes income, employment status, and outstanding debts or financial obligations.

Before applying for a loan with ClearViewLoans or any other lender offering no credit check loans, it’s essential to consider the risks associated with this type of borrowing. These loans often come with higher interest rates and fees and can lead to a cycle of debt if not managed properly.

It’s also crucial to find a reputable direct lender offering these types of loans and thoroughly research the terms and conditions before signing the dotted line.

By taking these precautions and being responsible with your borrowing, you can benefit from the convenience of no credit check loans without falling into a financial trap.

2. BadCreditLoans: Best Bad Credit Loans Without Credit Check

If you have a bad credit score and need a loan, BadCreditLoans can help. One of the most significant advantages of using this platform is that they offer loans without a credit check, making it easier for people with bad credit to access the funds they need.

Additionally, BadCreditLoans has an extensive network of lenders, which means that you may be able to find a loan that works for you, regardless of your financial situation.

To start with BadCreditLoans, you only need to complete their online request form. This free and straightforward process should only take a few minutes of your time.

Once you submit your request, BadCreditLoans will send your information to their network of lenders. If a lender is interested in working with you, they will contact you directly to discuss your loan options.

Some of the types of loans you may find through BadCreditLoans include personal, business, home, mortgage, credit cards, student, and auto loans.

The specific terms and requirements for each loan will vary depending on the lender you work with, so be sure to read the terms and conditions carefully before agreeing to anything.

How to Qualify for BadCreditLoans?

If you’re interested in obtaining a no-credit-check loan through BadCreditLoans, you’ll be pleased to know that the application process is simple. Here’s what you’ll need to do:

- Head to the BadCreditLoans website and fill out the online request form. The form asks for basic personal information, such as your name, address, Social Security number, and details about your income and employment.

- Once you’ve completed the form, click “submit.” Your information will then be sent to the network of lenders that BadCreditLoans works with.

- If a lender decides to offer you a loan, you’ll be redirected to their website to complete the application process. You may be asked to provide additional documentation to verify your identity, income, and employment status.

- Once your loan application is approved, the funds will be deposited into your checking account within one to two business days.

Remember, while BadCreditLoans doesn’t require a minimum credit score to qualify for a loan, the lenders in their network will likely charge higher interest rates to offset the increased risk of lending to someone with a poor credit history. As with any financial decision, reading the loan agreement carefully and comparing your options before signing the dotted line is essential.

3. LendYou: Best for Small Payday Loans Online

If you are looking for a fast and easy solution to your financial problems, LendYou may be the answer you have been looking for.

This online loan provider specializes in small payday loans that can help you through tough times. With LendYou, you can access a free online form that will connect you with lenders that offer no-credit-check loans for up to $2,500.

The best part about LendYou is that they cater to all credit histories, so you can still apply for a loan even if you have bad credit.

All you need to do is fill out the online form with your personal information, and LendYou will send your details to a network of loan providers who will compete for your business. You can compare offers and choose the best one that suits your needs.

Another advantage of using LendYou is the speed of the application process. You don’t have to wait long to get an offer, and once you accept one, your funds can be available as soon as the next day. This makes LendYou an ideal option if you have an emergency expense that requires immediate attention.

However, it’s important to note that no-credit-check loans can come with higher interest rates and fees. Before taking out a loan, make sure you can afford to pay it back on time, or you may end up in a worse financial situation than before. It’s also important to carefully read the terms and conditions to avoid hidden charges.

How to Qualify for LendYou?

If you’re considering applying for a loan through LendYou, there are some basic qualifications that you’ll need to meet.

First, you’ll need to be at least 18 years old and a resident of the United States. You’ll also need a valid checking or savings account in your name. If approved, this account will be used to dU.S.osit the loan funds.

In addition to these basic requirements, you’ll need to meet specific income requirements to qualify for a loan through LendYou. Specifically, you’ll need a minimum monthly income of $1,000. This income can come from various sources, including a job, self-employment, or government benefits.

It’s also worth noting that if you’re an active or reserve member of the U.S. Army, Air Force, Marine Corps, Navy, or Coast Guard (or a dependent of one) on duty under an order that doesn’t specify a deployment of fewer than 30 days, you won’t be eligible for a loan through LendYou.

The application process is simple if you meet these basic qualifications. You can complete the online application from home on your computer or a mobile device in just a few minutes. LendYou uses industry-trusted security practices to keep your data safe during application.

Once you submit your application, LendYou will match you with lenders with no credit checks and provide loan offers to review. Be sure to carefully review the terms of any loan offers to ensure you can handle the interest rates and monthly payments.

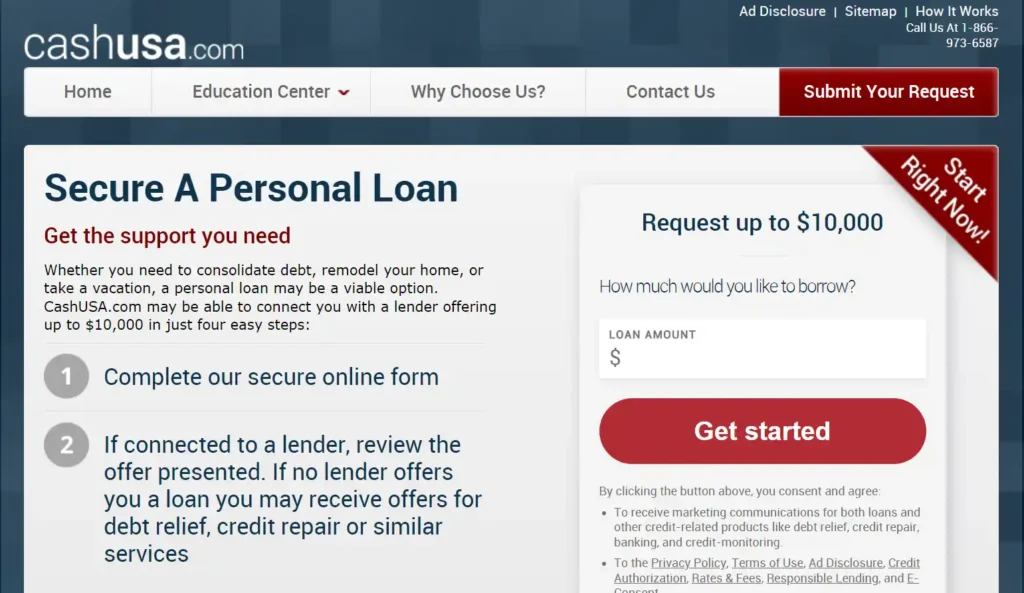

4. CashUSA: No-Hassle Unsecured Loans with Same-Day Funding

One of the best things about CashUSA is that it offers same-day funding for approved borrowers. This means you can potentially receive the loan amount you requested in your bank account on the same day you applied. The funds can be used for anything you need, such as unexpected bills, home repairs, or consolidating debt.

Unlike traditional banks or credit unions, CashUSA doesn’t require collateral for its loans, making them unsecured. This means you don’t have to use any of your assets as collateral to receive the loan.

Instead, the lender assesses your creditworthiness and financial status to determine the risk of lending you the money.

However, since there is no collateral, the interest rates on unsecured loans are usually higher than those for secured loans.

Therefore, it’s essential to carefully review the terms of any loan offer you receive from CashUSA or any other lender before accepting it.

How to Qualify for CashUSA?

If you’re looking for a no-credit-check loan with guaranteed approval from a direct lender, CU.S.hUSA could be the right option. Here’s how to qualify for their loan service:

First, you must have a monthly net income of at least $1,000. This can be from employment, self-employment, or any other reliable source of income.

Second, you must be employed for at least 90 days at your current job. This shows that you have a stable source of income and can repay the loan on time.

Third, you must be a U.S. citizen or permanent resident. This ensures that you meet the eligibility requirements for the loan service.

Fourth, you must be the primary account holder of a checking account. This is where your loan funds will be deposited and where your repayments will be taken from.

Finally, you must have a valid home and work email address and contact number. This is important for communication with the lender and for verifying your information.

If you meet these requirements, you may be eligible for a no-credit-check loan from CashUSA with guaranteed approval from a direct lender. Remember that other factors, such as your credit history and the loan amount, may also be considered during the application process.

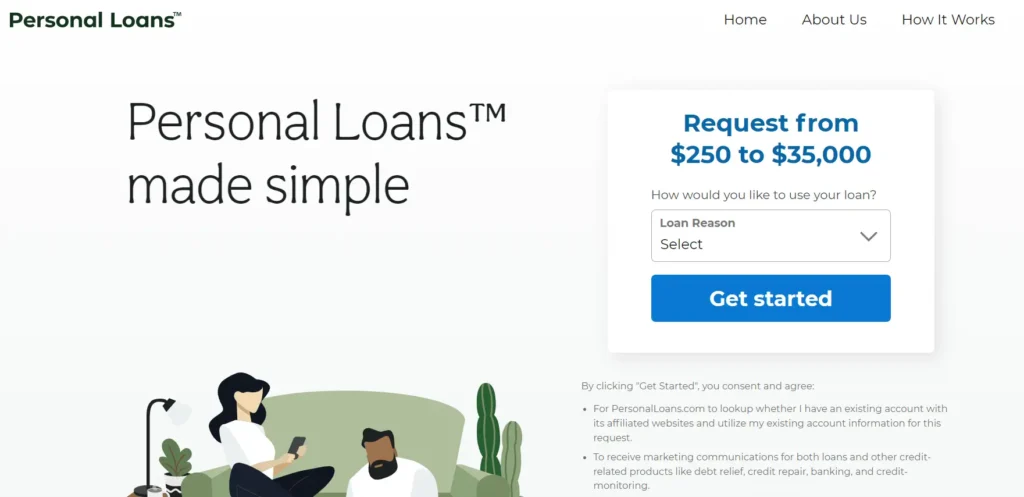

5. PersonalLoans: Best Personal Loan Rates Without A Hard Credit Check

If you’re looking for personal loan rates without a hard credit check, PersonalLoans is an excellent option. Their loan request process is simple and easy, allowing borrowers to apply for loans up to $35,000.

However, remember that the amount you can borrow will vary based on your financial information and the type of loan you’re seeking, whether it’s a credit or no-credit loan.

When filling out their loan request form, you’ll be asked to provide details such as the amount you want to borrow, the reason for the loan, and your credit type.

In addition, you’ll need to share basic information about your income and banking history to help lenders assess your eligibility for a loan.

Once you submit your request, PersonalLoans will forward your information to lenders in their network and other third-party networks to give you the best chance of finding a favorable bad-credit loan.

Before proceeding, review the provider’s terms carefully to ensure you understand the requirements and any potential impact on your credit report.

How to Qualify for Personal Loans?

Personal loans may be the right option if you need quick cash and have bad credit or no credit history. These loans do not require a specific credit score, making them ideal for individuals with a history of financial difficulty.

However, to qualify for personal loans, you must meet particular requirements.

One of the first requirements to qualify for personal loans is to be 18 or older and have a valid Social Security number. You must also be a U.S. citizen or permanent resident. This ensures the lender can verify your identity and track your credit history.

Another requirement for personal loans is having a full-time job, self-employment income, or disability or Social Security benefits. This requirement ensures that you have a source of income that can be used to pay back the loan.

You will also need to have a legitimate checking account. This is where the loan funds will be deposited, allowing the lender to withdraw the loan payments when they are due.

Finally, you must demonstrate a pattern of financial responsibility. This means you have a history of paying your bills on time and managing your finances responsibly.

If you meet these requirements, you may be able to qualify for personal loans without a credit check.

Types of Online Loans with No Credit Check

When you have poor credit, traditional lenders may hesitate to approve you for a loan. However, online lenders offer options for those with less-than-perfect credit scores. Here are some of the most common types of no-credit-check loans available online:

Payday loans:

Payday Loans are short-term loans designed to provide quick cash for emergencies. These loans typically have repayment weeks and require a repayment post-dated check or electronic access to your bank account as collateral.

The interest rates on these loans can be very high, often exceeding 400%, so taking out a payday loan is essential only if you know you can repay it on time.

Installment loans:

Installment loans are another type of no-credit-check loan. These loans are repaid over a more extended period than payday loans, typically six months to a year.

Installment loans can be used for various purposes, such as medical bills, car repairs, or home improvements. The interest rates on these loans are lower than payday loans, but they still tend to be higher than traditional loans.

Auto title loans:

Auto title loans are secured loans that use your car as collateral. These loans are typically short-term and require the borrower to hand over the title to their car in exchange for the loan.

The lender can repossess your car if you cannot repay the loan. Auto title loans typically have high-interest rates, so they should only be used in emergencies.

While these loans can provide a quick solution for those with poor credit, they can also come with risks. It’s important only to borrow what you can afford to repay and to make sure you fully understand the terms and conditions of the loan. Finding a reputable lender that is transparent about their fees and interest rates is also essential.

Alternatively, options are available if you cannot qualify for a traditional or online no-credit-check loan. These may include borrowing from friends or family, applying for a credit builder loan, or seeking out local non-profit organizations that provide financial assistance. It’s essential to explore all of your before deciding on a loan.

Online Loan Marketplaces vs. Direct Lenvss

When you need money quickly, you have several options to choose from. One of the most popular options for borrowers is online loans with no credit check. However, you may wonder if you should go through an online marketplace or a direct lender. Both options have advantages and disadvantages, so let’s look at each closely.

Direct lenders include credit unions, banks, and specific online lenders. These lenders offer the fastest funding, while marketplaces help you find the best deals. With direct lenders, you apply, get approval, receive funds, and make payments to the same company, making it the simplest way to borrow.

Because they handle every process step, direct lenders can give you cash fast, often on the same day. Direct lenders have the lowest interest rates and highest loan amounts. They also have more rigid requirements than marketplaces.

On the other hand, online marketplaces do not lend money to anyone or approve applications. Instead, they use the information you give them to find loan offers from a network of various types of lenders. You can review your suggestions for the best terms, then work with your lender for the rest of the process.

It can take some time to receive offers, review the terms and conditions, and finalize your loan agreement, so you might wait 24 to 72 hours to receive your funds.

Online lenders you can find through lending marketplaces offer the most flexibility with loan eligibility, while traditional lenders, such as a bank or credit union, typically have stricter requirements.

So, which option should you choose? It ultimately depends on your needs. A direct lender may be the way to go if you need cash fast and have good credit. An online marketplace may be better if you have bad credit or want to shop for the best terms.

No matter which option you choose, finding a reputable lender or marketplace is essential. Look for lenders with positive reviews, transparent terms and conditions, and no hidden fees. Be wary of lenders that guarantee approval or ask for upfront fees.

Advantages Of No Credit Check Loans

There are many advantages to choosing a no-credit-check loan from a direct lender. Here are just a few:

- Fast Approval: With no credit check to worry about, the application process is usually quick and easy. You can often receive approval for your loan within minutes, and the funds may be deposited into your account within 24 hours.

- Easy Qualification: Since no credit check loans are designed to help those with poor credit, the qualification criteria are usually more relaxed. This means that you may still be able to get a loan even if you have a low credit score or no credit history.

- Flexibility: No credit check loans can be used for a variety of various as paying off bills or unexpected expenses, consolidating debt, or making a large purchase.

- Improved Credit Score: Some lenders may report your payment activity to major credit bureaus, which can help to improve your credit score over time. This can make it easier for you to get approved for other types of loans or credit in the future.

Disadvantages Of No Credit Check Loans

While no credit check loans can seem like a quick and easy solution to financial problems, there are also disadvantages.

The main drawback is the potentially higher cost associated with them. A loan with no credit check can come with a higher interest rate than traditional loans, so make sure to crest rates from your specific guaranteed lender. This could mean that you end up paying more over time.

Additionally, there is usually a limit to how much you can borrow depending on the lender and state regulations, so you may not be able to get the amount you want. This can be frustrating if you need a large sum of money to cover a significant expense.

Another disadvantage of no-credit-check loans is that disreputable lenders can sometimes offer them. It’s crucial to essential search and ensure you’re working with a reputable lender with your best interests in mind. Look for reviews online and check the lender’s accreditation before taking out a loan.

Lastly, it’s important to remember that taking out any loan can have long-term financial consequences. If you’re unable you can’t on time, you could be subject to additional fees and even damage to your credit score. This can make it more difficult to obtain loans or credit in the future.

Why Do Banks Perform Credit Checks?

Banks and lenders perform credit checks to assess borrowers’ creditworthiness and loan repayment ability. A credit check allows the lender to see your credit history and score, giving them an idea of how responsible you are with credit and whether you’ll likely repay a loan on time.

Lenders use credit checks to minimize their risk of loan defaults. A high credit score indicates that you have responsible borrowing, and lenders are more likely to offer you favorable terms and interest rates.

On the other hand, a low credit score suggests that you may have a history of missed payments or other credit issues, and lenders may be hesitant to lend to you or offer you higher interest rates to offset the risk.

While some lenders offer no credit check loans, these typically come with higher interest rates and fees to offset the increased risk to the lender. It’s essential to consider the potential disadvantages of no credit check loans and alternative options if possible.

Alternatives to no credit check loans

Several alternatives exist if you are hesitant to take out a no-credit-check loan or have been denied.

- Secured loans: Secured loans require collateral, such as a car or home, to be considered a security. These loans often have lower interest rates and better terms than unsecured loans.

- Credit unions: Credit unions offer lower interest rates and more flexible terms than traditional banks. They may also provide personal loans to members with bad credit.

- Peer-to-peer lending connects borrowers with individual investors willing to lend money. These loans may have higher interest rates than traditional loans but may be more accessible for those with bad credit.

- Friends and family: While borrowing from loved ones can be risky, it can also be a viable option for those who need a loan without a credit check. Be sure to draft a clear repayment plan and stick to it to avoid damaging relationships.

- Credit counseling: Credit counseling can be a valuable resource if you are struggling with debt. Credit counselors can help you develop a debt management plan, negotiate with creditors, and improve your credit score. While no credit check loans may seem like a quick fix, weighing the potential risks and exploring alternative options before taking out any loan is essential.

Also Read